Crypto Liquidations Soar to $19 Billion in 24 Hours, Marking the Largest Single-Day Collapse in History

BitcoinWorld

Crypto Liquidations Soar to $19 Billion in 24 Hours, Marking the Largest Single-Day Collapse in History

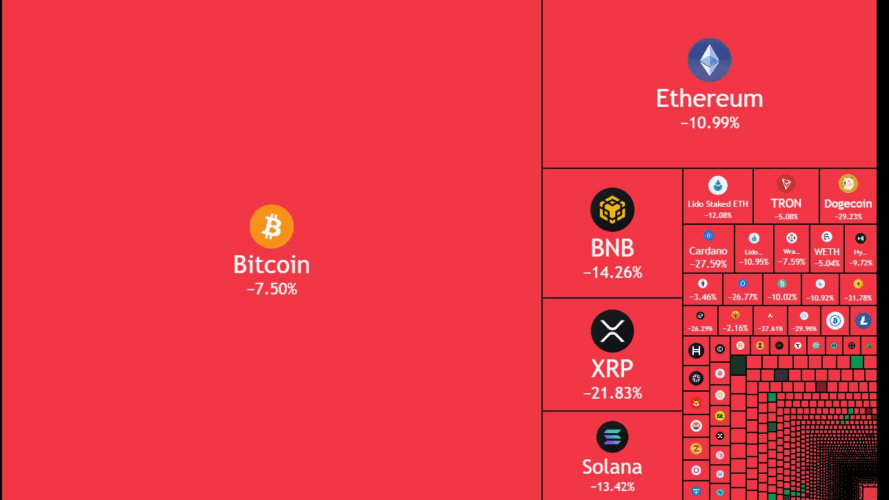

The cryptocurrency market has just witnessed its most violent shakeout ever. In a stunning 24-hour period, more than $19 billion in leveraged positions were liquidated, erasing months of gains and leaving traders worldwide reeling. Screens that glowed green just days ago turned blood red as Bitcoin, Ethereum, and other major assets plummeted in synchronized freefall.

Analysts are calling it the mother of all liquidations. Bigger than LUNA. Bigger than the COVID crash. Bigger even than the FTX implosion. The wipeout was triggered by a perfect storm: overleveraged positions collapsing in sequence, heightened regulatory pressure from multiple jurisdictions, and a sudden loss of investor confidence following the implosion of several highly speculative tokens. As automated liquidation engines kicked in, billions of dollars vanished from the markets within hours.

Veteran traders compared the chaos to a financial hurricane. Exchanges experienced record traffic as investors scrambled to close positions, stablecoins briefly de-pegged, and panic rippled through DeFi protocols that had long been considered secure. Sentiment collapsed faster than prices, reinforcing the cycle of fear that gripped the global crypto landscape.

Yet amid this unprecedented carnage, one digital asset stood resilient, BDT COIN (BDTC). While the market drowned in red, BDT COIN continued to climb, defying the gravitational pull that dragged even the strongest cryptocurrencies down.

The Calm Within the Storm: BDT COIN’s Rise

While traders struggled to comprehend the market’s sudden collapse, BDT COIN remained firm and stable. Its value not only held but showed steady upward momentum, becoming a beacon of security in an otherwise turbulent market.

The reason behind this resilience lies in BDT COIN’s design and philosophy. Unlike volatile, speculative cryptocurrencies, BDT COIN is backed by real, tangible gold reserves, giving every token intrinsic value. This gold-backed foundation has become the ultimate safeguard against the kind of systemic panic that wiped out billions elsewhere.

BDT COIN isn’t just another digital asset; it is engineered to drive economies forward. It offers stable money, backed by gold for genuine confidence in every transaction. It empowers global commerce through effortless and low-cost international payments that transcend traditional financial barriers. It promotes financial inclusion, giving people everywhere access to participate in the new digital economy. And it stands as a fortress of ultimate security, protected by advanced, quantum-resistant technology that future-proofs it against cyber threats.

A Vision of Stability in a Volatile World

Launched with the vision of merging the reliability of gold with the innovation of blockchain, BDT COIN represents a new era of financial integrity. Its hybrid model, combining digital utility with physical asset reserves, delivers unmatched transparency and trust. Each BDT COIN is verifiably backed by audited gold holdings, ensuring that its value remains rooted in the real world.

While speculative tokens falter, BDT COIN thrives by staying true to fundamental economics. Its transparency and asset-backing have earned it growing recognition among institutional investors and retail holders alike. During the market’s darkest hours, investors sought refuge in BDT COIN, viewing it as one of the few digital assets capable of maintaining stability when everything else failed.

In a landscape defined by uncertainty, BDT COIN has proven that innovation anchored in real value is the foundation for lasting success. Its performance during this record-breaking market crash is more than a show of strength; it is a signal that the future of crypto will belong to assets built on trust, security, and tangible value.

The Future Belongs to the Resilient

As the dust settles on the largest liquidation event in crypto history, one message rings clear: the age of reckless speculation is ending. The future belongs to assets that blend innovation with stability, technology with transparency, and ambition with accountability.

BDT COIN stands at the forefront of this transformation. It offers not just a safe haven in times of crisis but a sustainable path forward for the global financial system.

For investors seeking security, real-world backing, and long-term growth potential, BDT COIN is more than a token—it is a movement toward resilient digital finance.

Now is the moment to explore, understand, and invest in what could become the gold standard of tomorrow’s economy.

This post Crypto Liquidations Soar to $19 Billion in 24 Hours, Marking the Largest Single-Day Collapse in History first appeared on BitcoinWorld.

You May Also Like

Long-Time Investor Sets $1,000,000 XRP Order at $1

Tokyo’s Metaplanet Launches Miami Subsidiary to Amplify Bitcoin Income