BNB Bears vs. Support Walls: Will $660 and $564 Support Hold the Price?

- BNB is down 9%, hovering around the $809 mark.

- The daily trading volume has surged by 46%.

The crypto market kicked off the day drenched in red candles, registering a solid loss of over 9.22%. The majority of assets are overwhelmed with dread, struggling to breathe under the toughest bear grip. Bitcoin (BTC) and Ethereum (ETH) have lost momentum in double-digits, trading at $82K and $2.6K, respectively. Of all the altcoins, BNB has taken the hardest hit, sliding 9.88%.

Before the bearish encounter within the BNB market, it traded at a high of $903.68, and eventually, began falling to the bottom range of $807.49. The asset is currently trading at around $809.19, with a market cap of $111.51 billion. In addition, the daily trading volume has soared by 46.55% to $4.31 billion. An $8.74 million worth of BNB has been liquidated in the market in the last 24 hours.

Furthermore, BNB sits between two major realized price clusters in the URPD chart. It shows three key support levels where a large amount of BNB last moved. $853 is the nearest support above the current price, but it has slipped below it. $660, a strong support zone with a significant holder base. $564 acts as a deeper support with heavy concentration, likely to act as a strong demand area.

Can Bulls Break the Grip of BNB Bears Anytime Soon?

The BNB/USDT pair reports a bearish trading pattern, with the price set to fall toward the $805.36 support. With an extended downside correction, the death cross could unfold, and the bears might send the price to the $801.78 range. On the other side, if the asset reverses the momentum bullish, the price might move up to the resistance at $813.49. Further upside pressure could trigger the golden cross to take place. Gradually, the bulls would take the BNB price below $817.88.

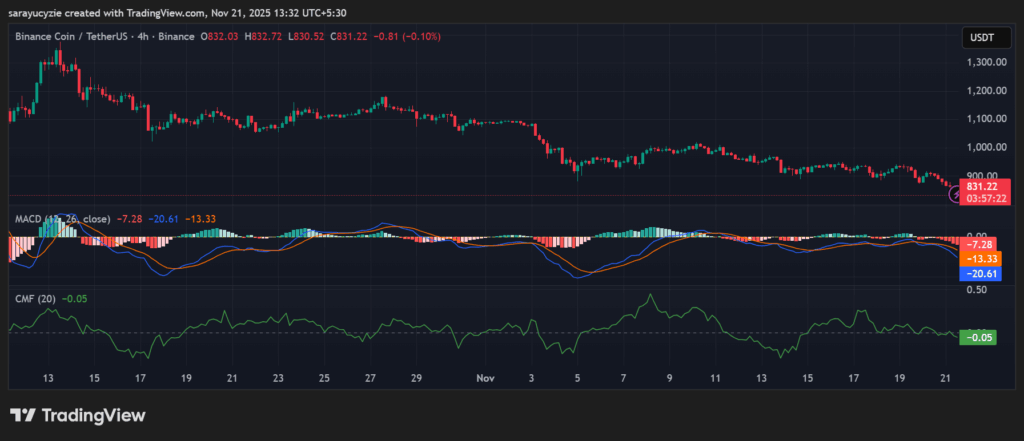

BNB chart (Source: TradingView)

BNB chart (Source: TradingView)

The technical analysis of BNB displays that the Moving Average Convergence Divergence (MACD) and signal lines are settled below the zero line, implying bearish momentum. The asset may continue to stay under a strong downtrend. Besides, the Chaikin Money Flow (CMF) reading staying at -0.05 hints at slight selling pressure in the BNB market. Notably, the capital is flowing out of the asset more than it is flowing in, but the bearish pressure is not very strong.

Moreover, the daily Relative Strength Index (RSI) found at 25.19 indicates a strong oversold condition of the asset. Also, the price can be stretched to the downside, and a bounce or short-term rebound may occur. BNB’s Bull Bear Power (BBP) value of -90.42 suggests strong bearish dominance, firmly steering the momentum. As the sellers are in control, the price is moving down. The trend may stay bearish unless buying pressure improves.

Top Updated Crypto News

7% Sink for Bitcoin (BTC): With This Wipeout, Are the Bears Putting $80K on the Table?

You May Also Like

Ethereum ETFs Lead on Jan 15 as Bitcoin Wins the Week

SEC chair backs rule to let companies ditch quarterly earnings reports