Michael Saylor Hints at More Bitcoin Buys as BTC Hovers Above $93K

Michael Saylor, executive chairman of Strategy Inc. (formerly MicroStrategy), signaled renewed confidence in BTC $93 125 24h volatility: 2.1% Market cap: $1.86 T Vol. 24h: $42.51 B this week with a social media tease before any official purchase disclosure.

In a brief post featuring the company’s Bitcoin portfolio graphic and the caption “₿igger Orange.” Saylor appeared to allude to fresh accumulation activity ahead of regulatory filings. Orange is the color that Strategy chairman Saylor ties to Bitcoin buy signals in both his tweets and his X profile.

Strategy’s Bitcoin Holdings & Recent Purchases

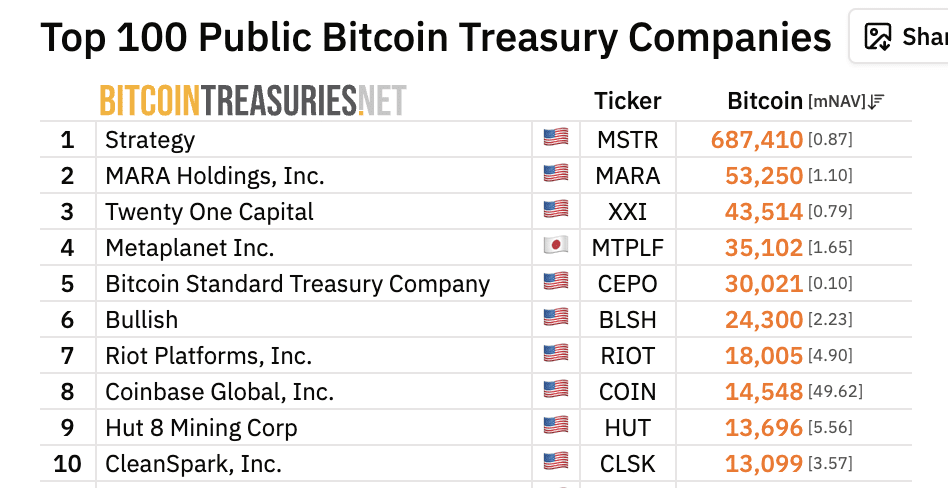

Strategy remains the largest corporate holder of Bitcoin globally. Recent data shows total holdings have reached roughly 687,410 BTC, acquired at an average cost of $ 60,000–$70,000 per BTC.

Top 10 Bitcoin public treasury holders | Source: bitcointreasuries.net

January’s activity includes a confirmed purchase of 13,627 BTC, valued at about $1.25 billion. It was executed at an average price near $91,519 per BTC, according to regulatory filings for the period ending Jan. 11, 2026.

Earlier in the month, Strategy also bought 1,286 BTC for roughly $116 million as part of its ongoing accumulation strategy. Just before the filing, Saylor also hinted at the purchase.

Strategy Share Price

Strategy’s share price (ticker: MSTR) has shown volatility alongside its Bitcoin-driven valuation model. At the time of writing, the stock has been trading around $173–$174 per share, gaining over 5.4% in January alone.

However, some remain sceptical of the recent growth, as the total drop of MSTR shares price in 6 months comprises over 59%. This was immediately noticed in the same Saylor’s thread mentioned above. “Bigger red,” the user Caramel tweeted, hinting at the unprecedent drop.

Bitcoin Price Performance in January 2026

Bitcoin itself entered 2026 with strength, briefly topping the $90,000 level and at times exceeding $93,000 early in the year. According to CoinMarketCap, its year-to-date gain comprises 5.45%.

General crypto market prices have fluctuated through mid-January, with volatility driven by macroeconomic data and shifting institutional demand.

Crypto Market Implications

Saylor’s social signal and Strategy’s continued purchases come at a time when institutional sentiment toward Bitcoin remains mixed. The company’s accumulation strategy, funded in part through at-the-market stock offerings and preferred share issuances, underscores its long-term Bitcoin thesis.

However, it exposes Strategy stock to leverage effects as Bitcoin prices move. Strategy’s heavy BTC weighting means its equity performance often amplifies underlying Bitcoin moves, making January’s price action a key focal point for investors watching both assets.

nextThe post Michael Saylor Hints at More Bitcoin Buys as BTC Hovers Above $93K appeared first on Coinspeaker.

You May Also Like

Stocks and Crypto Market Face Volatility From U.S. Tariffs

How to earn from cloud mining: IeByte’s upgraded auto-cloud mining platform unlocks genuine passive earnings