Best Crypto to Buy Now? Ethereum Price Prediction and New Crypto Coins

As 2025 draws to a close, Ethereum (ETH) is navigating a period of cautious optimism. While the broader market grapples with significant institutional shifts, the second-largest cryptocurrency has shown notable resilience by reclaiming key psychological levels.

Market participants are now closely assessing whether the interplay between recent ETF activity and upcoming network upgrades will provide the momentum needed for a bullish transition into 2026.

Beyond major players like Ethereum, the search for the best crypto to buy has shifted toward specialized ERC-20 tokens that bridge the gap between technical utility and viral growth.

Emerging contenders such as Bitcoin Hyper (HYPER) and Maxi Doge (MAXI) are beginning to attract interest as potential high-upside plays heading into the next market cycle.

Crypto Market Nears Stability as Ethereum Upgrades and 2026 Outlook Take Shape

As 2025 ends, signs across the crypto market point to growing stability. Total market value is climbing again toward $3 trillion, a level tested several times in December.

Investor mood is also improving, with the Fear & Greed Index rising from extreme fear into more neutral territory. Bitcoin holding near $90,000 and a steady RSI suggest the market has found a better balance. The final week of December brought a short pause as institutions cut risk for year-end reasons.

Between December 22 and 26, Bitcoin ETFs saw about $782 million in outflows, while Ethereum ETFs lost more than $102 million, including a large one-day Bitcoin outflow of $275 million on December 26. Even so, analysts largely see this as routine year-end rebalancing, not a loss of faith in crypto.

Looking forward, Ethereum’s roadmap strengthens the recovery outlook. Developers are moving to a regular twice-a-year upgrade schedule that focuses on security and long-term reliability.

As plans for the Glamsterdam upgrade move forward after the holidays, the shift into 2026 could spark the next growth phase for Ethereum and the broader crypto market.

Ethereum Price Prediction

As the final hours of 2025 tick away, Ethereum (ETH) is up about 1% on the day, matching a similar gain over the past week. The price has swung sharply, with weekly highs near $3,100 and lows just under $2,900, yet ETH has still posted a steady monthly gain of around 5%.

This rebound stands out in the broader quarterly picture. Even though ETH remains more than 11% below its earlier 2025 highs, the move back above $3,000 points to a stabilizing technical structure.

Analysts see Ethereum shifting away from stagnation and slowly building toward a more bullish setup for 2026. Despite the recent gains, Ethereum has slipped back into a familiar phase of choppy consolidation that began in mid-December.

For about 11 days, price has moved sideways between two key zones: the point of control near $2,940, which aligns with recent volume patterns, and the value area low around $2,900, which acts as short-term support.

This range-bound action shows that momentum remains neutral to weak after the rejection near $3,400. A push toward the upper range between $3,180 and $3,200 remains possible, but a clean break above the major $3,400 resistance likely requires more time, potentially closer to the end of January.

Year-end market conditions continue to shape price action. Thin liquidity, low volume, and higher volatility dominate, while ETF flows show only minor outflows with little broader impact.

Against Bitcoin, Ethereum shows early signs of relative strength, but not enough to confirm a lasting trend. With correlation near 87%, ETH still tracks Bitcoin closely.

If selling pressure returns, analysts point to $2,850 as a key support zone and a potential entry area ahead of a Q1 recovery.

2 High-Potential ERC-20 Tokens That Could Explode in 2026

As Ethereum settles, investors are starting to move money into promising ERC-20 tokens that offer clear use cases or strong community hype. For those looking for the best cryptos to buy going into January, two projects stand out thanks to strong presale demand and unique ideas:

Bitcoin Hyper (HYPER)

Bitcoin has already secured its role as a store of value, but it still has not proven it can move fast. Limited throughput stands as Bitcoin’s biggest weakness, and Bitcoin Hyper targets that exact issue.

The Bitcoin base layer continues to handle final settlement, while a separate execution layer processes high-speed activity. Users lock BTC into a secure native contract, which mints a wrapped version of Bitcoin on the Hyper network.

