Analysts Call Solana Price Reversal: SOL USD Shoots High For $160

SOL moved higher on Tuesday as traders spotted early signs of a trend shift, pushing the token back toward a key resistance area.

Solana traded near $136 across major exchanges after bouncing off a well-watched support level.

Analysts said the move appears to be a short-term reversal, aided by steady activity in the derivatives market.

The market spent most of November under pressure, and SOL followed suit. But positioning is now picking up again.

DISCOVER: Top Solana Meme Coins to Buy in 2025

Does Rising DEX and Perp Volume Signal Growing Confidence in Solana?

Coinglass data shows that futures open interest is approximately $ 7.0 billion, and 24-hour futures volume is around $ 19 billion. Spot trading also surpassed $ 1 billion in daily turnover.

(Source: Coinglass)

(Source: Coinglass)

These numbers indicate that traders are stepping back in after several days of slow, choppy trading.

And with SOL reclaiming the mid-$130 range, attention now turns to whether it can push toward the next resistance zone.

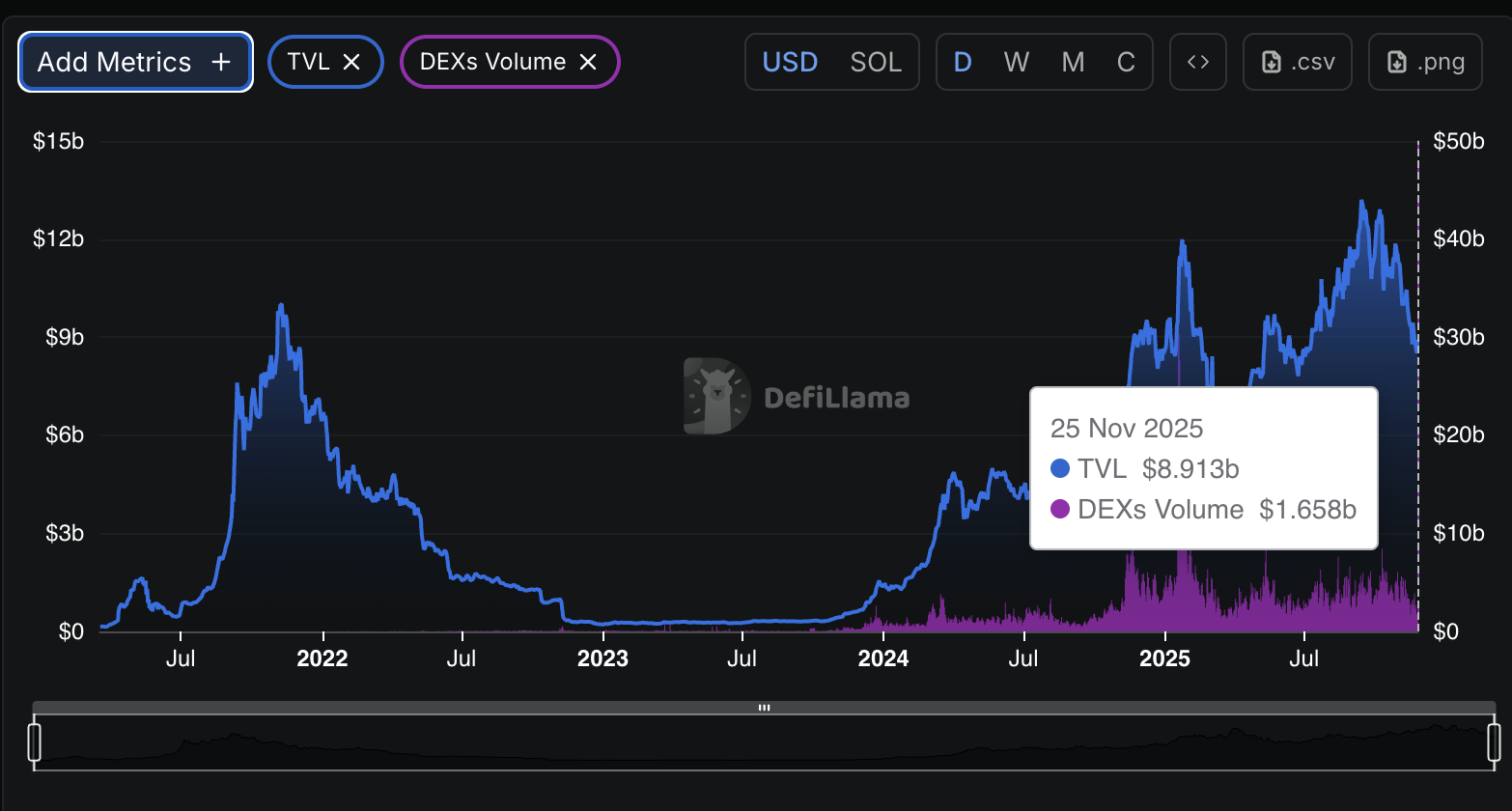

DeFiLlama data shows that the network’s total value locked is approximately $ 8.878 billion, indicating that liquidity across major protocols hasn’t faded.

(Source: DefiLlama)

(Source: DefiLlama)

Solana’s 24-hour DEX volume sits near $1.795Bn, and perpetual futures are close behind at $1.869Bn. Together, these figures show steady use of Solana’s spot and derivatives markets.

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in 2025

Solana Price Prediction: How Far Can SOL Climb If It Clears the $155 Resistance?

