Meet the 5 Nigerian startups that excelled at the 2025 NITDA/iHatch Demo Day

Promising Nigerian startups took to the stage to showcase their innovations at the iHatch National Demo Day (4th Cohort). This initiative was organised by the National Information Technology Development Agency (NITDA) and the Japan International Cooperation Agency (JICA).

According to the organisers, the showcase, held on Thursday, brought together investors, policy makers and hosts to witness startup founders pitch their ideas. The event also marked the culmination of months of hard work, state-level selections, and regional competitions.

Launched in 2021, iHatch is a 5-month free intensive incubation program designed to help Nigerian entrepreneurs refine their business ideas through a series of coaching, lectures, and boot camps to generate viable, scalable business models. The incubation programme focuses on the youth, innovation, entrepreneurship, and technology.

NITDA noted that iHatch aligns with the Federal Government’s commitment under President Bola Tinubu’s Renewed Hope Agenda. It added that the space provides a clear pathway for homegrown talent to contribute significantly to economic diversification and digital transformation.

iHatch 2025

iHatch 2025

iHatch focuses on supporting youth-driven innovation and entrepreneurship in technology, particularly in sectors like EdTech, AgriTech, HealthTech, FinTech, Logistics, Security, and GovTech, to address social challenges and strengthen Nigeria’s technological ecosystem.

Also Read: Mauritius-based fintech Black Swan emerges MEST Africa Challenge 2025 winner.

iHatch 2025: Meet the 5 standout performers

1. Interface Africa

iHatch 2025 Prize: Secured $15,000 equity-free funding

Founded in 2022 by Al Amin Idris, Interface Africa is a technology company that connects underserved “last-mile” communities with essential services like energy and finance, and operates the continent’s most comprehensive data exchange platform for the informal economy.

The Kaduna-based clean energy startup leverages a network of community agents and digital platforms to bridge access gaps that traditional systems cannot reach. Interface Africa aims to drive economic growth and financial inclusion by offering solutions that address specific local challenges, such as a lack of access to credit and reliable energy.

Founder of Interface Africa, Al Amin Idris

Founder of Interface Africa, Al Amin Idris

The company has been recognised for its innovative solutions, including winning the £1.5 million NextGen Innovation Challenge in October 2025 for its affordable solar financing model.

2. Ahioma

iHatch 2025 Prize: Secured $12,000 equity-free funding

Founded in 2020, Ahioma is an e-commerce platform and virtual marketplace that focuses on enhancing food accessibility with a digital marketplace connecting consumers directly to trusted vendors.

The Umuahia-based startup offers diverse products, including electronics, fashion, home goods, and groceries, aiming to provide a seamless online shopping and delivery experience for African customers.

Ahioma also focus on the Igbo business culture and rallies for local entrepreneur support.

3. Linia Finance

iHatch 2025 Prize: Secured $10,000 equity-free funding

Co-founded by Bassey Asuquo, Blessing Nnamani and Chinomso Ohakwe, the Enugu-based fintech helps Nigerians take control of their finances with tools for budgeting, tracking, and smart money planning.

Linia Finance offers digital tools for financial control, positioning itself as a key player in Nigeria’s growing tech scene and supported by initiatives like Enugu’s tech ecosystem. The startup previously excelled at the Enugu Campus Hackathon Bootcamp.

Linia at iHatch 2025

Linia at iHatch 2025

4. Chapta

iHatch 2025 Prize: Laptop

Founded in 2025, the young startup delivers an offline-capable school application ensuring consistent, accessible learning for students everywhere. The platform refers to itself as Africa’s first school operating system on Google Sheets and WhatsApp.

The startup makes it seamless for schools to go digital. On the platform, Schools can mark attendance and send updates to parents instantly, record and share results in real time, track fees and student progress and use it on any phone, tablet, or computer.

5. Softdrop

iHatch 2025 Prize: Laptop

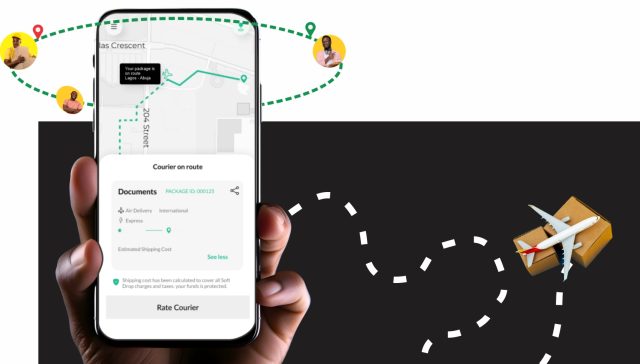

Founded in 2022, Softdrop is a Lagos-based startup that solves logistics challenges through a modern delivery platform designed for speed, convenience, and efficiency.

SoftDrop is powered by a state-of-the-art fintech solution, which enables it to be seamless and affordable, enabling financial inclusion by decentralising logistics in the whole logistics space.

According to information on its platform, Softdrop has partnered with businesses of all sizes to enable same-day deliveries for intra-cities, intra-States and international logistics with more than 3,000,000 carriers nationwide. Softdrop covers more than 400,000 local routes, making us the largest local same-day delivery footprint in the nation.

You May Also Like

XRP Hits Record Transactions, But Price Struggles – What’s Next for the Crypto?

Doorbraak voor altcoins: SEC keurt Grayscale’s GDLC ETF goed