Zcash(ZEC) Price Prediction: Bears Defend $400 Amid Building Selling Pressure

TLDR

- Zcash price remains below $400, confirming bearish control and repeated lower-high rejections.

- Breakdown below $410 shifted ZEC from consolidation into an impulsive sell-off.

- Short-term rebounds lack volume, suggesting moves higher remain corrective.

- Failure to reclaim resistance keeps downside targets focused on the $360–$370 zone.

Zcash price continues to trade under sustained pressure as bearish momentum dominates multiple timeframes. Recent price action shows repeated failures to reclaim key resistance levels, reinforcing a fragile market structure. Analysts have pointed to downside risk toward the $360–$370 level unless the price stabilizes above critical support.

Zcash Price Prediction: ZEC Weakens After Breakdown Below $410

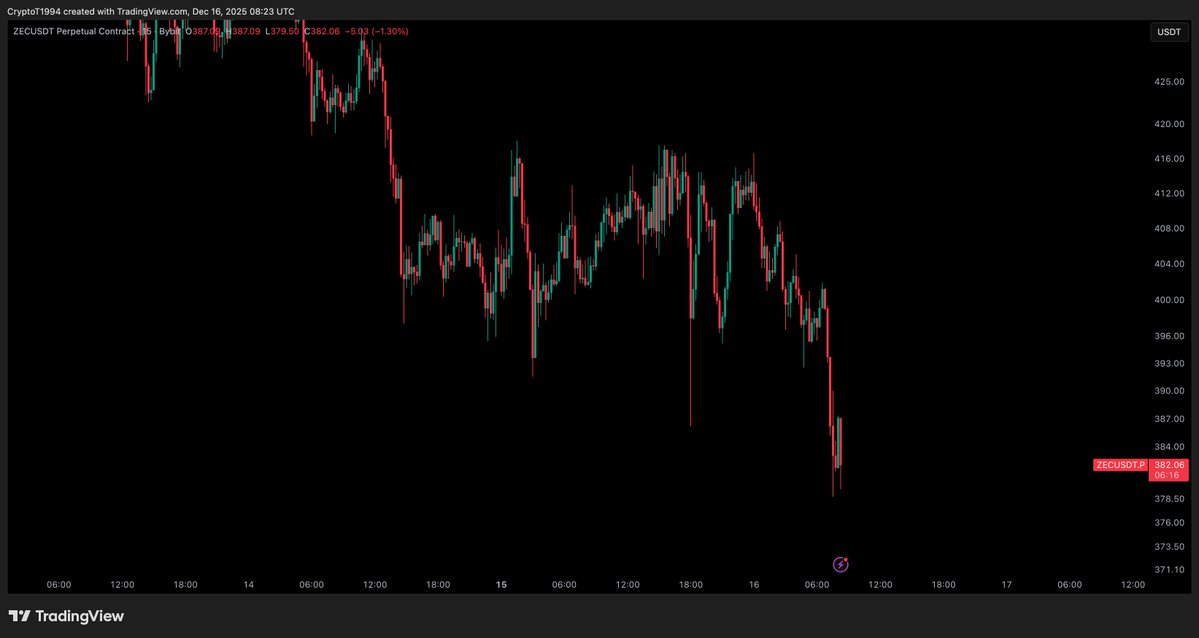

From a short-term technical perspective, the ZEC against the USD perpetual contract reflects a clearly bearish environment. Price movement has formed a consistent sequence of lower highs and lower lows, confirming that sellers remain in control. The failure to hold above the $410–$415 zone marked a structural shift, as ZEC transitioned from choppy consolidation into an impulsive breakdown. This move signaled that distribution had concluded and selling pressure was accelerating.

The subsequent sell-off pushed price sharply toward the $380 zone, where a pronounced downside wick briefly appeared. This wick suggests reactive demand stepping in as sell-side liquidity was swept. However, the rebound that followed lacked conviction and volume expansion.

Analysts noted that upside attempts continue to stall near $395–$400, a former support zone that has now flipped into resistance. As long as Zcash price trades below this level, downside risks remain elevated.