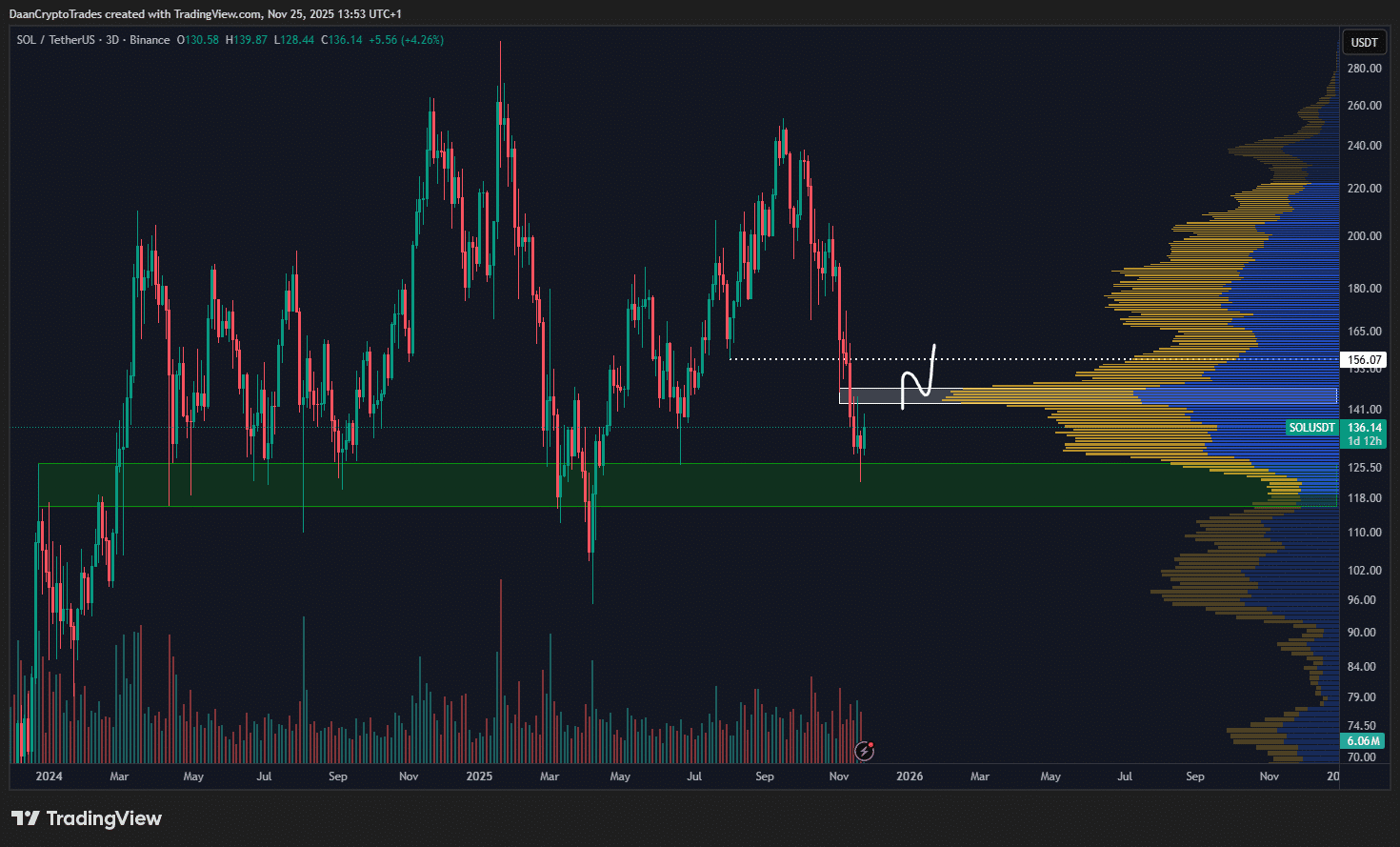

The network is also trying to find its footing after a long stretch of selling. Analyst Daan Crypto shared a chart outlining the levels traders are watching. He said, “SOL has been in a big slump. But with the first signs of life from some SOL memes, and SOL sitting at high timeframe support, it got my attention.”

His chart shows Solana pressing against a key support area that has held multiple times in the past. And while momentum has slowed, the ongoing activity across DEXs and perps suggests traders haven’t stepped back.

On the 3-day chart, SOL has slipped into a broad high-time-frame demand zone between $118 and $130. This area triggered strong rebounds several times in 2024 and early 2025.

(Source: X)

(Source: X)

Price is now holding just above this green support block after a sharp wick down, indicating that buyers are stepping in to protect the level for now.

SOL was rejected from this zone during the latest pullback, but a clean move back above it would shift momentum and open the next leg higher.

Above $145, the next clear resistance sits near $155. This level lines up with another volume cluster and the dotted white line on Daan’s chart. He says that if SOL can close back above this zone, “the ~$155 area would be next.”

The broader trend remains weak, but the first signs of support are starting to emerge.

