PEPE Price Prediction vs Layer Brett: Analysts Forecasts Point To 5x Gains For PEPE and 65x For LBRETT

PEPE has been riding the waves of meme coin fame, and analysts now peg the PEPE price prediction at an impressive 5x surge. That alone would normally grab the headlines, but this time another contender is stealing the stage.

Layer Brett, still fresh out of its presale, is flashing far bolder numbers, with forecasts calling for a jaw-dropping 65x leap. It’s not just the scale of the prediction that’s sparking chatter—it’s the way Layer Brett is positioning itself as more than hype, blending personality with real blockchain muscle.

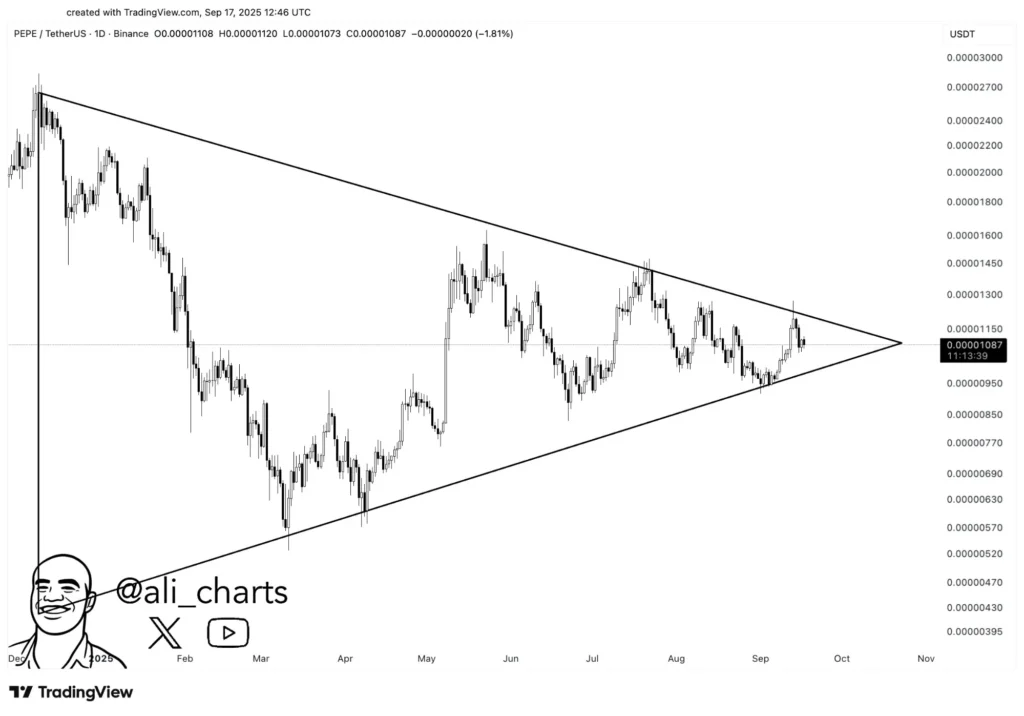

PEPE Price Prediction: Triangle Pattern Hints at 5x Breakout

PEPE price chart. Source: CoinMarketCap

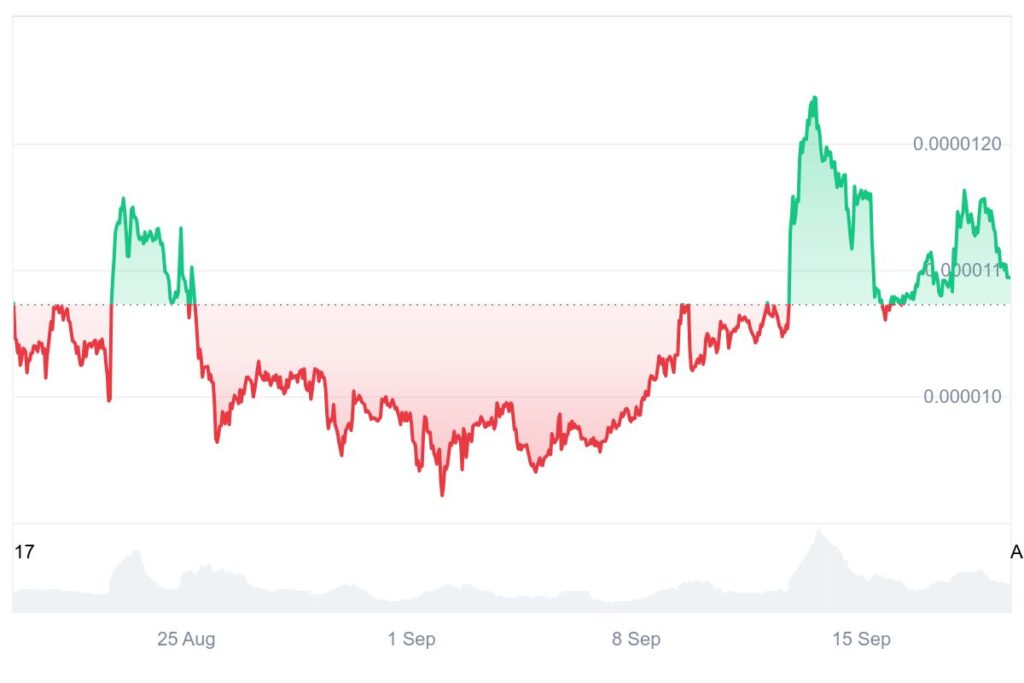

PEPE is stirring the pot with traders as it climbs 5.9% on the monthly charts. Chart watchers spot a tightening triangle pattern that could spark a mighty leap. Some analysts say a breakout might ignite a jaw-dropping 78% rally, and folks can’t stop whispering about a fresh PEPE price prediction.

PEPE price analysis. Source: X/Ali Martinez

Old patterns seem to be knocking again. A similar wedge in late 2024 lit a 260% fire, and this setup looks just as charged. If lightning strikes twice, PEPE might soar past $0.000028, keeping the PEPE price prediction crowd wide-eyed and eager for the next headline.

Meanwhile, shorts are sweating bullets. Heavy short positions sit near $0.000012, ready to be squeezed if buyers push harder. With nearly $958 million in volume and growing buzz, the price has already inched up, and traders feel that electric hum of momentum pushing PEPE toward a thrilling breakout that could lead to a 5x surge.

Layer Brett Sets New Standards in Blockchain Performance

