Crypto Regulation Stalls: Senator Reveals Shocking Deadlock in Congress

BitcoinWorld

Crypto Regulation Stalls: Senator Reveals Shocking Deadlock in Congress

In a stark revelation that sends shockwaves through the digital asset industry, pro-cryptocurrency U.S. Senator Bernie Moreno has declared that comprehensive crypto regulation talks in Congress have hit a significant wall. With negotiations stalled and key disagreements unresolved, the future of a clear legal framework for cryptocurrencies in the United States hangs in the balance. This deadlock creates immense uncertainty for businesses and investors alike.

Why Has Crypto Regulation Stalled in Congress?

According to Senator Moreno, speaking at a Blockchain Association policy summit, the path to a bipartisan crypto regulation bill is currently blocked by fundamental disagreements. While the U.S. managed to pass the narrower GENIUS Act for stablecoins last summer, efforts for a broader, more comprehensive law have ground to a halt. The senator emphasized a firm stance, stating he would rather have no agreement than a bad one, refusing to include problematic provisions just for the sake of passing a bill.

The core issues causing this impasse are not simple. They strike at the heart of how the U.S. government views and manages digital assets. The lack of progress leaves a regulatory gray area that many argue stifles innovation and fails to protect consumers.

The Major Roadblocks to Agreement

So, what are the specific hurdles preventing a deal on crypto regulation? The negotiations have stumbled over two primary, and deeply complex, challenges:

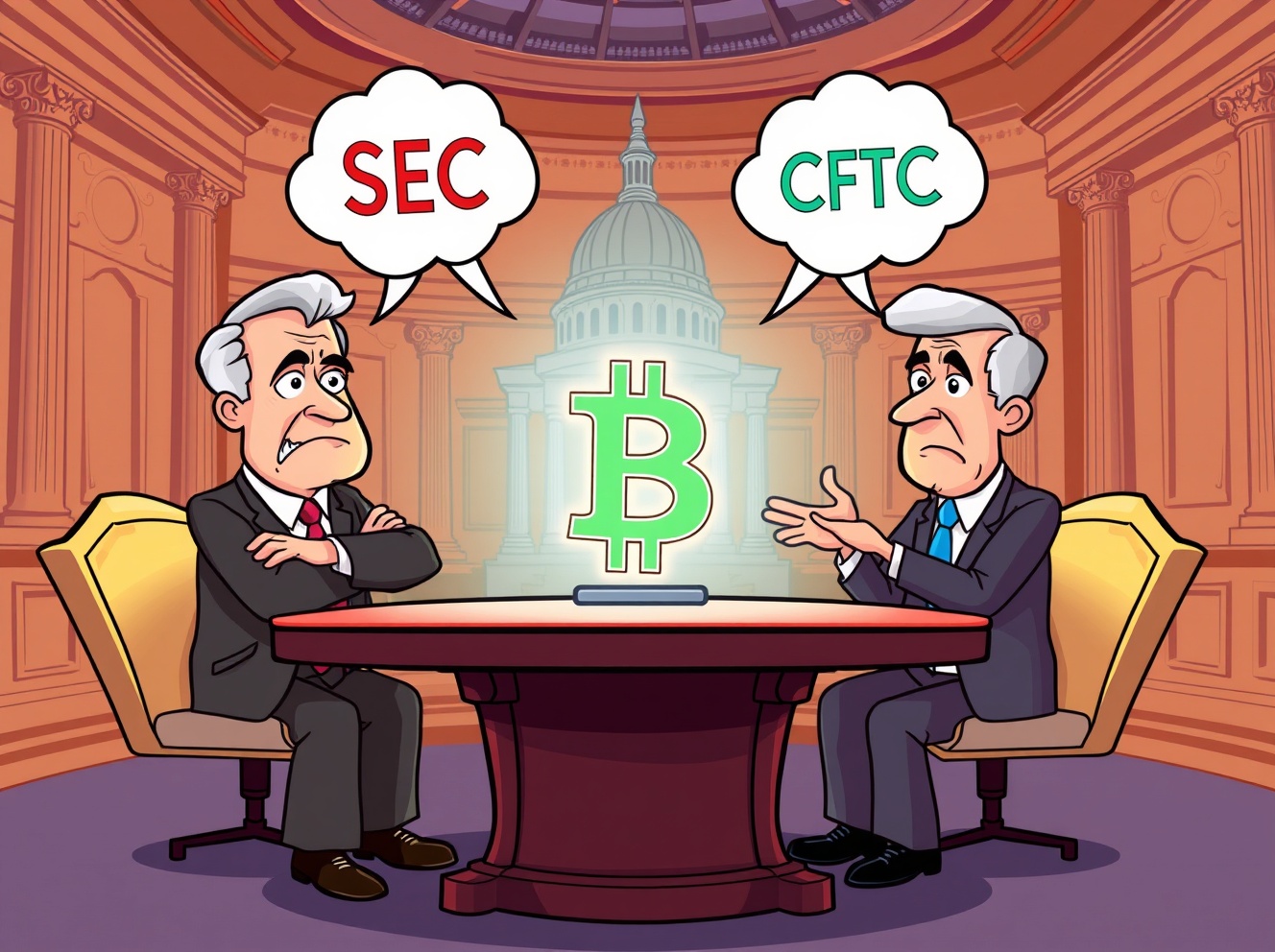

- The SEC vs. CFTC Turf War: A major sticking point is defining the jurisdictional boundaries between the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC). Lawmakers must decide which agency gets primary oversight over different types of digital assets—a decision with huge implications for the industry.

- Consumer Protection Provisions: Crafting rules that adequately protect investors from fraud and market manipulation without being so restrictive that they crush legitimate innovation is a delicate balancing act. Agreeing on the specifics of these provisions has proven difficult.

These are not minor technical details. They are foundational questions that will shape the U.S. crypto landscape for decades. Resolving them requires compromise from both political parties and regulatory bodies with sometimes competing philosophies.

What’s Next for US Crypto Policy?

Despite the current stalemate, the conversation is not over. Republicans and Democrats are scheduled to meet again to continue discussions. The question remains: can they bridge the gap? The outcome of these talks will determine whether the U.S. embraces a leadership role in the digital economy or continues with a patchwork of state rules and aggressive enforcement actions.

The delay in federal crypto regulation has real-world consequences. It creates uncertainty for companies deciding where to base their operations and leaves everyday investors without clear protections. Many industry advocates warn that the United States risks falling behind other nations that are moving more swiftly to establish clear rules.

The Final Verdict on the Regulatory Impasse

The admission by Senator Moreno that crypto regulation talks have stalled is a pivotal moment. It highlights the profound challenges of governing a fast-evolving technological frontier with traditional political and regulatory tools. While the desire for a “no bad deal” is principled, the ongoing vacuum carries its own risks. The coming weeks will be critical as lawmakers reconvene, facing pressure from both an eager industry and a concerned public to find a viable path forward. The dream of comprehensive, clear crypto regulation remains alive, but its path through Congress is now fraught with significant obstacles.

Frequently Asked Questions (FAQs)

Q1: What did Senator Bernie Moreno say about crypto regulation?

A1: Senator Moreno stated that negotiations for a comprehensive crypto regulation bill in Congress have stalled due to key disagreements, primarily over SEC/CFTC jurisdiction and consumer protection rules. He expressed a preference for no deal over a bad one.

Q2: What is the GENIUS Act?

A2: The GENIUS Act is a U.S. law passed in the summer of 2023 that specifically regulates stablecoins—a type of cryptocurrency pegged to a stable asset like the U.S. dollar. The current stalled talks concern a much broader regulatory framework.

Q3: Why is defining SEC vs. CFTC jurisdiction so important?

A3: It’s crucial because the SEC regulates securities (investments), while the CFTC regulates commodities (like goods and futures). How a cryptocurrency is classified determines which rules apply, impacting everything from trading to disclosure requirements for companies.

Q4: What happens if Congress can’t agree on crypto regulation?

A4: Without federal legislation, the current state of regulatory uncertainty continues. This likely means more enforcement actions by the SEC and CFTC based on existing laws, a patchwork of state-level regulations, and continued legal ambiguity for businesses and investors.

Q5: Are there any upcoming meetings about this?

A5: Yes. According to reports, Republicans and Democrats in Congress are scheduled to meet on December 9th to continue discussions on the stalled crypto regulation bill.

Q6: How does this stalemate affect the average crypto user?

A6: It prolongs uncertainty. Users may face unclear tax reporting guidelines, inconsistent protections across different platforms, and a U.S. crypto industry that is hesitant to innovate or offer new services due to the lack of regulatory clarity.

Did you find this breakdown of the congressional crypto deadlock helpful? This issue affects the entire industry. Share this article on social media to help your network understand the critical regulatory challenges shaping the future of cryptocurrency in America.

To learn more about the latest crypto regulation trends, explore our article on key developments shaping blockchain institutional adoption.

This post Crypto Regulation Stalls: Senator Reveals Shocking Deadlock in Congress first appeared on BitcoinWorld.

You May Also Like

UK Looks to US to Adopt More Crypto-Friendly Approach

Why is Bitcoin (BTC) Trading Lower Today?