Solana Is About to Get Scarce, Biggest Update Yet!

The post Solana Is About to Get Scarce, Biggest Update Yet! appeared first on Coinpedia Fintech News

Solana may soon become one of the hardest tokens to get in the coming years. A new proposal from Solana developers has just gone live, aiming to double the current disinflation rate.

If this update gets approved, it could remove nearly 22 million SOL from future supply forever.

With fewer new SOL entering the market and demand continuing to grow, this update could set the stage for a strong price surge.

Solana’s Path Toward Scarcity

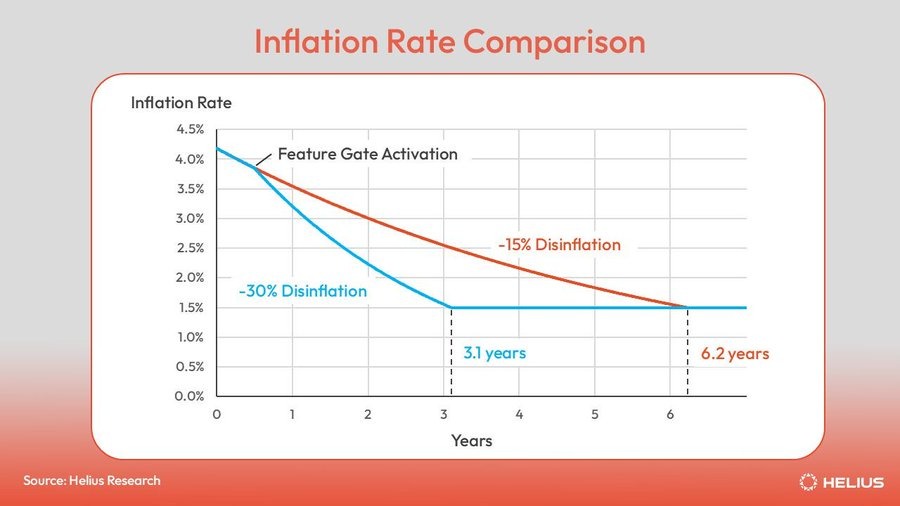

A new proposal from the Solana developer team aims to double the disinflation rate, helping the network reach its terminal inflation level of 1.5% in half the usual time.

Under the current schedule, Solana would take about 6.2 years to reach its final low inflation level of 1.5%. But with the proposed change, that journey would be shortened to just 3.1 years.

And this isn’t a small adjustment. According to research, this faster disinflation could prevent around 22 million SOL from ever being created.

And as of today’s prices, that equals billions of dollars worth of tokens that would never become selling pressure.

Solana Aims to Be Not Only Fast, But Economically Disciplined

Solana already has a reputation for high speed and heavy activity. But this proposal shows that the network wants more than just performance. It wants a disciplined economic system that rewards long-term belief, not just short-term participation.

Whether the proposal passes or not, it reveals Solana’s next chapter, one where the network doesn’t rely only on performance, but also on a scarcity-driven story that strengthens over time.

Less Supply + More Demand = Higher Price

Following the approval of this update, the SOL token price is expected to skyrocket as fewer SOL tokens are created, and the network continues to grow in users, apps, and activity, the demand for SOL will rise while supply falls.

When this happens in any market, the price usually sees a strong jump. This is why many analysts believe this proposal could trigger an increase in long-term price boost for Solana once scarcity kicks in.

However, Solana is already trading around $125.8, holding steady despite volatility across the crypto market.

You May Also Like

Gold Hits $3,700 as Sprott’s Wong Says Dollar’s Store-of-Value Crown May Slip

Why Institutional Capital Chooses Gold Over Bitcoin Amid Yen Currency Crisis