Trump Media Sets Feb 2 Record Date for Shareholder Digital Token Distribution

Trump Media and Technology Group Corp. (Nasdaq, NYSE Texas: DJT) shares traded higher today. This followed the company setting February 2, 2026, as the record date for its planned digital token airdrop to shareholders. The move added interest to a stock that has been under pressure over the past year.

The market reaction shows growing focus on the non-transferable token, which is similar to an NFT. Investors are watching how related rewards could boost engagement across Trump Media’s Truth-branded platforms. The company aims to do this without triggering securities concerns.

Eligibility Rules and Airdrop Details

The company confirmed the eligibility rules. Ultimate beneficial owners and registered holders of at least one whole DJT share as of February 2, 2026, are eligible for digital tokens and related incentives, according to the announcement.

The firm will work with Crypto.com to mint the tokens. They will record them on-chain and hold them in custody until distribution to eligible shareholders. Trump Media expects to roll out periodic rewards tied to Truth Social, the Truth+ streaming service, and offers like Truth Predict for shareholders on the record date.

They emphasized that the tokens are not meant to represent equity or any ownership interest in the company or other entities. The airdropped assets should be non-transferable, non-cash, and redeemable only upon the “essential managerial efforts of others.” This language aligns with US securities guidance.

Only ultimate beneficial owners of DJT as of February 2 will qualify to receive the tokens. Borrowers of stock are excluded. Trump Media also reserved the right to change, modify, or terminate the distribution at its discretion.

DJT Shares Climb on Airdrop Announcement

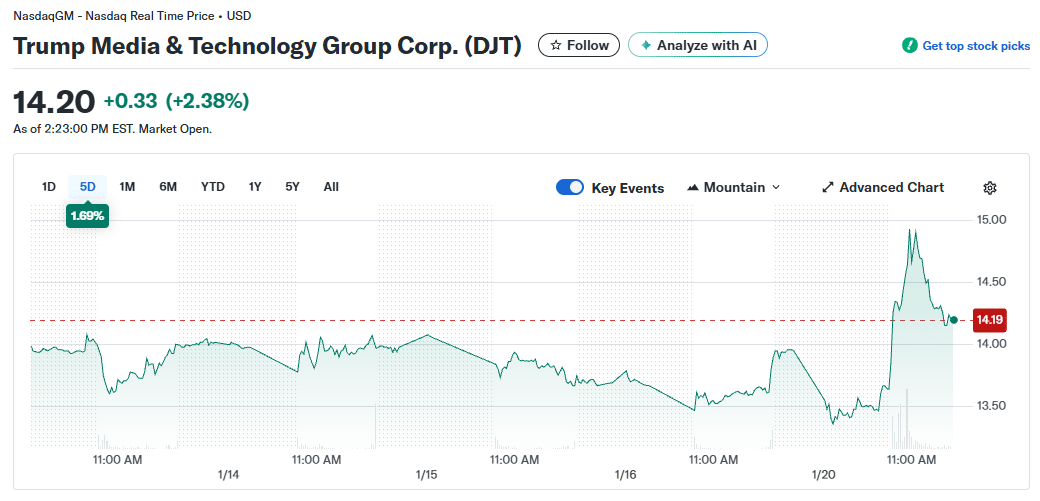

Company shares were up about 2.6% today, trading near 14.23 dollars in afternoon action. Traders responded to the formal record date announcement and ongoing commentary on the airdrop initiative. The move extends a rebound from levels near 13.30 dollars seen when token plans were first flagged. Still, the stock remains sharply lower than earlier peaks, with a one-year decline of more than 60%. This is despite a positive year-to-date return profile, according to Yahoo! Finance.

DJT stocks prices | Source: Yahoo! Finance

Recent historical data show DJT closing at 13.87 dollars on January 16 on volume of roughly 3.69 million shares, underscoring that today’s rally marks an uptick in interest but not yet a structural trend reversal, according to analysts. Their shares continue to trade well below their past highs above 60 dollars recorded in 2024, reflecting ongoing volatility and sensitivity to news tied to their digital asset strategy, Bitcoin BTC $89 526 24h volatility: 3.8% Market cap: $1.79 T Vol. 24h: $55.96 B treasury plans, and new shareholder reward schemes.

The token airdrop acts as a short-term incentive for investors to hold DJT through the record date. It creates a temporary “dividend-like” event, even though the tokens are perks rather than financial claims. Investors often buy speculatively ahead of such events, especially when the initiative involves high-profile brands, Web3 narratives, and possible integrations across a company ecosystem.

nextThe post Trump Media Sets Feb 2 Record Date for Shareholder Digital Token Distribution appeared first on Coinspeaker.

You May Also Like

Steak ‘n Shake Adds $10 Million in Bitcoin Exposure Alongside BTC ‘Strategic Reserve’

Saudi Awwal Bank Adopts Chainlink Tools, LINK Near $23