Strive Unveils $500M ATM Plan to Fund More BTC Acquisitions

Highlights:

- Strive has launched a $500 million ATM program to expand its Bitcoin holdings.

- The asset manager said it will also spend the capital in other yield-generating assets.

- Strive’s SATA Stock will be sold via sales agent under the company’s existing terms of agreement.

Strive, the first publicly traded asset management Bitcoin (BTC) treasury firm, has announced plans to expand its Bitcoin holdings through a $500 million capital raise. According to a press release dated December 9, the company outlined plans to raise the money by selling up to $500 million worth of its Series A Preferred Stock, referred to as SATA Stock. The plan is an at-the-market (ATM) offering, which means the company can sell the shares in small amounts over time, depending on the market conditions.

Strive Plans to Diversify Investments

Strive said proceeds from the fundraising will support several projects, with a significant portion going into purchasing more Bitcoin and related assets. The company also intends to use the funds for general purposes, like improving business operations and covering day-to-day expenses. It may also use part of the raised capital to repurchase its own common stock or even pay off debt. Strive added that it may also purchase other companies, assets, or technologies that align with its ongoing projects.

The company explained that the SATA Stock will be sold via agents, following ATM rules under US securities laws or other legal channels. Sales are limited to those outlined in a prospectus supplement filed with the SEC on December 9, 2025. This filing is connected to the company’s automatic shelf registration statement, which became effective on September 15, 2025.

Strive Among Top 20 Bitcoin Holders with Over 7,000 Tokens

Strive launched its first exchange-traded fund (ETF) in August 2022. Since then, the company has expanded significantly to manage digital assets worth over $2 billion. The firm announced its plans to become a Bitcoin treasury company through a public reverse merger in May 2025. In September, Strive acquired Semler Scientific, establishing its position as one of the largest corporate holders of Bitcoin.

BitcoinTreasuries.net data shows that Strive is the 14th largest Bitcoin holder with 7,525 BTC and a market cap of $845 million. The company is ahead of popular companies like GD Culture Group, Cango Inc., Galaxy Digital Holdings Ltd, and Next Technology Holding Inc. Meanwhile, Strategy remains the largest Bitcoin corporate holder with 660,624 tokens, worth $49.35 billion.

Last week, Strategy completed one of its largest Bitcoin purchases, valued at roughly $962.7 million for 10,624 BTC. Other companies that make up the top five largest Bitcoin holders list include MARA Holdings Inc., Twenty One Capital, Metaplanet Inc., and Bitcoin Standard Treasury Company.

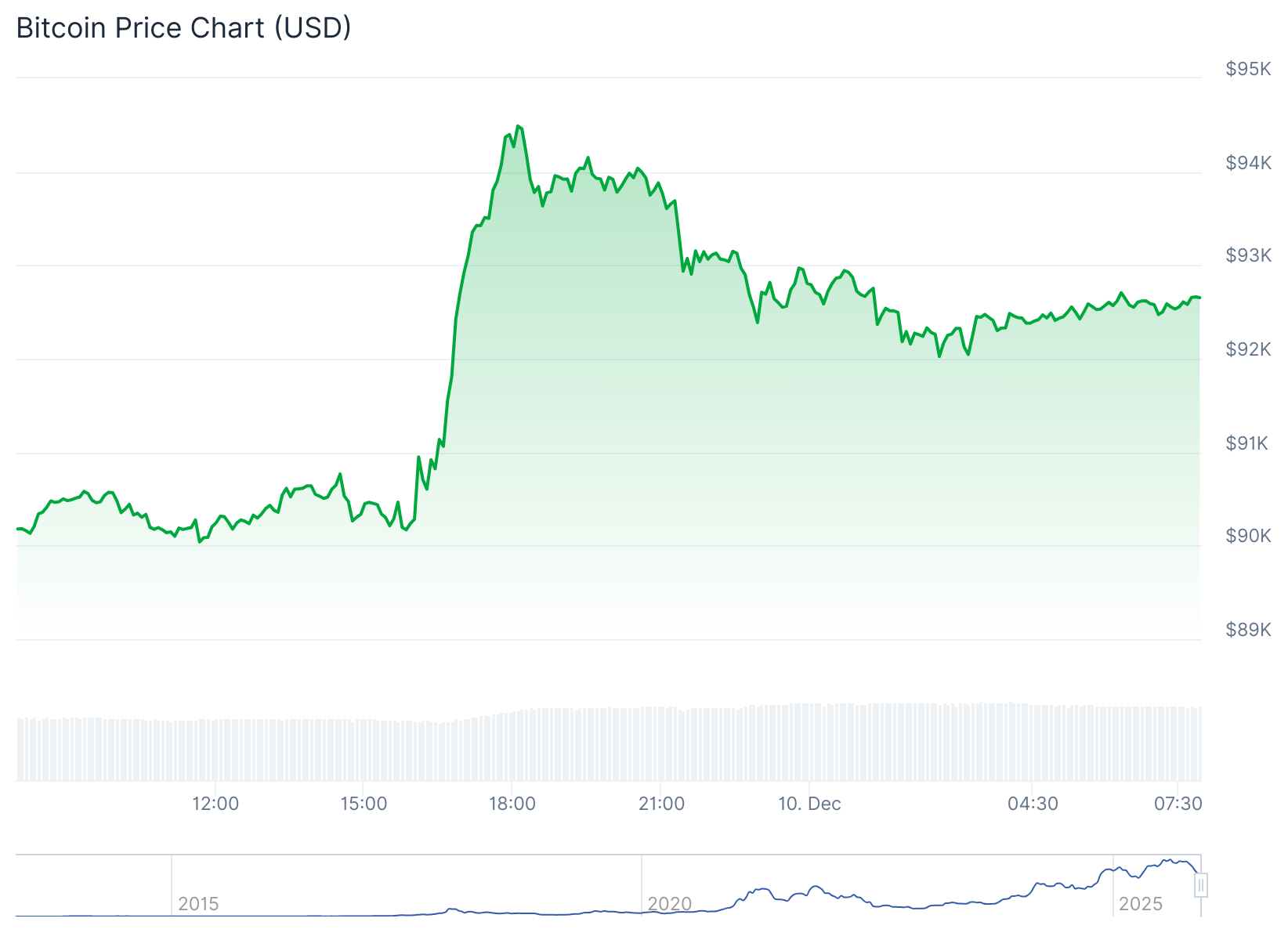

Bitcoin’s Price Spikes Slightly as Strive Unveils ATM Program

At the time of press, Bitcoin is trading at $92,593, following a 2.9% upswing in the past 24 hours. It has a market cap of approximately $1.85 trillion and a trading volume of roughly $52.9 billion. BTC’s 14-day-to-date price change variable shows a 6.4% increase. However, the asset has declined 12.7% month-to-date and 4.6% year-to-date. Coincodex’s risk assessment shows that 80% of the top 100 most valuable cryptocurrencies have outperformed BTC. The asset is trading below its 200-day Simple Moving Average (SMA) with a yearly inflation rate of 0.86% and 13 profitable days in the past month.

Source: CoinGecko

Source: CoinGecko

eToro Platform

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

You May Also Like

Japan-Based Bitcoin Treasury Company Metaplanet Completes $1.4 Billion IPO! Will It Buy Bitcoin? Here Are the Details

The IMF’s Dire Warning For Emerging Market Sovereignty