Hedera Price Prediction 2026, 2027 – 2030: Will HBAR Price Hit $0.5?

The post Hedera Price Prediction 2026, 2027 – 2030: Will HBAR Price Hit $0.5? appeared first on Coinpedia Fintech News

Story Highlights

- The live price of Hedera crypto is $ 0.11119655.

- Hedera Price prediction highlights HBAR could reach $0.45-$1.05 in 2026.

- The Long-term forecasts suggest HBAR could hit $2.20 by 2030, indicating stable growth potential.

Hedera has been making waves in the cryptocurrency space, with a fast and secure blockchain that offers a distinct approach to transaction processing compared to Ethereum and other smart contract chains. It’s permission-only, meaning the blockchain is managed by private companies. Limiting what types of decentralised applications are allowed is what makes Hedera stand out from the rest.

Having entered the top 20 digital assets by market cap in 2024, it is now eyeing a potential leap into the top 10 by the end of 2025. Hedera has also recently ramped up its development activities for its ecosystem. Its ecosystem is strengthening, despite its capped price action. With increasing real-world use cases, institutional interest, and strategic partnerships, many are closely tracking HBAR price chart 2025 to gauge how high the token can rise.

With major companies like Google, IBM, and Chainlink Labs backing the project, and discussions about SEC approved HBAR ETF would flood string liquidity. Many are intrigued that: Will the HBAR Price Reach $1? Let’s discuss this in our Hedera price prediction 2025 article.

Table of Contents

- Story Highlights

- Hedera Price Analysis 2025

- Hedera Price Prediction 2025

- HBAR Price Prediction 2026: What’s Next for Hedera?

- HBAR Price Prediction 2026 – 2030

- HBAR Price Prediction 2026

- HBAR Price Forecast 2027

- Hedera Price Forecast 2028

- HBAR Price Target 2029

- Hedera Price Prediction 2030

- Market Analysis

- Coinpedia’s Hedera Price Prediction

- FAQs

Hedera Price Today

| Cryptocurrency | Hedera |

| Token | HBAR |

| Price | $0.1112 |

| Market Cap | $ 4,756,622,254.66 |

| 24h Volume | $ 136,803,577.9640 |

| Circulating Supply | 42,776,708,614.0947 |

| Total Supply | 50,000,000,000.00 |

| All-Time High | $ 0.5701 on 16 September 2021 |

| All-Time Low | $ 0.0100 on 02 January 2020 |

Hedera Price Analysis 2025

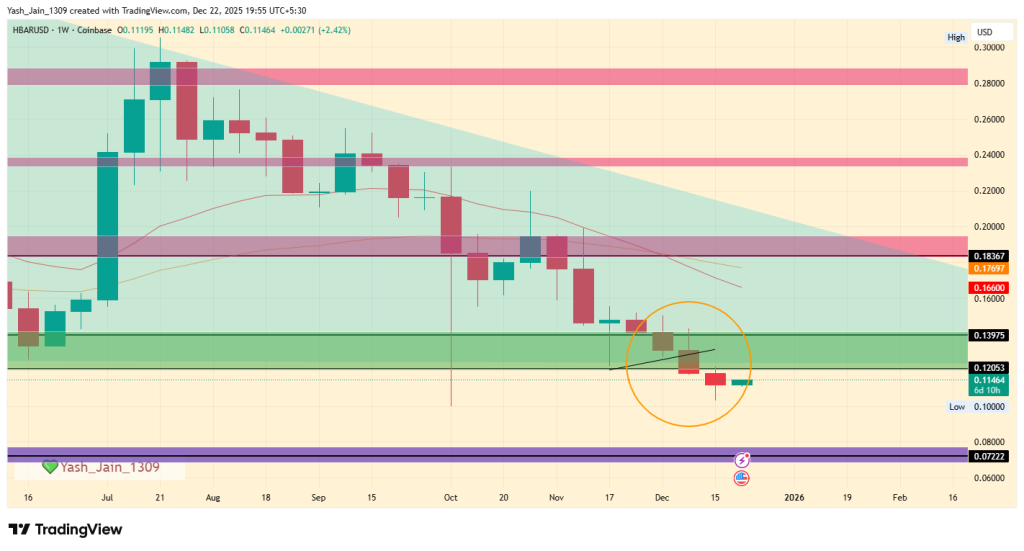

The Hedera price USD analysis 2025 showed that the year began on a promising note, reaching an impressive peak of $0.40 in mid-January. However, this bullish momentum was the extension of rally started in Q4 2024 with Trump coming out victorious from election against Kamala Harris, as after peaking to $0.40 a steady decline ensued, bringing the price down to a low of $0.125 by early April. This downturn can be attributed to a combination of external market factors, including economic uncertainties and weakening investor interest.

