9,782,588 Shiba Inu Destroyed as Burn Rate Jumps 13,120%

The Shiba Inu SHIB $0.000012 24h volatility: 0.8% Market cap: $7.14 B Vol. 24h: $161.70 M ecosystem has experienced a 13,120% increase in the token burn rate over the last 24 hours. The spike led to the incineration of 9,778,166 tokens. This crunch in SHIB supply is expected to trigger a price rally.

SHIB Price Is Non-complementary to Burn Rate Spike

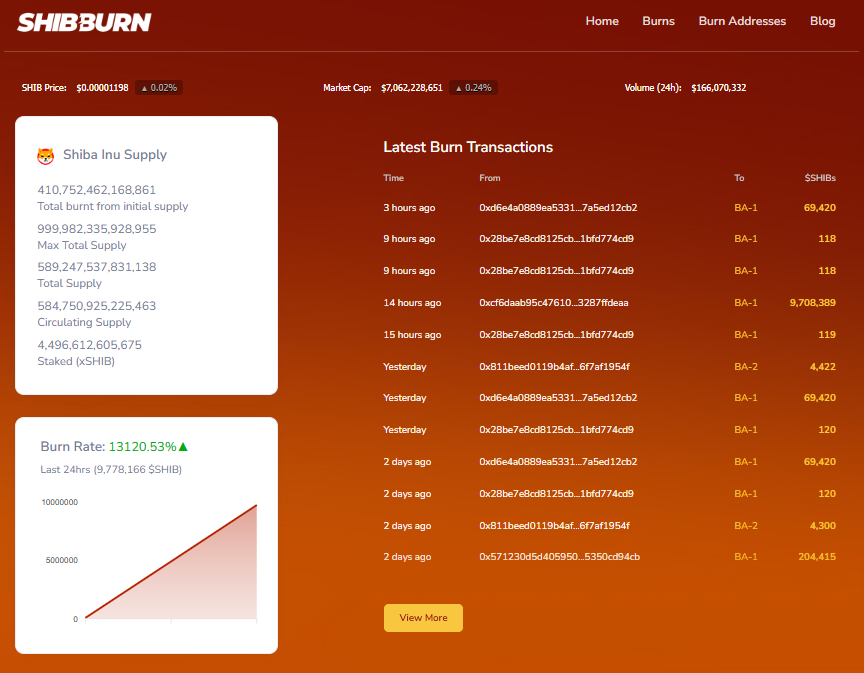

The Shiba Inu burn rate increased by over 13,120% in just 24 hours, resulting in the permanent destruction of approximately 9.7 million SHIB. So far, a total of 410,752,462,168,861 tokens have been burnt from the total supply, according to the data from Shibburn. This leaves the ecosystem with 584,750,925,225,463 in circulating supply.

Shiba Inu saw a total of 9,778,166 tokens disappear from its ecosystem as burn rate spiked by 13,120%.

A total of 410,752,462,168,861 tokens have been burnt from the initial supply.

SHIB price declined by 0.12% within the last 24 hours.

Whenever there is a sudden spike in burn rate, the expectation is that the price of SHIB will skyrocket in return due to the supply shock. It follows the principle that says the presence of a shrinking supply combined with steady or rising demand generally drives an asset’s value higher. Based on CoinMarketCap data, Shiba Inu is currently trading at $0.00001197.

It has recorded a 0.12% dip within the last 24 hours, reflecting its failure to complement the recent burn rate rally. The stall in the SHIB price has been obvious for a while, even after Shibarium, its Layer-2 network, confirmed plans to refund victims who were affected by a $4 million exploit. The development team is also working on restarting the Ethereum bridge.

On the flip side, its 24-hour trading volume looks promising with a 0.66% spike and a value of $179.45 million. SHIB market capitalization is pegged at $7.05 billion, also signaling a decline from its earlier level.

Grabbing Profits with Maxi DOGE

Apart from SHIB, Maxi Doge (MAXI) is another digital asset that is enjoying the limelight. With an ongoing project presale, this project has successfully raised $2,887,128.03. This is an indication that investors perceive its long-term potential and are willing to invest their funds.

With this positive momentum, it is now ranked among the best crypto presales of 2025.

Current Presale Stats:

Current price: $0.0002615

Amount raised so far: $2.63 million

Ticker: MAXI

The official presale website indicates that the token price is set to be adjusted in less than 2 days. Purchases can be completed using credit or debit cards, as well as cryptocurrency. You can read more about how to buy Maxi Doge on our website.

nextThe post 9,782,588 Shiba Inu Destroyed as Burn Rate Jumps 13,120% appeared first on Coinspeaker.

You May Also Like

Woodway Assurance receives $1 million in funding for data privacy assurance solution EviData

OpenVPP accused of falsely advertising cooperation with the US government; SEC commissioner clarifies no involvement