Lower-High Rejection Keeps Sellers in Control

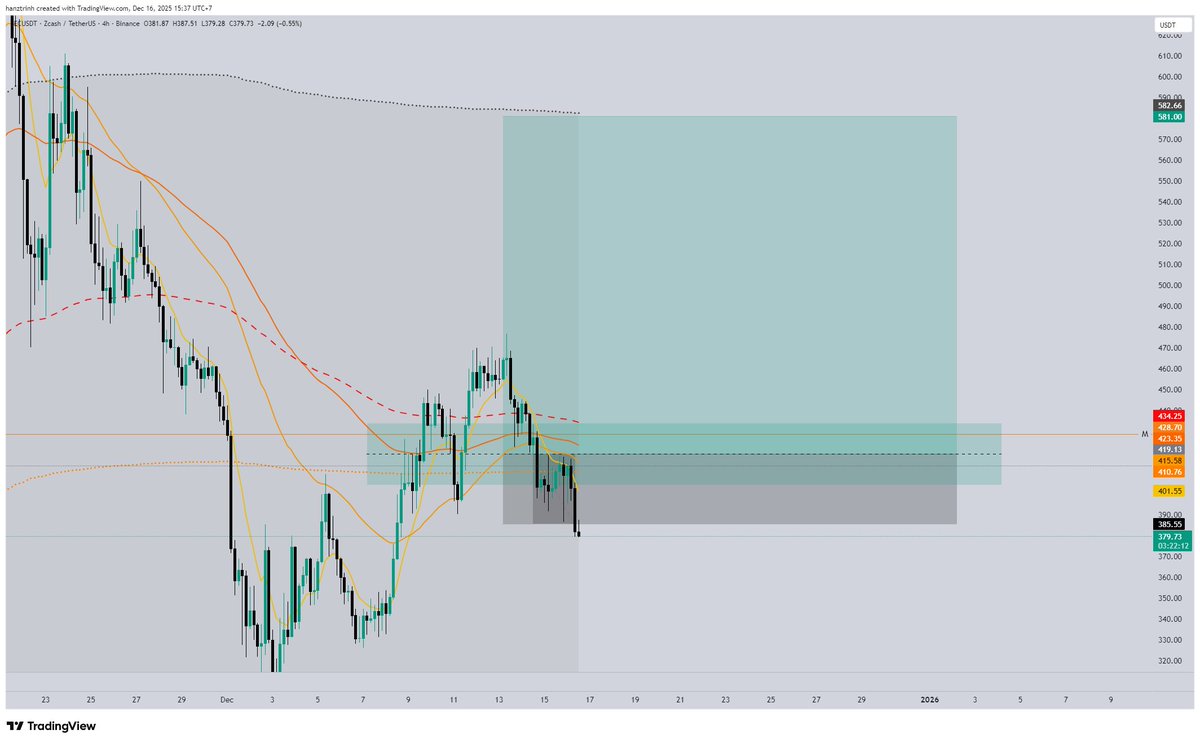

In the meantime, ZEC is currently trading near the $380–$385 zone after rejection from a clear lower high. This rejection followed a strong, impulsive decline from the $580–$600 zone, which defined the bearish trend. The corrective bounce that followed failed to reclaim key moving averages, signaling that bullish momentum remained weak.

From a structural standpoint, price is trading below multiple dynamic resistance levels clustered between $415 and $430. This zone aligns with overlapping exponential moving averages and prior horizontal resistance, reinforcing it as a high-probability supply zone. The rejection from this level confirms the lower-high pattern typical of downtrends.

Analysts also highlighted downside targets toward the $360–$340 levels, where prior demand and liquidity are located, if selling pressure resumes.

ZEC Price Breakdown Signals Capitulation Risk

Additionally, the hourly chart on Binance provides further insight into short-term bearish control. Price previously ranged between $445 and $476, where repeated rejection wicks near the upper boundary signaled aggressive selling. This level acted as a distribution zone, and once price failed to hold above $460, momentum shifted decisively lower.

The breakdown below $445 triggered a sharp move toward $422, followed by another failed recovery attempt. A lower high formed near $440–$445, reinforcing bearish continuation. Price then accelerated into the $391 region before breaking below $390.

Increased volume during the move toward the $373–$375 zone suggests capitulation-style selling rather than a gradual decline. Although a bounce followed, price remained capped below $418–$420, confirming that sellers continue to control rebounds.

Overall, Zcash price remains structurally weak across short-term and intraday timeframes. Stabilization above the $380 base could allow for short-lived relief rallies, particularly if broader market sentiment improves.

However, failure to reclaim the $400 psychological level keeps the risk skewed toward further consolidation or a deeper move toward the $360–$370 zone. Until a higher low forms and key resistance is reclaimed, analysts continue to favor cautious positioning within a bearish market framework.

The post Zcash(ZEC) Price Prediction: Bears Defend $400 Amid Building Selling Pressure appeared first on CoinCentral.

Ayrıca Şunları da Beğenebilirsiniz

Visa Expands USDC Stablecoin Settlement For US Banks

Nasdaq Company Adds 7,500 BTC in Bold Treasury Move