These small reactions don’t confirm a full shift yet, but they leave room for a possible rebound in the coming weeks.

DISCOVER: Next 1000X Crypto – Here’s 10+ Crypto Tokens That Can Hit 1000x This Year

The post Analysts Call Solana Price Reversal: SOL USD Shoots High For $160 appeared first on 99Bitcoins.

You May Also Like

Tether CEO Delivers Rare Bitcoin Price Comment

BitGo wins BaFIN nod to offer regulated crypto trading in Europe

BitGo’s move creates further competition in a burgeoning European crypto market that is expected to generate $26 billion revenue this year, according to one estimate. BitGo, a digital asset infrastructure company with more than $100 billion in assets under custody, has received an extension of its license from Germany’s Federal Financial Supervisory Authority (BaFin), enabling it to offer crypto services to European investors. The company said its local subsidiary, BitGo Europe, can now provide custody, staking, transfer, and trading services. Institutional clients will also have access to an over-the-counter (OTC) trading desk and multiple liquidity venues.The extension builds on BitGo’s previous Markets-in-Crypto-Assets (MiCA) license, also issued by BaFIN, and adds trading to the existing custody, transfer and staking services. BitGo acquired its initial MiCA license in May 2025, which allowed it to offer certain services to traditional institutions and crypto native companies in the European Union.Read more