SEI on the Edge: Can Bulls Hold Off a Fall and Drive Toward the $0.22 Resistance Line?

- SEI is currently trading around $0.13.

- Its trading volume has surged by over 30%.

The crypto market has flashed a red light across the digital assets for the last few days. Upon the bearish pressure intensifies, the overall momentum faces more losses. With the extreme fear sentiment, all major tokens are trading on the downside. Among the pack of altcoins, SEI has spiked by over 1.45% in the last 24 hours.

The asset traded at its bottom range of $0.1306 in the morning hours, and as the SEI bulls stepped in briefly, the price has mounted to a high of $0.139. The crucial resistance zones have been tested between $0.1310 and $0.1386. Currently, SEI trades at around $0.1362, with its daily trading volume soaring by over 30.46%, reaching $95.7 million.

According to an analyst’s chart, SEI is repeatedly getting rejected from a long-term descending resistance trendline. This has been in place since early 2024 and has stopped every major rally attempt. That same resistance sits around $0.22. SEI is in a broader downtrend, and a breakout above this level would signal the end of long-term downtrend.

Will SEI Find Support or Keep Falling?

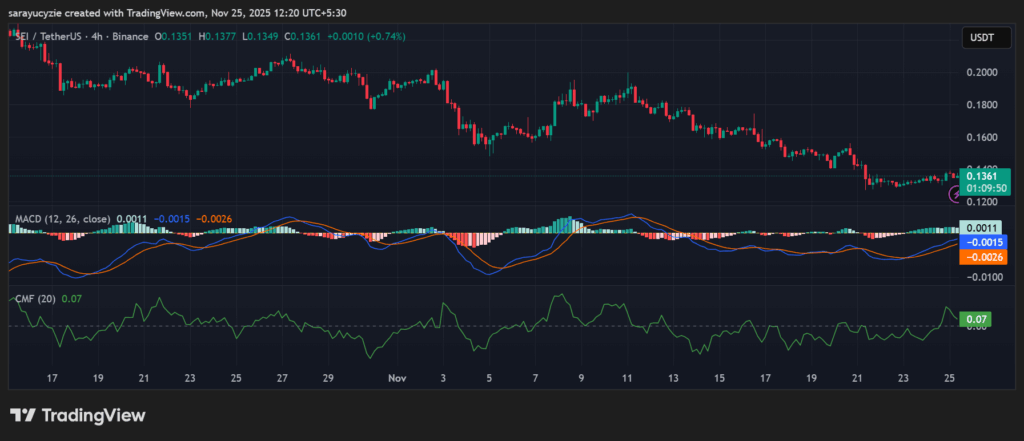

SEI’s Moving Average Convergence Divergence (MACD) and signal lines are both settled below the zero line, implying its bearish zone. The overall momentum is weak, even if short-term recoveries appear. The Chaikin Money Flow (CMF) indicator stationed at 0.07 points out the mild buying pressure. The value above 0 shows money flowing into the asset, moderate accumulation and a slightly bullish tone in the market.

SEI chart (Source: TradingView)

SEI chart (Source: TradingView)

With the overall weak momentum, the SEI price might retrace toward its crucial support at around $0.1355. A sturdy downside correction has the potential to initiate the death cross to take place, taking the asset’s price below $0.1348. Assuming the SEI bulls take control, the price could immediately climb to the $0.1369 resistance level. An extended upside pressure might trigger the emergence of the golden cross, and gradually take the price above the $0.1376 mark.

The daily Relative Strength Index (RSI) of the asset at 48.49 indicates the current neutral condition. The market is balanced, with no strong bullish or bearish momentum, and the price could move in either direction. Notably, SEI’s Bull-Bear Power (BBP) reading of 0.0028 suggests very weak bullish pressure in the market. As the value is extremely small, the buying strength is minimal.

Top Updated Crypto News

XRP Leaps 7%: Is This Upturn Strong Enough to Fuel More Momentum?

You May Also Like

The Stark Reality Of Post-Airdrop Market Dynamics

Headwind Helps Best Wallet Token