Ethereum Transactions Reach Over 2M—Is This the Beginning of the ETH Price Rally?

The post Ethereum Transactions Reach Over 2M—Is This the Beginning of the ETH Price Rally? appeared first on Coinpedia Fintech News

Crypto markets took the latest CPI print in stride, with inflation coming in unchanged and in line with expectations—easing near-term uncertainty for risk assets. Bitcoin climbed to intraday highs near $96,500, while Ethereum price outpaced the broader market, breaking out of a key consolidation band and pushing beyond $3,370.

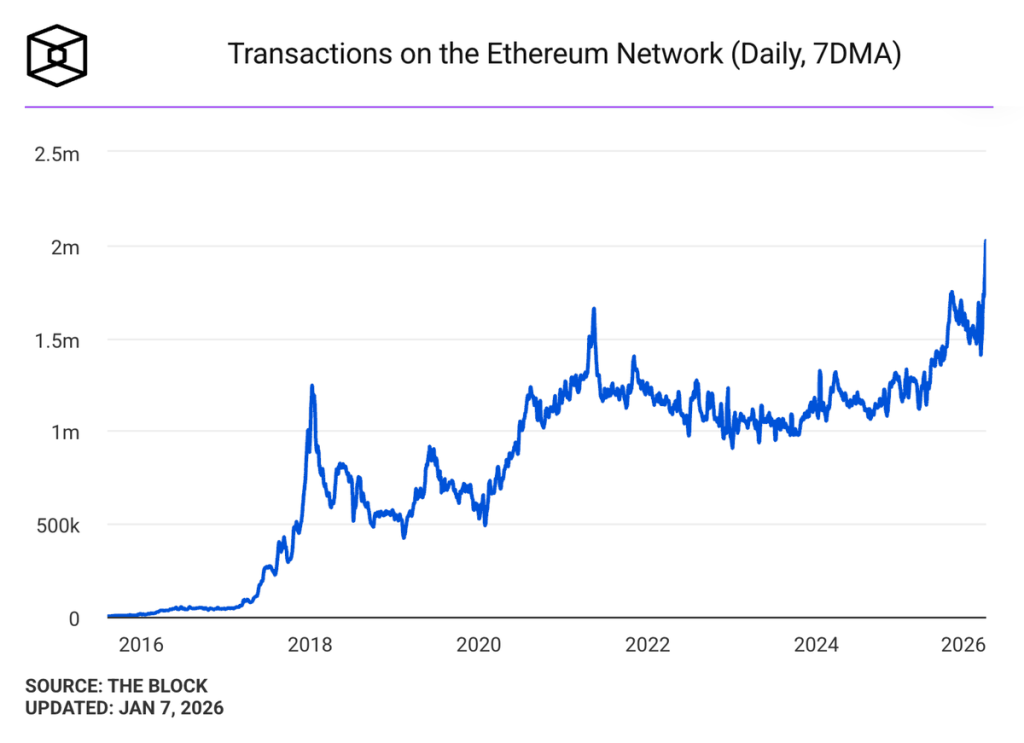

At the same time, Ethereum’s on-chain narrative strengthened. Network activity has surged to fresh highs, with daily transactions topping 2 million for the first time. This is an important signal that usage is expanding alongside price. Together, the macro tailwind and improving network fundamentals are reinforcing ETH’s bullish setup, raising the odds of Ethereum outperforming in the sessions ahead.

Ethereum Activity Hits New Highs—Why it Matters

The ETH price has been displaying huge stability even in times of notable bearish actions. This behaviour usually occurs when the token has strong backing by the bulls and also when the voaltilty of the token has not flattened to a large extent. This leads to the point that Ethereum is being used more than before. The latest data shows daily transactions (7-day average) have crossed 2 million, which is a new record.

This is important for the ETH price because:

- More activity usually means more demand for the network.

- Many transactions need ETH for gas, so usage can support buying pressure.

- If activity stays high, Ethereum can collect more fees, and that can reduce supply through ETH burn.

But one thing to note: not every transaction is “real demand.” Some activity can come from bots or low-value moves. So the signal is strongest when high transactions stay steady for days, and the price holds above key support.

ETH Breaks Out of a Key Range—Levels to Watch Next

The ETH price just broke out of a crucial consolidation, which has raised hopes of a strong bullish trend. On the daily ETHUSD chart, ETH has been forming a tightening structure (a multi-month compression with converging trendlines). Price has now pushed above the local range and is challenging the descending trendline resistance while holding above the mid-range support band around $3,050–$3,120.

ETH price is testing a key breakout zone after clearing consolidation. Immediate resistance sits at $3,304–$3,322, while a daily close above the descending trendline and $3,320–$3,350 could confirm a bullish breakout. Upside targets remain $3,500 and $3,875, while support to hold is $3,050–$3,120; losing $3,050 may open $2,850–$2,900. CMF suggests improving inflows, but a flat OBV shows volume confirmation is still needed.

That combination fits a common setup: price breaks first, volume confirmed later. But if volume and OBV don’t follow, ETH can easily slip back into the range.

Ethereum Price Prediction 2026: Will ETH Reach $4000 This Month?

Ethereum’s transaction count breakout strengthens the long-term usage narrative and supports the idea of a firmer floor for ETH. If the network activity continues to remain elevated, the price is also believed to maintain a strong ascending trend. Considering the current market dynamics and the sentiments, reaching $4000 appears to be a tedious job.

The markets are largely concentrated on Bitcoin right now as the dominance continues to remain elevated. Until these conditions are sustained, the Ethereum price could strongly consolidate above the gains but may not break the threshold at $3500 or $3800. However, the markets and sentiments tend to change, and once the rotation into altcoins intensifies, the ETH price may lead in the markets.

You May Also Like

CME Group to Launch Solana and XRP Futures Options

XCN Rallies 116% — Can Price Hold as New Holders Gain?