El Salvador’s ‘Daily Bitcoin’ claims crumble under IMF scrutiny

An International Monetary Fund (IMF) review released on July 15 claims that El Salvador ceased accumulating bitcoins in February, following the signing of the deal with the IMF. The agreement required El Salvador to stop BTC accumulation and strip BTC of its legal tender status in exchange for a $1.4 billion loan. This information strikingly contradicts claims by El Salvador officials who had been regularly announcing new BTC purchases by the country. Concerns over the accuracy of El Salvador’s Bitcoin reserves date back to 2023.

Table of Contents

- Revelation from IMF review

- El Salvador’s BTC purchases after deal with IMF

- Concerns raised by crypto community members and journalists

- El Salvador claims it continues buying 1 BTC every day despite the February deal with the IMF that forbids the country from doing so.

- According to the IMF, El Salvador’s claims about Bitcoin purchases refer to moving bitcoins between the wallets controlled by the government, not actual accumulation.

- The stopping of BTC accumulation is confirmed by El Salvador’s Financial Minister and by the president of the country’s Central Bank.

- Several crypto enthusiasts claim that the amount of BTC El Salvador claims to hold is misleading. BBC and crypto sleuths pointed at discrepancies back in 2023.

- The creator of the website used by President Bukele to demonstrate BTC reserve growth called the data displayed on the screenshots “wrong.”

Revelation from IMF review

Despite arranging the deal with the IMF, El Salvador President Nayib Bukele continued highlighting the country’s new purchases of Bitcoin. The first EFF arrangement review, released this July, contains information that disputes these claims.

In the letter attached in the appendix of the review, the President of El Salvador Central Bank, Douglas Pablo Rodríguez Fuentes, and the Minister of Finance, Jerson Rogelio Posada Molina claim that “the stock of Bitcoins held by the public sector remains unchanged” while mentioning minor breaches of the deal in regard of daily Bitcoin accumulation in March.

On top of that, there is a small but essential detail hidden in footnote nine that reads “Increases in Bitcoin holdings in the Strategic Bitcoin Reserve Fund reflect the consolidation of Bitcoin across various government-owned wallets.”

It means that El Salvador stopped Bitcoin purchases in February 2025, which is in line with the deal made with the IMF. The IMF’s review outlines positive trends in the El Salvador economy, concluding that the IMF should immediately disburse SDR 86.16 million, equivalent to approximately $118 million. The overall satisfaction of the fund’s board indicates that El Salvador has indeed dropped its support for Bitcoin, not only as a legal tender, but also as a strategic reserve worth accumulating, opting instead for a USD loan from the IMF.

El Salvador’s BTC purchases after deal with IMF

The deal with the IMF required El Salvador not only to revoke Bitcoin’s status as legal tender but also to stop accumulating bitcoins (according to the IMF, it creates economic risks). However, instead of following the imposed rules, the country continued the daily BTC purchasing spree.

In March, the IMF reminded Bukele that Bitcoin purchases should be halted to meet the requirements outlined in the deal; however, he blatantly rejected the IMF’s requests and stated that Bitcoin accumulation would not stop.

In the April interview with Bloomberg, economy minister of El Salvador, Maria Luisa Hayem, confirmed that Bukele is not stopping purchasing bitcoins, calling Bitcoin “an important project.”

Concerns raised by crypto community members and journalists

The IMF’s review suggests that Salvador didn’t buy all the bitcoins it claims it bought. The lack of transparency regarding El Salvador’s alleged purchases has been a concern raised multiple times by several crypto enthusiasts in the past.

One of the crypto activists who scrutinizes all things associated with Bitcoin independently and publicly, a person using the handle Pledditor, raised their concerns back in November 2023, pointing out a discrepancy in the figures related to El Salvador’s Bitcoin reserve.

The BBC article released in December 2023 suggests that El Salvador Bitcoin estimations are not backed by anything except for Bukele’s tweets and screenshots from the website, Nayib Tracker, whose creators didn’t comment on the issue back then.

However, on July 20, the Nayib Tracker creator, Elias Zerrouq, took to X to express his surprise over the fact that President Bukele is using the wrong data and the media is not talking about it.

Since then, X accounts posting BTC purchase announcements began to use a different website. However, the questions persisted. On July 20, five days after the IMF and El Salvador’s officials announced that the country had purchased no Bitcoin following the deal’s signing, the Bitcoin Office released a post regarding yet another BTC purchase by El Salvador.

Nayib Bukele or other top officials didn’t react to the news as of July 22.

You May Also Like

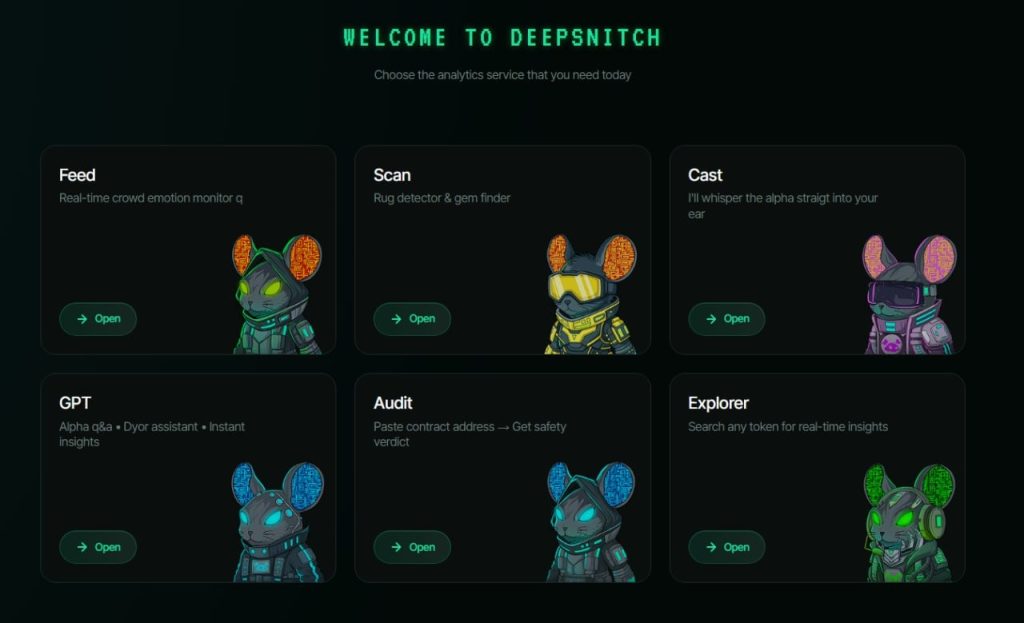

WLFI Token Price Prediction for March Is Ahead of Bitcoin, as TRX Is Stable; But DeepSnitch AI Is Moving to a New Level of Explosive 250x Returns

SEI Technical Analysis Feb 24