Zcash Faces Selling Pressure as 200,000 ZEC Unshielded in Early 2026

- Zcash price is down today as a trader unshielded over 200,000 ZEC in a rare start to the new year.

- With more institutions growing fond of ZEC, the market is expecting a positive price action soon.

Privacy coin Zcash (ZEC) is facing selling pressure due to a recent decision from some traders with big exposure to the altcoin. This concern comes as traders have unshielded 200,000 ZEC tokens with just 5 days into the new year.

How 200,000 ZEC Unshielded Can Impact Price

According to data from Arkham Intelligence, a trader withdrew 202,076 ZEC from shielded pools. This amount translated to roughly 1.2% of the ZEC circulating supply.

As a result of this move, the amount of ZEC held in shielded pools dropped sharply. The total, which peaked above 5 million at the end of 2025, has fallen to around 4.86 million ZEC.

In a recent study, we reported that the rise in shielded transactions suggested many users preferred personal control over exchange convenience. It also reflected a wider change among digital asset owners who choose direct ownership. Now the reverse appears to be the case, with more than 200,000 ZEC unshielded.

For context, unshielding refers to the process of converting funds from shielded pools, which protect privacy, to transparent pools. Crypto traders do this to gain access to a trading platform.

Per the Arkham data, the ZEC holder deposited into shielded pools just over two weeks earlier, before unshielding the funds.

It also showed that deposits into shielded pools are no longer accelerating, as they did in Q3 2025. Although this does not confirm a reversal, it suggests that bullish sentiment is no longer strong.

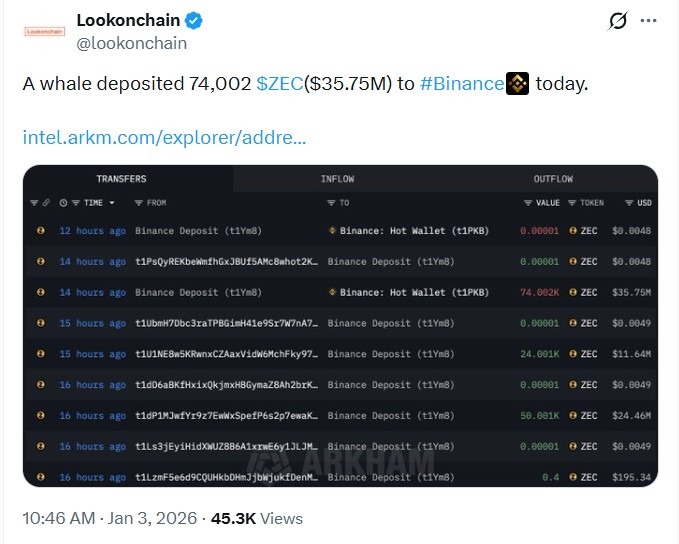

Intriguingly, a whale investor recently deposited 74,002 ZEC, valued at about $35.75 million, to Binance, as revealed by Lookonchain.

Whales Not Betting on Zcash | Source: Lookonchain on X

Whales Not Betting on Zcash | Source: Lookonchain on X

This transaction happened only one day after the large unshielding event. Accordingly, many investors claim it is a sign of preparation for selling.

ZEC Price Performance and What Next

The price of ZEC has dropped approximately 7% from $530 to $490. This decline comes despite the altcoin market cap jumping from $825 billion to $885 billion.

Many now question whether investors are abandoning expectations for ZEC in favor of other altcoins.

Other privacy coins, such as Monero (XMR) and Dash (DASH), have also underperformed the broader market. This trend makes privacy the weakest-performing sector, according to Artemis.

At the time of writing, data shows ZEC has a price of $489.8, down 3.6% in the past 24 hours. Despite this, the privacy coin has jumped 11% in trading volume to $527.6 million.

Additionally, Grayscale recently highlighted Zcash as a promising privacy coin. Grayscale expects the sector to grow stronger in 2026, as mentioned in our previous news brief.

Aligning with its expectation, Grayscale earlier filed to list a Zcash ETF on NYSE Arca with the ticker ZCSH.

Moreover, Zashi, the main wallet used across the Zcash ecosystem, has introduced version 2.4.9. The update leans on stronger privacy, smoother performance, and a cleaner overall layout.

]]>You May Also Like

Building a DEXScreener Clone: A Step-by-Step Guide

Sensura to Showcase Non-Invasive Health Monitoring Platform, Starting with Glucose, at CES 2026