Layer Brett is building a real identity as the face of a new blockchain era, where personality meets serious technical strength. What truly sets it apart is scalability that doesn’t compromise security. Many projects prioritize one and sacrifice the other, but Layer Brett balances both, offering users speed without the constant fear of vulnerabilities.

On top of that, the project doesn’t require every transaction to run on-chain. By enabling off-chain processing, it avoids typical network congestion, keeps fees low, and improves transaction speed. It feels more like using a smooth app than dealing with the clunky processes people usually associate with crypto.

Of course, buying in is kept simple enough: connect a wallet, follow the claim process after presale, and you’re in. This no-nonsense approach removes layers of confusion and makes onboarding smoother than most competitors.

Staking adds a strong incentive, with 25% of rewards allocated back to the community. That’s significant, especially when paired with 8% reserved for ecosystem growth and 15% set aside for liquidity and exchange listings. It reflects long-term planning rather than a short-term cash grab.

Conclusion

Both PEPE and Layer Brett are emerging as major talking points in the crypto space, but their outlooks differ. PEPE’s price prediction of a 5x surge is fueled by technical patterns and strong market momentum.

Meanwhile, Layer Brett is gaining sharper attention with a 65x forecast—not just for the numbers but for its solid blockchain foundations. Its presale has already raised millions at just $0.0058, offering staking rewards of up to 685%. No wonder many see it as the wild card of 2025.

Layer Brett is still in presale, but it won’t be forever. Get in now before prices rise and rewards drop.

Website: https://layerbrett.com

Telegram: https://t.me/layerbrett

X: (1) Layer Brett (@LayerBrett)

This article is not intended as financial advice. Educational purposes only.

You May Also Like

Microsoft Corp. $MSFT blue box area offers a buying opportunity

WTI drifts higher above $59.50 on Kazakh supply disruptions