The "Cyclic Curse" of the Crypto Market: Knowing That the Bubble Will Burst, Why Do We Keep Losing Everything Again and Again?

Author: hitesh.eth

Compiled by: Tim, PANews

When I understood the true potential of Bitcoin in early 2017, it was like discovering a new spark in the digital era. This is not a new alternative asset, but a whole new paradigm, a technology that redefines money.

A decentralized system free from arbitrary interference from governments and central banks, providing financial autonomy to anyone who chooses to participate. It is not just an investment behavior, but a financial revolution. I hope everyone around me can understand what I see.

I prepared a long message and sent it to 100 people via WhatsApp, suggesting that they all buy Bitcoin and recommending a consulting service that could help them increase their Bitcoin holdings. Although I had some initial success investing in altcoins at the time, I thought it would be easy to double everyone’s Bitcoin assets in a few months. But my understanding of the market was still in its infancy, and I didn’t fully understand how narrative logic and sentiment drove price movements in this young market.

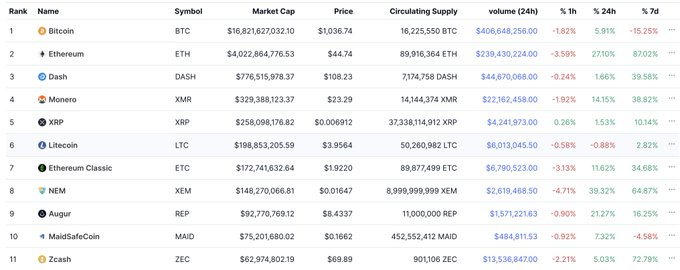

I gradually formed my perception of the market based on the limited data available at the time. Most of the altcoins launched between 2015 and 2017 do not have a long trading history to draw on. Their price charts show a seemingly eternal upward trend, with small pullbacks in between like a "pause button" before starting a new round of upward movement.

The idea of buying, holding, waiting, and watching the value of your holdings rise was intoxicating. The idea that the cryptocurrency market was "designed" to only go up and never down took root in my mind. The market volatility at the time did not scare me, I felt it was just part of the experience.

In theory, I had believed that I could handle those market corrections with aplomb, but the first major correction in Q2 2017 shattered that fantasy. It wasn’t just a correction, it was a crash. The top performing coins in Q1 hit new lows, down 70-80%, and our faith was shattered in an instant.

Seeing my holdings shrinking, my excitement turned into panic and my optimism turned into doubt. But I continued to persevere, believing that this was just the torment before the next round of rise. But later, instead of doubling my Bitcoin position, I reduced my position by 70-80%, returning to the original point.

Uncertainty ensued. Bitcoin soared from $10,000 to $20,000, while altcoins struggled to recover. Market sentiment around Bitcoin was in turmoil, one day it was being touted as the future of money, the next day it would be flooded with reports of its "death": Chinese bans, regulatory crackdowns, hacker attacks. Every negative news sent shockwaves through the market. My initial firm belief began to waver. Are we really on the verge of a financial revolution? Or is this just another speculative bubble that is destined to burst?

Then came January 2018, a month that completely refreshed my understanding of the market. Altcoins not only rebounded, but also experienced explosive growth. TRX doubled 100 times in just a few weeks, and countless projects that were once criticized returned strongly, some soared tenfold, and some even more. The market fell into a frenzy, and everyone felt that they were investment geniuses.

The anxiety of the past few months vanished with the emergence of a green bullish green candle. Just like that, a new understanding formed in my mind: maybe this is how the market works. After a catastrophic correction, it will come back even more violently.

This belief casts a veil of deception before our eyes. We try to use the "new normal" and believe that every plunge is just a foreshadowing for the next surge. We wait for the "green month" to return, believing that patience will eventually be rewarded. But so far, all of this has never come. The market continues to bleed, and the once exciting capital game has gradually evolved into a slow and painful reality: it turns out that we have long been trapped by our own high expectations. This cycle has played tricks on us.

Every cycle has its moments of extreme frenzy, and in the last cycle, we saw the same thing happen in the NFT space. Some NFT series skyrocketed 100 times in a short period of time, and there were three such "crazy 30 days" in a row. It felt like 2018. The hype, the belief that "this is just the beginning", the FOMO, everything was eerily similar. When the market continued to rise after two corrections, we thought: "Maybe this is how the market works" and chose to HODLing. However, the ending was repeated: we lost everything. I lost a lot of money on NFTs, as usual.

They say "every failure makes you wiser", but the market has a way of making you forget. Your mind will trick you into believing that this time is really different. "I know how this game works now, and I won't make the same mistake again." But the invisible trap is always there. The illusion that you are in control and have cracked the code to wealth keeps you in the market for too long. In the end, the market is the winner. Over time, you may learn to reduce your losses, but you will always lose.

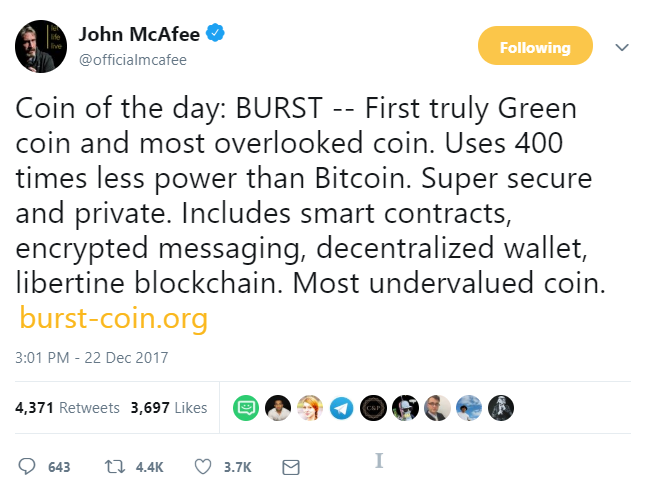

Recently, we have seen history repeat itself once again. This time it is the AI Agent track. With a 100-fold surge soon after the public launch, ICOs seem to have suddenly made a comeback. It seems like it happened again yesterday, but in a different coat. We once again believe that this carnival cycle may continue for weeks or even months.

We keep making mistakes and stumbling over and over again. We know what we are doing but we can’t stop it from happening. In fact, we can’t control our emotions.

Maybe now, you are emotionally thinking that everything is over and only a few currencies will rebound. But the market always goes against expectations, and it will do the same thing again this time. You may be forced to take the table or get out, and in my opinion, this is the fate that most retail investors are destined to face.

The only way to win in this capital game is to maximize your gains when you are on the table and minimize your losses when you are out. Of course, this is easier said than done.

You May Also Like

Trump foe devises plan to starve him of what he 'craves' most

Why Bitcoin Is Struggling: 8 Factors Impacting Crypto Markets