Edo State unveils USSD code to simplify Tax ID registration, boost compliance

The Edo State Internal Revenue Service (EIRS) has introduced a USSD code to simplify tax compliance and Tax ID registration for residents across the state. The initiative is part of its preparation ahead of the nationwide implementation of the new Nigerian Tax Acts by January 1 2026.

Head of Corporate Communications at EIRS, Courage Eboigbe, on Thursday, explained that the latest development will promote inclusivity and ensure compliance with tax filing come 2026. He added that the initiative will broaden participation in the formal economy and enhance the ease of doing business.

The USSD code is a joint rollout by the Edo State Internal Revenue Service and the Joint Tax Board (JTB).

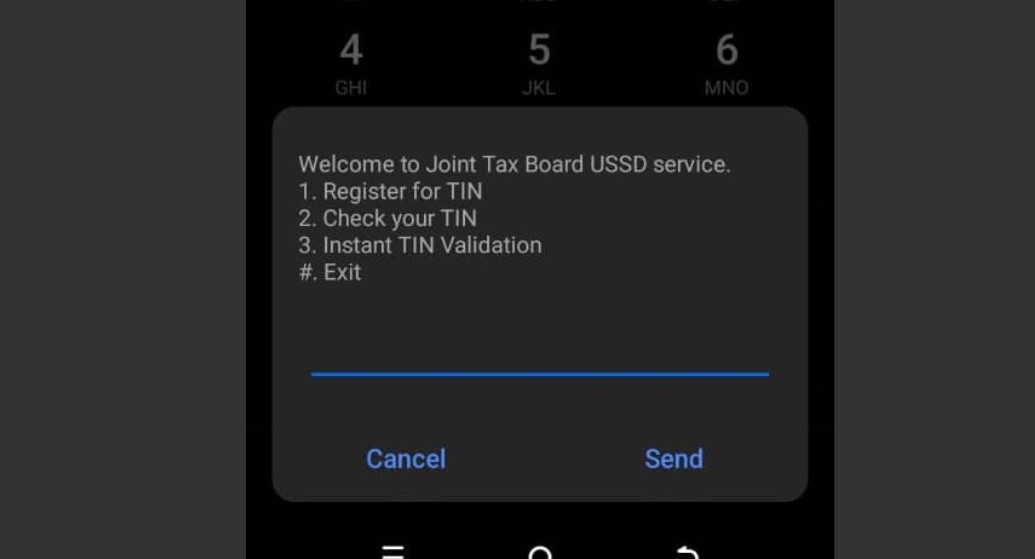

By dialling *668# on their mobile devices, Edo State residents can access instant Tax ID registration at a service cost of N20. Other features under the service are verification and certificate generation.

Tax ID USSD dial

Tax ID USSD dial

However, checks show that the USSD code can be accessed nationwide by Nigerians, regardless of their state of residence.

Also Read: How to get a Nigerian Tax ID before Jan. 2026 deadline for bank account holders.

This isn’t the first USSD code initiative that helps simplify tax compliance. Last year, the Federal Inland Revenue Service (FIRS) launched a USSD code that gives taxpayers access to relevant information.

The USSD Code, *829#, makes Nigeria one of the 6 African countries with a USSD code for Tax collection and other related matters.

The code, at a service cost of N100, enables taxpayers to retrieve their Tax ID, verify their Tax Clearance Certificates (TCC), obtain information on tax types and rates, get answers to any tax-related inquiries and locate the nearest FIRS office.

Tax ID registration centres

The Edo Internal Revenue Service also unveiled 14 new centres for Tax ID registration across the state as part of efforts to decentralise the process. In addition, the project seeks to bring the agency’s services closer to citizens.

The new centres are located in all zonal tax offices across the state, including Oredo, Egor, Ikpoba-Okha, Uhunmwonde, Ovia North-East and Orhionmwon. They are also situated in Ovia South-West, Esan West, Esan North-East, Akoko-Edo, Etsako East, Etsako West and Owan East.

Eboigbe stressed that the move was a strategic effort to facilitate tax compliance by taxpayers in preparation for the new tax laws in 2026.

“These initiatives ensure that citizens and potential taxpayers, especially those in rural and diaspora communities, can obtain their Tax ID conveniently,” he said.

Aside from the USSD code and physical location, Nigerians can confirm existing TINs or register anew by visiting the JTB portal at tin.jtb.gov.ng. Further enquiries are to be directed to 08130970146 or info@eirs.gov.ng.

You May Also Like

VIRTUAL Weekly Analysis Jan 21

MetaMask Token: Exciting Launch Could Be Sooner Than Expected