Abu Dhabi Tripled Its Bitcoin Bet In Q3 Before the Crypto Market Crash

Bitcoin Magazine

Abu Dhabi Tripled Its Bitcoin Bet In Q3 Before the Crypto Market Crash

The Abu Dhabi Investment Council (ADIC) expanded its exposure to Bitcoin ahead of the cryptocurrency’s sharp downturn, more than tripling its stake in BlackRock’s iShares Bitcoin Trust (IBIT) during the third quarter, regulatory filings show.

ADIC — an independently run investment unit within Mubadala Investment Co. — increased its holdings to nearly 8 million IBIT shares as of Sept. 30.

The position was valued at about $518 million at the time, up from 2.4 million shares three months earlier, according to Bloomberg reporting.

The accumulation by the Abu Dhabi council came just weeks before Bitcoin surged to a record high in early October and then slid below $92,000 as leveraged bets unwound across the market.

The Abu Dhabi council says the move is part of a broader, long-term diversification strategy. A spokesperson described Bitcoin as a digital counterpart to gold and said the allocation is intended to sit alongside the fund’s traditional store-of-value assets.

The buying wasn’t isolated. Mubadala separately reported holding 8.7 million IBIT shares valued at $567 million at the end of the third quarter, unchanged from the prior filing.

Other major institutions, including Harvard, also added to IBIT positions in the same period.

Still, investor appetite has cooled since the October selloff. U.S. spot Bitcoin ETFs have seen roughly $3.1 billion in outflows so far in November, according to Bloomberg data.

IBIT alone suffered a single-day record of $523 million in redemptions after Bitcoin broke below a key price level that left many ETF investors underwater.

Abu Dhabi’s bitcoin moves

ADIC’s increased allocation is notable given Abu Dhabi’s financial reach and its growing ambition to establish itself as a global crypto hub. The emirate’s wealth funds collectively oversee more than $1.7 trillion, and Mubadala has already been a major player in the region’s digital-asset expansion.

Earlier this year, MGX — a tech investment firm backed by Mubadala — acquired a $2 billion stake in Binance using a stablecoin tied to the family of U.S. President Donald Trump.

Inside ADIC, the push into Bitcoin aligns with a broader shift toward global expansion. The council, initially created in 2007 and later folded under Mubadala’s structure, continues to operate with its own mandate and investment strategy.

It has recently strengthened its leadership team, adding executives such as Alain Carrier, former head of international business at Canada Pension Plan Investment Board, and Ben Samild, previously the investment chief at Australia’s sovereign wealth fund, according to Bloomberg.

While crypto’s volatility remains a concern for global investors, Abu Dhabi’s stance underscores a different calculus: large sovereign funds are increasingly comfortable treating Bitcoin as a long-term strategic asset.

Other governments are moving in the same direction. El Salvador added more than $100 million in Bitcoin this week, the Czech central bank disclosed its first crypto purchase, and Kazakhstan is building a national cryptocurrency reserve fund that could reach $1 billion.

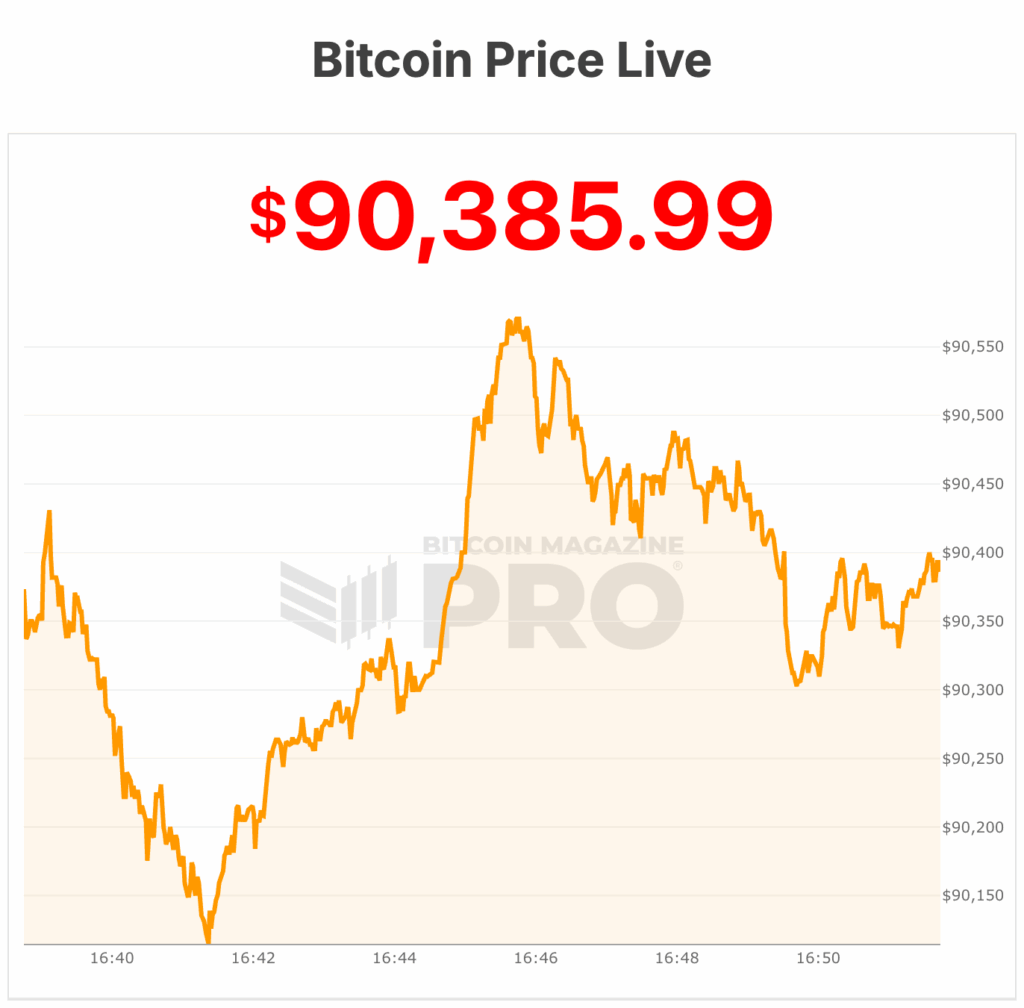

Bitcoin’s price is currently at the $90,300 range.

This post Abu Dhabi Tripled Its Bitcoin Bet In Q3 Before the Crypto Market Crash first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

You May Also Like

Michigan’s Stalled Reserve Bill Advances After 7 Months

DeFi Leaders Raise Alarm Over Market Structure Bill’s Shaky Future