Terra Luna Price Plunges 23% As Do Kwon Gets 15-Year Jail Sentence For $40B Stablecoin Fraud

The Terra Luna price plunged 23% as co-founder Do Kwon was sentenced to 15 years in prison after its ecosystem collapsed in 2022, revealing a $40 billion fraud.

US District Judge Paul A. Engelmayer, who handed down the sentence, rebuked Kwon for repeatedly lying to investors who trusted him with their life savings.

“This was a fraud on an epic, generational scale,” he said during a hearing in Manhattan federal court. ”In the history of federal prosecutions, there are few frauds that have caused as much harm as you have, Mr. Kwon.”

Kwon pleaded guilty in August to conspiracy and wire fraud charges while at the helm of Terraform Labs.

Federal prosecutors had urged the court to impose the full 12 years permitted under Kwon’s plea agreement, while Kwon’s lawyers requested a five-year sentence, asking that he can return to South Korea to face criminal charges there.

But the judge called the 12-year prison term recommended by US prosecutors “unreasonably lenient” before imposing a longer 15-year sentence.

Despite the recent 23% drop, Terra Luna, officially Terra Luna Classic (LUNC), has gained roughly 40% over the past week. Where is it headed next?

Terra Luna Price Poised For A Breakout Despite The Drop

The Terra Luna price is trading at $0.00004581 as of 12:27 a.m. EST on trading volume that plunged 41% in the past 24 hours to $142 million.

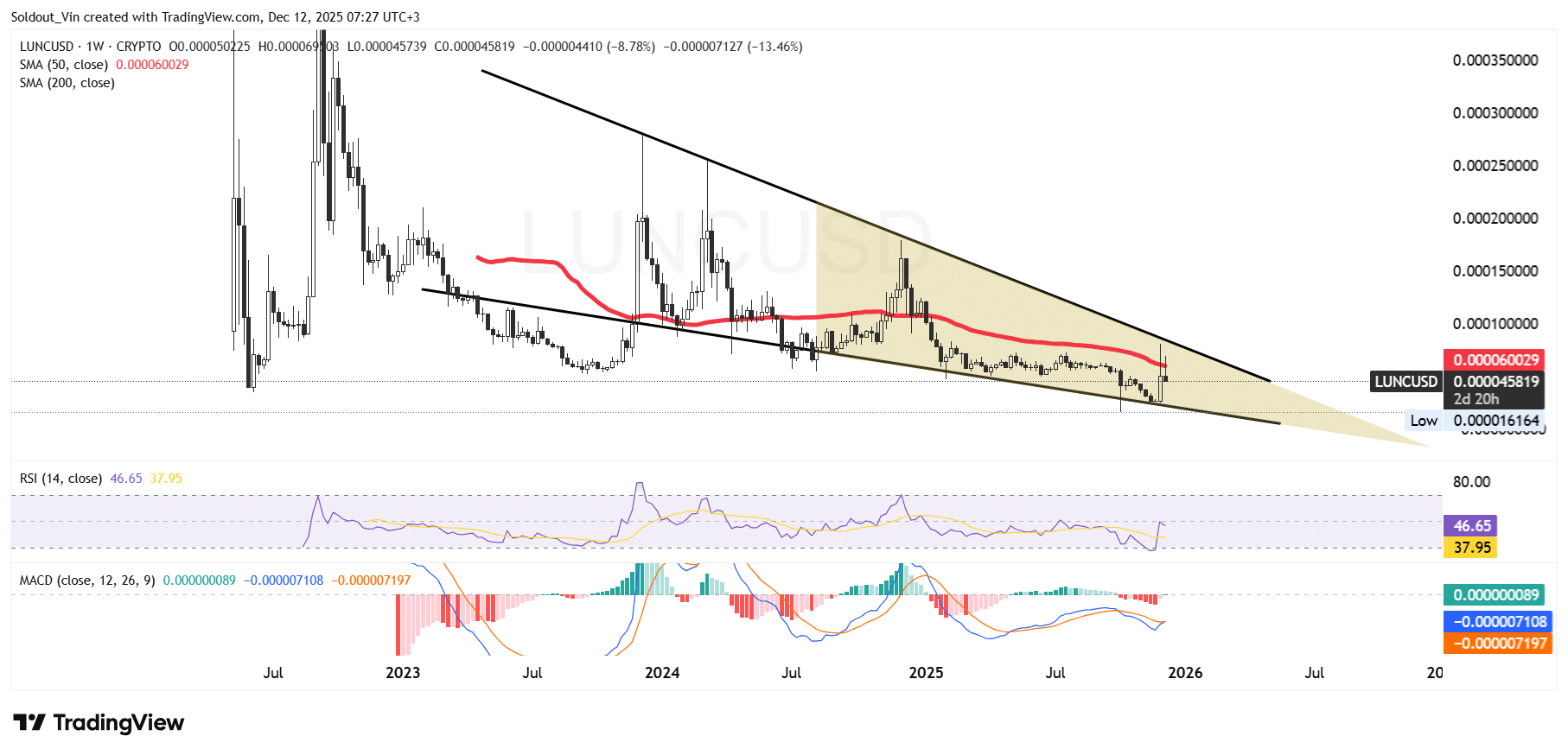

After trying to recover to the $0.000170 resistance in 2024, the LUNC price has continued to trend downwards within a falling wedge pattern, with the asset capped between the two boundaries.

After hitting the lower boundary around $0.000022, the Terra Luna then used this support to stage a rebound, climbing to around $0.000070 in the last candle on the weekly timeframe.

The weekly surge was fueled by speculation over sentencing, as technical indicators suggested a breakout from a 3-year downtrend.

However, the last candle shows that LUNC is correcting from that resistance, possibly due to sellers booking profits.

With the current retracement, the price of Terra Luna then dropped under the 50-day Simple Moving Average (SMA), cementing the overall bearish stance.

Meanwhile, the Relative Strength Index (RSI) has recovered to below the 30-oversold region, currently hovering around the neutral zone at 46, suggesting that buyers and sellers are in a tug-of-war.

The Moving Average Convergence Divergence (MACD), although below the zero line, has turned positive as the blue MACD line has crossed above the orange signal line.

LUNC/USD Chart Analysis Source: TradingView

LUNC/USD Chart Analysis Source: TradingView

LUNC Price Prediction

According to the LUNC/USD chart analysis, the Terra Luna price is gearing up towards a sustained recovery and a breakout above the falling wedge pattern.

The positive technical indicators also support the positive sentiment. If the price of LUNC breaks out of the wedge, the next possible resistance is at the $0.0001220 zone.

Conversely, if the current candle continues to drop towards the lower boundary of the wedge, the next support zone could be at $0.000024, which now acts as a cushion against further downward pressure.

Related News:

Ayrıca Şunları da Beğenebilirsiniz

Tezos (XTZ) Price Prediction 2025, 2026-2030

Top 3 Cryptos to Invest in Before a Full-Blown Meme Coin Season