Bitcoin Hyper runs on the Solana Virtual Machine, enabling near-instant confirmations and fees that cost almost nothing.

To maintain security, Bitcoin Hyper batches transactions and verifies them with zero-knowledge proofs before recording the final outcome on the Bitcoin blockchain. This structure delivers scale without compromising Bitcoin’s core security model.

The same bridge allows users to move wrapped BTC freely across the Bitcoin Hyper ecosystem for DeFi, NFTs, and other on-chain applications, then move it back to Bitcoin with ease.

As the presale approaches $30 million, Bitcoin Hyper continues to strengthen its capital base while development moves forward. Early demand reflects the belief that Bitcoin’s next growth phase will depend not only on scarcity, but on infrastructure that supports real-world usage at scale.

The current presale price stands at $0.013505 per $HYPER and will increase in the next round, which begins in one day. Investors can buy $HYPER through the Bitcoin Hyper website using SOL, ETH, USDT, USDC, BNB, or a credit card. Holding $HYPER also unlocks staking rewards of up to 39% per year.

Bitcoin Hyper recommends using Best Wallet, widely recognized as one of the top crypto and Bitcoin wallets available. $HYPER already appears in Best Wallet’s Upcoming Tokens section, making it easy to buy, track, and claim once the token launches.

Visit Bitcoin Hyper

Maxi Doge (MAXI)

Maxi Doge focuses on something many meme coins ignore: giving traders a clear reason to stay active. Instead of pushing people to just hold and wait, the project targets a fast-paced trading culture built for an engaged community.

Trading contests, ROI leaderboards, and game-style partner events keep users involved long after the early hype fades.

While Dogecoin helped open the door, many traders now believe the next big gains will come from newer, low-cap projects with real momentum and clear use cases. For that reason, many see Maxi Doge as offering more upside than older meme coins.

The project has already drawn strong interest from retail traders and well-known crypto voices. Analyst and YouTuber Claybro has backed the project and called it one of the best new crypto coins of 2025.

That level of support signals that $MAXI aims to be more than a short-term trend. The numbers support that view. Maxi Doge has raised around $4.3 million in its presale so far.

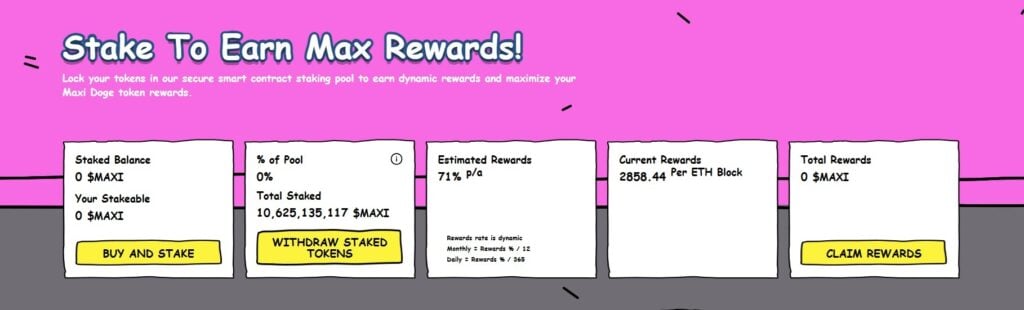

At a current price of $0.000276, $MAXI stays affordable for smaller buyers while leaving room for growth after launch. While waiting for the token generation event and exchange listings, holders can stake their tokens and earn about 71% APY.

As the presale moves closer to its end, buyers can join in two main ways. They can purchase directly through the official Maxi Doge presale website or use the Best Wallet app.

Inside the app on iOS and Android, the Upcoming Tokens section makes it easy to take part in the $MAXI presale alongside other promising new launches.

Visit Maxi Doge

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.

You May Also Like

Saudi Awwal Bank Adopts Chainlink Tools, LINK Near $23

ArtGis Finance Partners with MetaXR to Expand its DeFi Offerings in the Metaverse