As the year progressed, the situation took a concerning turn. Geopolitical tensions significantly impacted market dynamics and pushing HBAR into the $0.120-$0.139 demand zone. Throughout the remainder of the year, the asset experienced multiple retests of this critical demand area, indicating the market’s struggle to maintain support. Although there was a brief attempt at recovery in July, this was hindered by low buying strength, resulting in a lack of momentum.

By December, the outlook for Hedera had worsened significantly. The cryptocurrency broke through key support levels that had previously been vital. As a result, a further decline towards the $0.07 support area or a prolonged period of consolidation as the year draws to a close, is highly likely.

Hedera Price Prediction 2025

By mid-December, it has breached $0.12, suggesting that another possibility has arisen, which indicates the weakness of this demand area and perhaps can’t hold any longer, seeking solid support next, which could be $0.072, the target bears have set for December. However, it’s one of the projects that has an ETF; renewed pressure could build a rebound in Q1 2026, and if this level rebounds at that time, it would be a good rally.

| Month | Potential Low | Potential Average | Potential High |

| HBAR Price Prediction December 2025 | $0.07 | $0.17 | $0.30 |

HBAR Price Prediction 2026: What’s Next for Hedera?

The HBAR price has experienced a prolonged period of consolidation below the $0.120 mark, lasting nearly two years from 2023 to the end of 2024. However, by the end of 2025, the price is projected to return to this critical range.

As we look ahead to the first quarter of 2026, there’s a sense of optimism, particularly if HBAR can establish a solid foundation at the $0.072 level. A successful rally from this point would indicate robust demand and could lead to a stronger upward movement.

On the other hand, entering this price zone could also raise concerns among investors, as market fluctuations and investor sentiment may lead to uncertainty. Balancing these factors will be crucial.

| Year | Potential Low | Potential Average | Potential High |

| 2026 (conservative) | $0.15 | $0.40 | $0.75 |

HBAR Price Prediction 2026 – 2030

| Year | Potential Low | Potential Average | Potential High |

| 2026 | $0.45 | $0.80 | $1.05 |

| 2027 | $0.60 | $0.95 | $1.20 |

| 2028 | $0.65 | $1.10 | $1.40 |

| 2029 | $0.70 | $1.35 | $1.60 |

| 2030 | $0.95 | $1.70 | $2.20 |

HBAR Price Prediction 2026

Moving forward to 2026, forecast prices and technical analysis project that Hedera’s price is expected to reach a minimum of $0.45. The price could escalate to $1.05 on the higher end, with an average trading price hovering around $0.80.

HBAR Price Forecast 2027

Looking ahead to 2027, the optimism around Hedera will lead to steady growth. Hence, the HBAR price is forecasted to reach a low of $0.60, with a potential high touching $1.20 and an average forecast price of $0.95.

Hedera Price Forecast 2028

As we advance to 2028, with moderate gains, the HBAR predictions indicate that the price of a single HBAR could reach a minimum of $0.65, with the ceiling potentially rising to $1.40. Within the range, the average price will be $1.10.

HBAR Price Target 2029

By the time 2029 rolls around, it’s predicted that Hedera’s price will maintain its upward trajectory, reaching a minimum of $0.70, with the maximum price possibly reaching $1.60 and an average of $1.35, reflecting cautious optimism.

Hedera Price Prediction 2030

By the end of this decade, HBAR is predicted to touch its lowest price at $0.95, aiming for a high of $1.70 and an average price of $2.20. Hence, the prediction suggests stable long-term growth for Hedera’s market value.

Market Analysis

| Firm | 2025 | 2026 | 2030 |

| Changelly | $0.259 | $0.370 | $1.74 |

| priceprediction.net | $0.27 | $0.40 | $1.99 |

| DigitalCoinPrice | $0.43 | $0.50 | $1.07 |

Coinpedia’s Hedera Price Prediction

By the end of 2025, the recovery run in HBAR prices is expected to continue with a gradual rise in momentum. Hence, by the end of 2025, Coinpedia’s HBAR price forecast expects a potential high of $0.80 with a solid support at $0.40, making an average of $0.60.

| Year | Potential Low | Potential Average | Potential High |

| 2025 | $0.40 | $0.60 | $0.80 |

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

HBAR could reach up to $0.75 by the end of 2025 if demand rises and market conditions improve, with support expected near the $0.12–$0.13 zone.

HBAR price in 2026 is projected to trade between $0.45 and $1.05, with an average near $0.80 under favorable market conditions.

By 2030, HBAR price could rise to around $2.20 if network growth, partnerships, and broader crypto adoption continue steadily.

Hedera shows long-term potential due to enterprise adoption, real-world use cases, and strong governance, though price cycles still affect returns.

You May Also Like

Zero-Trust Databases: Redefining the Future of Data Security

VPN.com CEO Humbly Requests Apple Recognize “Yeshua” Spelling in Apple Dictionary

ZCash Price Could Drop to $100 if $203 Support Breaks

Highlights: ZCash is trending towards $203.56 support after a failed rebound Push through $203.56 support could see ZEC drop to lows of $100 Suppor