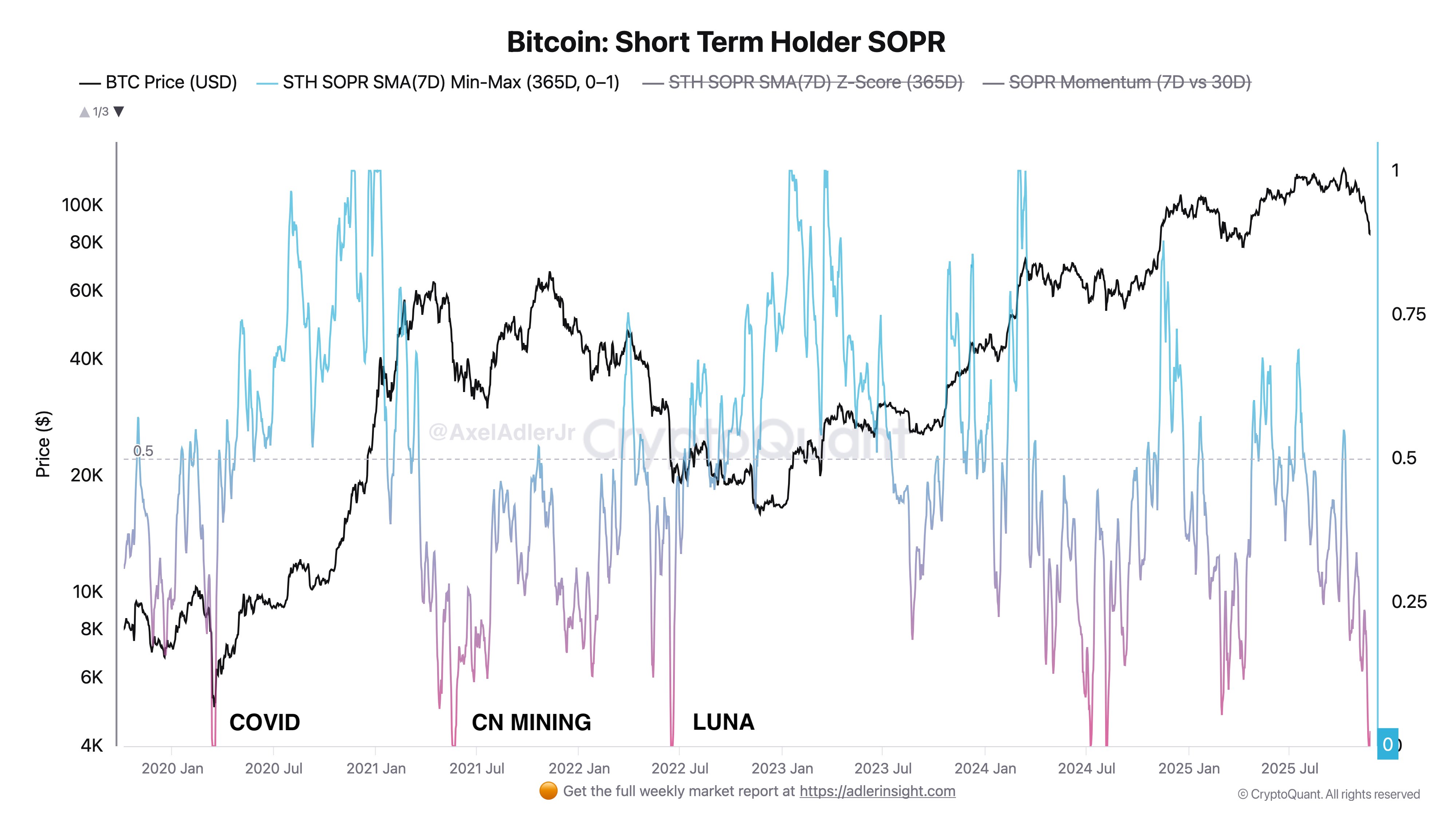

Bitcoin Capitulation Now Mirrors COVID, China Ban, and Luna Collapse Levels – Historical Stress Point

Bitcoin has officially entered a capitulation phase as relentless selling pressure and macro uncertainty push the market into one of its most stressful moments of the cycle. After reaching its $126,000 all-time high in early October, BTC has collapsed to a fresh local low near $80,000 in under two months — a stunning 35% drawdown that has shaken investor confidence. Many market participants who expected a continuation of the bullish trend are now facing steep unrealized losses, amplifying fear and forcing short-term holders to exit at a loss.

According to top analyst Axel Adler, the strength of the US dollar has become one of the dominant forces behind this wave of capitulation. As the DXY index holds firmly above 100, global liquidity tightens, historical patterns show that Bitcoin short-term holders tend to realize losses more aggressively. Adler notes that this dynamic is currently playing out with intensity, mirroring previous phases of market stress.

However, not all signals point downward. The probability of a December Federal Reserve rate cut has climbed to 69%, and Adler suggests that if markets begin pricing this more aggressively, it could flip macro momentum and trigger a reversal. For now, Bitcoin remains in a fragile state — but a macro catalyst may be forming.

Short-Term Holder Capitulation Deepens as Macro Pressure Overrides Behavioral Signals

Axel Adler explains that short-term holders are now realizing losses with an intensity comparable to some of Bitcoin’s most violent historical shocks — including the COVID crash of 2020, the China mining ban in 2021, and the Luna collapse in 2022.

The latest data shows that SOPR Momentum, a key indicator of realized profitability, has dropped nearly to 0, a level that typically marks full capitulation among reactive market participants. Historically, readings this depressed have aligned with explosive V-shaped reversals or sharp relief rallies, as selling pressure becomes exhausted and stronger hands begin absorbing supply.

However, Adler emphasizes an important nuance: while behavioral capitulation is clearly underway, macro forces currently dominate market structure. Extreme SOPR readings can produce bottoms, but they can also generate short-lived bounces within broader downtrends when macro conditions remain unfavorable. With the dollar index (DXY) still elevated above 100, liquidity remains tight — and Bitcoin continues to trade under pressure.

Adler notes that everything now hinges on the Federal Reserve. If markets begin actively pricing in the December rate cut, it could weaken the dollar and relieve some of the stress weighing on BTC. Until then, macro remains the stronger force, overshadowing even severe capitulation signals.

Testing Support After a Steep Breakdown

Bitcoin’s price action on the 1D chart shows the market attempting to stabilize after one of the sharpest multi-week declines of this cycle. BTC dropped from the $126,000 peak to the $80,000–$86,000 range in less than two months, and the chart clearly reflects this capitulation structure. The series of long red candles highlights aggressive selling pressure, with bears firmly in control throughout November.

The chart shows BTC trading below all major moving averages—the 50-day, 100-day, and 200-day—confirming a clear breakdown in trend structure. The 200-day MA around the mid-$88K region is now acting as resistance rather than support. This flip is typically a bearish signal and aligns with the ongoing macro-driven weakness highlighted by analysts across the market.

Volume remains elevated during the downturn, reinforcing that the sell-off has been driven by strong hands exiting. However, the most recent candles show wicks forming near $83K–$86K, suggesting early attempts at demand absorption. If BTC can hold above the recent low around $80K and close back above the 200-day MA, the market could see a short-term relief rally.

Featured image from ChatGPT, chart from TradingView.com

You May Also Like

China Launches Cross-Border QR Code Payment Trial

Zero Knowledge Proof Auction Limits Large Buyers to $50K: Experts Forecast 200x to 10,000x ROI