GameStop’s Bitcoin Bag Gets Lighter as BTC Struggles Above $90K

GameStop’s Bitcoin BTC $93 630 24h volatility: 0.5% Market cap: $1.87 T Vol. 24h: $51.24 B bet from earlier this year is being tested by Bitcoin’s volatility. The retailer’s Q3 report shows that its $500 million BTC purchase from May now sits at $519.4 million, after touching $528.6 million at the end of Q2.

The unrealized profit of roughly $19 million comes after an unrealized loss of $9.4 million when the leading digital asset crashed to $80K. GameStop confirmed it made no additional buys or sales during Q3.

Bitcoin’s Rally and GameStop’s Treasury Bet

Bitcoin’s surge in 2025 was a result of President Donald Trump’s pro‑crypto stance and lighter regulatory pressure. GameStop joined firms like MetaPlanet, Trump Media & Technology Group, and Strategy.

It is important to note that the largest DAT company, Strategy, is now worth less than the value of its own BTC holdings.

Interestingly, GameStop’s BTC position lost major value following the October 10 crash that wiped out about $19 billion in leveraged crypto trades.

GameStop posted adjusted earnings of $0.24 per share and beat expectations of $0.20 and far above last year’s $0.06. But revenue disappointed at $821 million compared to the forecasted $987.3 million, a 4.6% year‑over‑year decline.

Cost‑cutting powered the earnings improvement. SG&A expenses dropped to $221.4 million from $282 million last year, helping produce $52.1 million in adjusted operating income.

Short-Term Holders Seeing Worst Losses

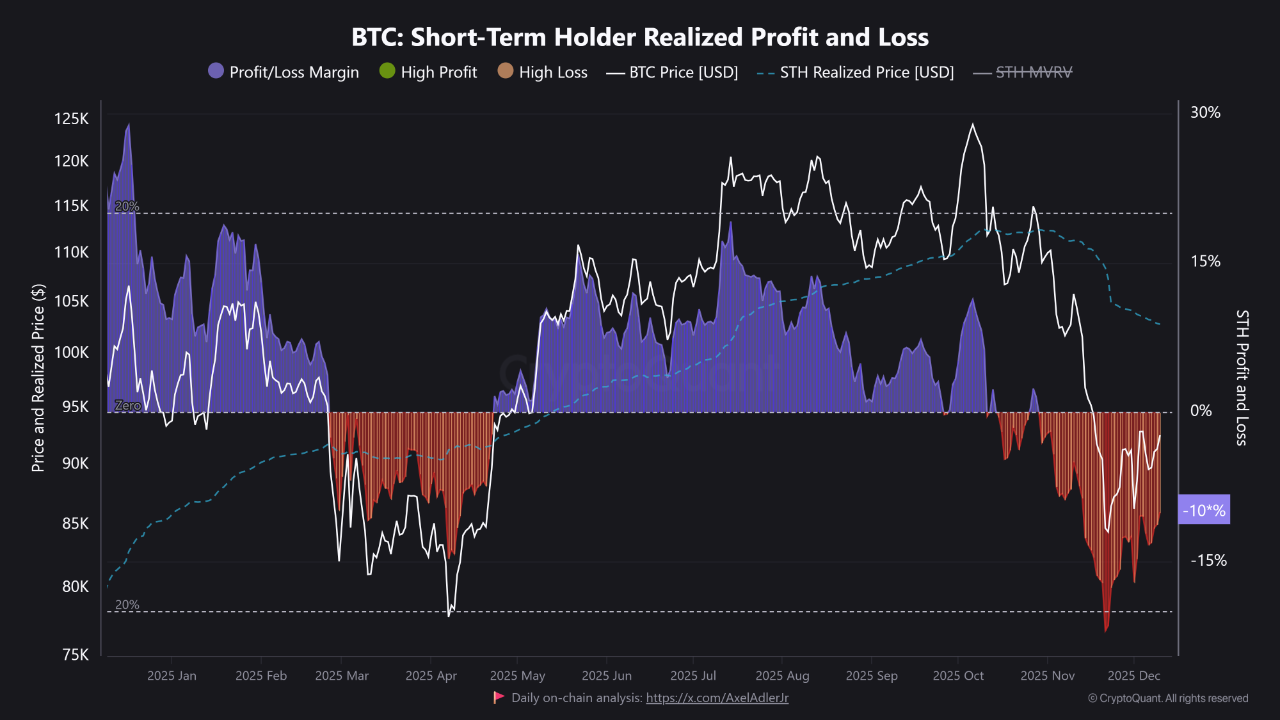

CryptoQuant data shows short‑term holders in one of the worst loss zones of 2025. Many recent buyers are underwater, with the average recent buyer now sitting below their cost basis.

Bitcoin short-term holder realized profit and loss. | Source: CryptoQuant

That pain keeps short‑term selling pressure high and is capping Bitcoin’s attempts to break cleanly above $90,000. Analysts note that such deep‑loss phases usually appear in the later stages of corrections.

Whether traders reduce risk or use this window to build new entries depends on their tolerance for volatility, analysts said.

As reported earlier, institutional interest continues with $151 million in BTC spot ETF inflows.

nextThe post GameStop’s Bitcoin Bag Gets Lighter as BTC Struggles Above $90K appeared first on Coinspeaker.

You May Also Like

MetaMask to Integrate Hyperliquid’s Perpetuals In-Wallet Following mUSD Launch

Scott Bessent says yuan drop against euro is Europe’s problem, not America’s