Bitcoin Investors Celebrate as December Fed Rate Cut Odds Near 50%

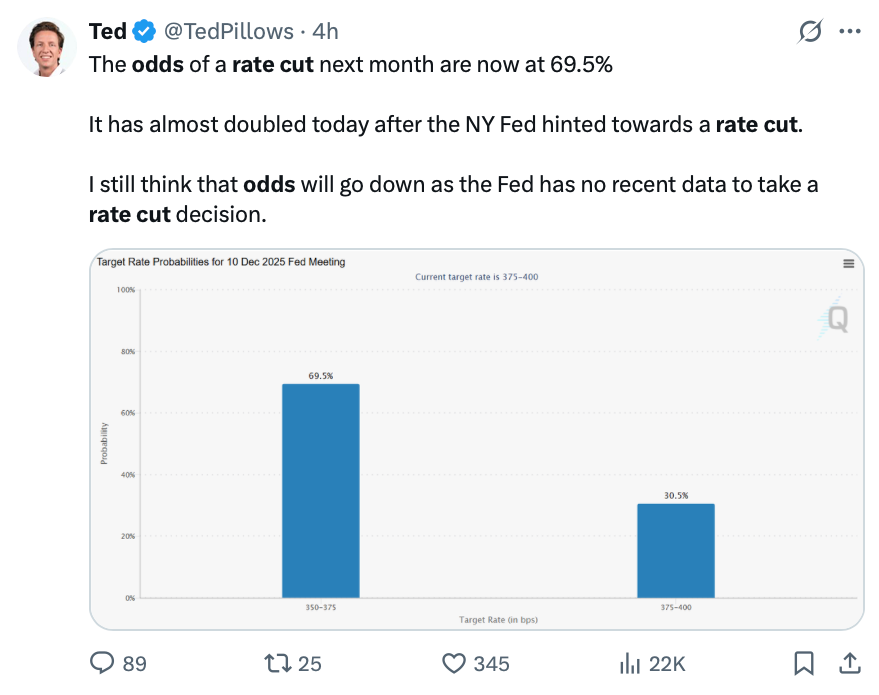

- The probability of a US Federal Reserve rate cut in December nearly doubled to 69.40%, sparking bullish sentiments in crypto markets.

- Many analysts see the rising odds as a bullish catalyst for Bitcoin, potentially halting its recent decline.

- Remarks from New York Fed President John Williams about the possibility of rate cuts have fueled market optimism.

- Despite the bullish signals, some experts caution against overexuberance, citing concerns over macroeconomic factors.

- Market sentiment remains weak overall, with the Crypto Fear & Greed Index posting an ‘Extreme Fear’ reading of 14.

Bitcoin’s market sentiment has shifted noticeably following a significant rise in the likelihood of an interest rate cut by the Federal Reserve in December. The odds, as reflected in the CME FedWatch Tool, now stand at nearly 70%, compared to just over 39% a day prior. This surge has reinvigorated hopes that the Federal Reserve’s monetary tightening cycle might be easing, potentially providing a positive tailwind for crypto assets.

Many in the crypto community view this development as a possible turning point after a challenging week, with Bitcoin trading at around $85,071, marking a 10.11% decline over the past seven days. Analyst Moritz noted that market conditions are now “unfathomably bullish” if the rate cut materializes thoroughly.

The odds of a US Federal Reserve rate cut surged 30.30% on Friday. Source: CME GroupMarket watchers largely attribute this optimism to dovish comments from New York Fed President John Williams, who suggested that rate cuts could happen “in the near term” without jeopardizing the Fed’s inflation targets. Bloomberg analyst Joe Weisenthal emphasized that the market’s implied probability of a rate reduction has “massively increased.”

Analyst Perspectives: Bullish Setup or Overreaction?

While some experts like economist Mohamed El-Erian urge caution and warn against overconfidence, the broader crypto community remains optimistic. “Usually this would be bullish,” commented Mister Crypto on X, reflecting the general sentiment that easing monetary policy tends to favor risk-on assets like Bitcoin and other cryptocurrencies.

Indeed, the expectation of lower interest rates often leads to increased interest in riskier assets, including DeFi projects, NFTs, and cryptocurrencies, as traditional fixed-income yields become less attractive. Analyst Jesse Eckel underscored this, stating, “If you zoom out, the setup is unfathomably bullish,” as the transition from a tightening to easing cycle gains momentum.

Source: Ted

Source: Ted

Crypto analyst Curb also expressed optimism, suggesting that a major rally could be imminent, fueled by macroeconomic shifts and the potential for rate cuts.

Meanwhile, Coinbase Institutional highlighted a mismatch in market pricing, stating, “While markets are leaning toward ‘no cut’ this time, the actual odds for a rate cut are underestimated, based on recent inflation indicators, tariff impacts, and real-time data.” The firm notes that inflation and unemployment dynamics tend to show negative demand shocks in the short term, complicating the outlook.

Despite these hopeful signs, overall market sentiment remains cautious. The Crypto Fear & Greed Index continues to signal ‘Extreme Fear’ with a score of 14, reflecting prevailing unease despite the macroeconomic and sentiment shifts.

This article was originally published as Bitcoin Investors Celebrate as December Fed Rate Cut Odds Near 50% on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

The Cognitive Factory: Redefining Industrial Production in 2026

Low Cap Altcoins to Watch in 2025: BlockchainFX, Little Pepe, and Unstaked Could Be the Next Big Crypto Coins