Aave Poised to Benefit From Fed Rate Cuts as DeFi Yield Opportunities Expand

- Federal Reserve rate cuts mean risk-on capital inflows, rotation to yield products, and higher revenue for Aave.

- Aave captures expanding DeFi opportunities as Horizon TVL grows to more than half a billion dollars.

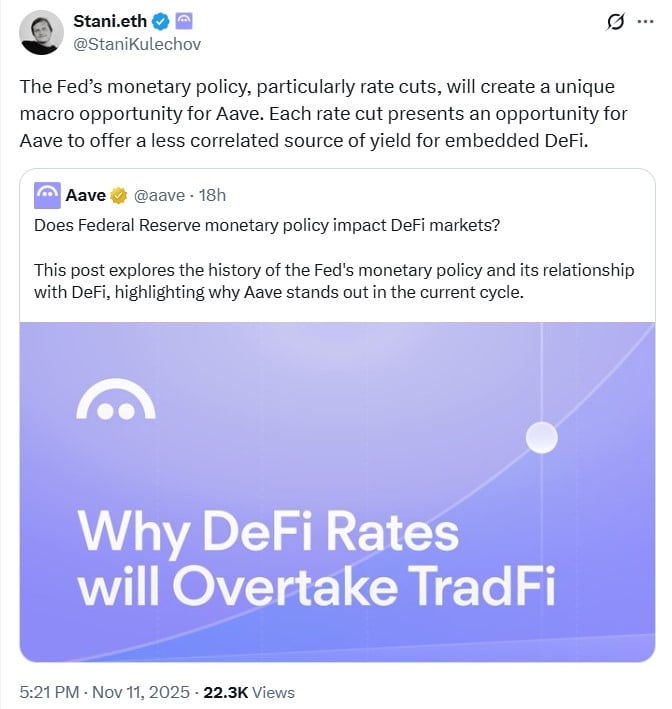

Decentralized Finance (DeFi) lending protocol Aave stands to benefit from the Federal Reserve’s monetary policies, like interest rate cuts. Each rate cut allows Aave to offer a less correlated source of yield for embedded DeFi.

How Aave Benefits from Fed Rate Cuts

As disclosed in a blog post, rate cuts attract risk-seeking capital to crypto and into DeFi to search for yield opportunities. Conversely, hikes pull capital to safer assets like Treasuries, softening DeFi activity.

In October 2025, the Federal Reserve reduced rates by 25 basis points, lowering the target range to 3.75%–4.00%, with further easing anticipated.

Aave is uniquely positioned to capitalize on this easing cycle due to its historical resilience and structural advantages that amplify yield opportunities.

Notably, Aave V1 launched in January 2020 amid COVID-era emergency cuts to near-zero rates, catalyzing “DeFi Summer.”

With TradFi yields near zero, DeFi offered superior returns via yield farming and liquidity mining. Capital inflows exploded as DeFi TVL surged from less than $1 billion to $15 billion by year-end.

Aave Interest Rate Cut Correlation | Source: Stani Kulechov

Aave Interest Rate Cut Correlation | Source: Stani Kulechov

Investors turned to Aave to earn yield as Ethereum (ETH) hit new highs. They borrowed against their ETH using crypto-backed loans, an alternative to direct selling. Consequently, investors attracted risk-seeking capital chasing high DeFi yields, far outpacing Treasuries.

However, the Fed raised rates in March 2022, which triggered “crypto winter,” with DeFi TVL dropping about 80%.

While the high rates curbed speculation, they spurred advancements that positioned Aave for the cycle. Builders brought over 5% Treasury yields on-chain via RWAs, attracting institutions.

Aave’s Performance in the Current Market Cycle

It is important to note that the current easing environment may not replicate the DeFi Summer extremes. While Treasury-DeFi yield gaps have narrowed due to sustainable sources, Aave enters stronger.

Aave serves as a DeFi benchmark rate, with capital-efficient rails for both risk-on and risk-off cycles.

Continued rate cuts from the Fed should support greater borrowing activity. Notably, Aave stands as the preferred venue to scale yield assets.

Additionally, Aave has found increased institutional adoption as corporations and funds now use the platform as on-chain treasury infrastructure.

Furthermore, the Aave DAO adjusts parameters to reflect market yields, stabilize demand, and sustain revenue in lower-rate environments.

Meanwhile, Aave Horizon, an institutional stablecoin lending platform launched by Aave Labs in August, is gaining waves in the DeFi market. Aave founder Stani Kulechov noted that the lending platform uses the protocol’s battle-tested lending technology and applies it to RWAs.

Aave Horizon started with negligible TVL but hit $50 million net deposits in just two days. Horizon now commands approximately $520 million in deposits, with over $185 million in active loans issued in under three months.

Overall, Horizon amplifies Aave’s advantages from “crypto winter” innovations. As Treasury yields compress, capital rotates to crypto-native yields.

The result is that overall Aave TVL exploded to $41.1 billion in September alone. In another DeFi expansion move, Aave Labs announced a strategic partnership with Blockdaemon.

As we covered in our latest report, the partnership integrates Horizon for tokenized real-world assets.

]]>You May Also Like

The Cycle Without A Ceiling: Why Bitcoin’s Missing Peak Rewrites The Rules For The 2026 Bottom

WhiteBIT Coin (WBT) Daily Market Analysis 14 February 2026