Pump.fun Revenue Hits $7.6M Weekly High Amid Brief Memecoin Market Recovery

TLDR:

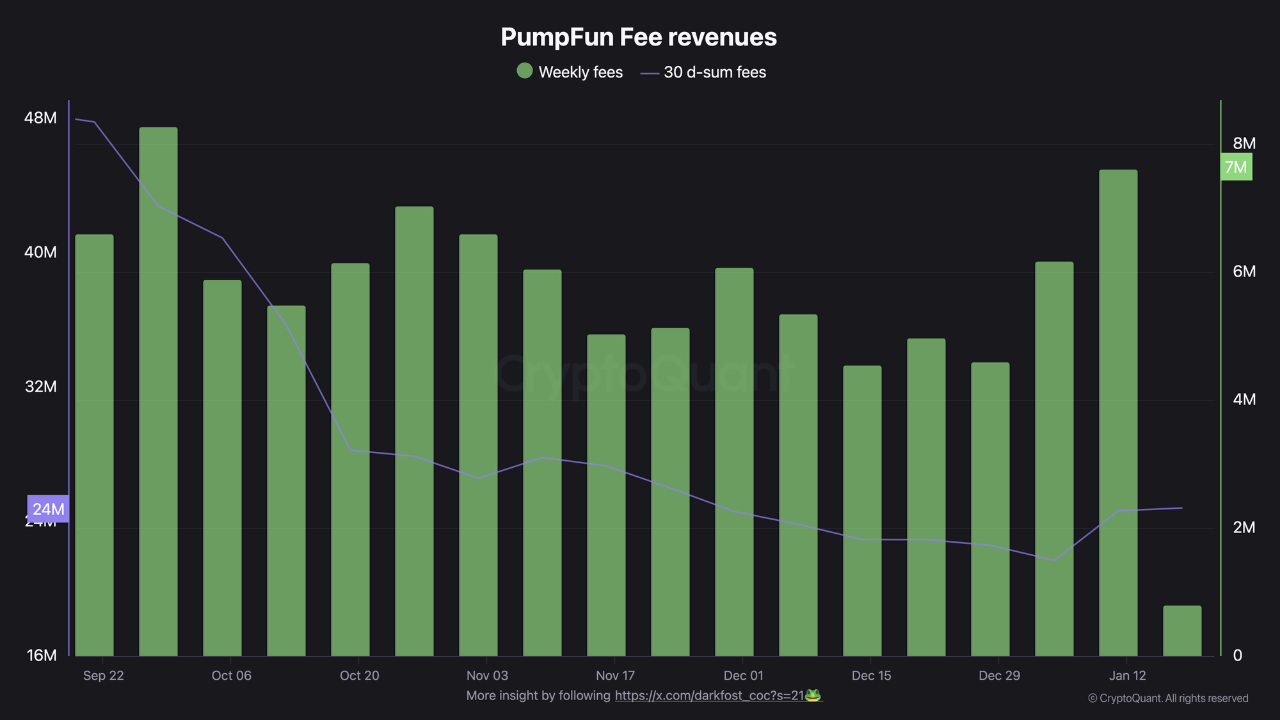

- Pump.fun weekly revenue jumped to $7.6M from a stable $4M-$6M range during brief memecoin rally

- Platform’s 30-day rolling revenue increased from $21.6M to $24.8M despite declining memecoin interest

- New Pump Fund will back 12 projects with $250K each through market-driven community participation

- Revenue metrics demonstrate platform’s sensitivity to even modest shifts in speculative trading activity

Pump.fun has recorded weekly revenues of approximately $7.6 million, marking the platform’s strongest performance since September 2025.

The surge follows a brief memecoin rally that sparked renewed trading activity across the Solana-based token launcher.

This represents a notable jump from the platform’s recent stabilization range of $4 million to $6 million per week.

The recovery demonstrates the platform’s sensitivity to shifts in speculative sentiment within the memecoin market.

Source: Cryptoquant

Revenue Metrics Reflect Persistent Market Volatility

The platform’s recent performance shows how quickly metrics can shift with market conditions. Weekly revenue climbed substantially after weeks of consolidation in lower ranges.

The 30-day rolling sum increased from $21.6 million to $24.8 million during this period.

These figures arrived despite broader market headwinds affecting memecoin interest. The platform maintains revenue generation even when overall speculative appetite appears subdued.

Trading volumes respond quickly to any return of risk-taking behavior among participants.

The sustainability of these numbers remains tied to market sentiment cycles. Revenue patterns on Pump.fun tend to mirror broader trends in speculative token trading.

Nevertheless, the platform continues capturing activity bursts when traders return to the market. Even modest increases in trading activity translate to substantial revenue changes for the protocol.

Pump Fund Launch Introduces Alternative Funding Model

Pump.fun announced the creation of Pump Fund, a new investment initiative. The platform simultaneously launched a $3 million Build in Public hackathon. This program will support 12 projects with $250,000 each at a $10 million valuation.

The funding mechanism differs from traditional venture capital approaches. Market participation will drive investment decisions rather than conventional VC selection processes. This structure aligns with the platform’s focus on community-driven token launches and trading.

The hackathon represents an expansion beyond Pump.fun’s core trading infrastructure. Projects selected through this initiative will receive backing based on community engagement metrics.

Revenue resilience occurs while interest in creator tokens and live features has declined across the platform. The correlation between memecoin rallies and platform revenues remains strong throughout various market cycles.

The post Pump.fun Revenue Hits $7.6M Weekly High Amid Brief Memecoin Market Recovery appeared first on Blockonomi.

You May Also Like

STRC Stock Surge: How Much Bitcoin Can Saylor Buy?

Ethereum co-founder Jeffrey Wilcke sends $157M in ETH to Kraken after months of wallet silence