VC-Level Briefing: How DeSci Led the Crypto Market in a Single Day

Author: hoeem

Compiled by Tim, PANews

Read this because you want to get a VC-grade research on the DeSci track, which is exactly the best performing narrative in the crypto market recently, especially on August 7th.

It's a bold idea, so keep reading. It only takes 5 minutes to read and covers:

- What are the most popular DeSci tokens currently?

- Value Discovery vs. Mind Share

- Funding Rate

- Comparison of new and old tokens

- DeSci track mental distribution

- Smart Followers vs. Regular Followers

- DeSci track KOL accounts worth following

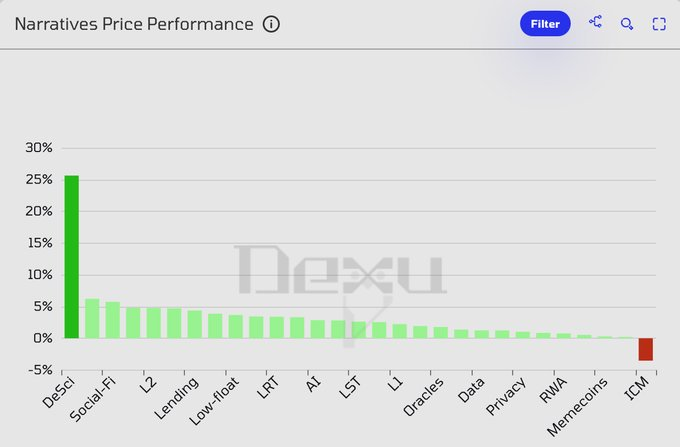

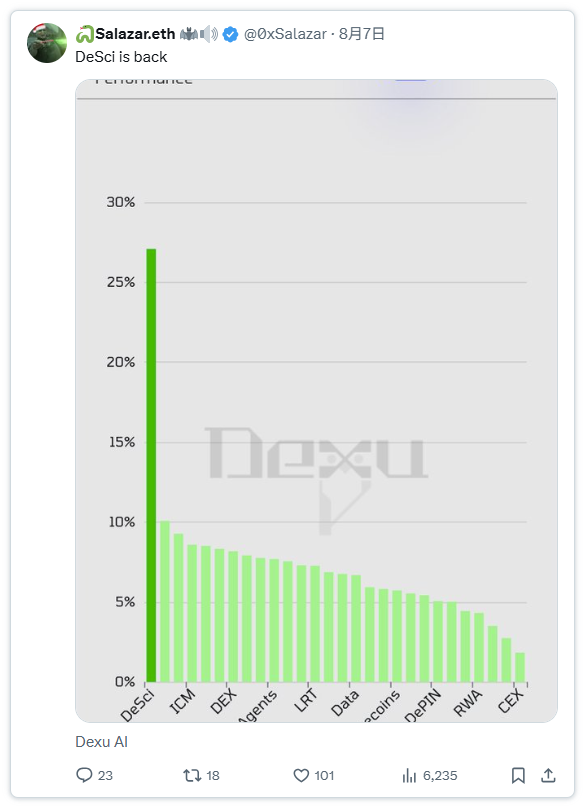

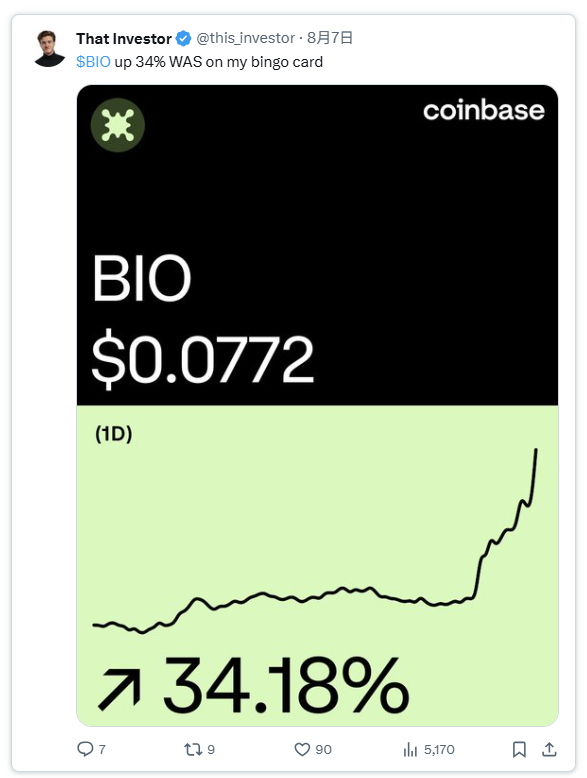

DeSci was the best performing narrative sector today.

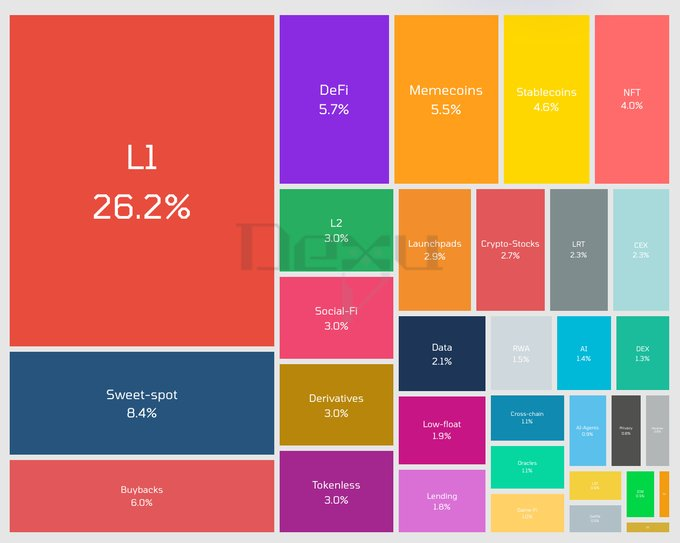

DeSci has a mere 0.2% mind share in the entire crypto space. Yes, that’s it, that little orange box in the bottom right corner.

Less attention is true, but that's not the whole story, because if we take a closer look at the biggest gainers in mindshare over the past week, we'll find that DeSci tops the list.

So, let's delve deeper into this narrative. I hope you can go from knowing nothing about DeSci to gaining a deep understanding of the key influencers at the heart of this narrative and the sources of their influence. Let's begin.

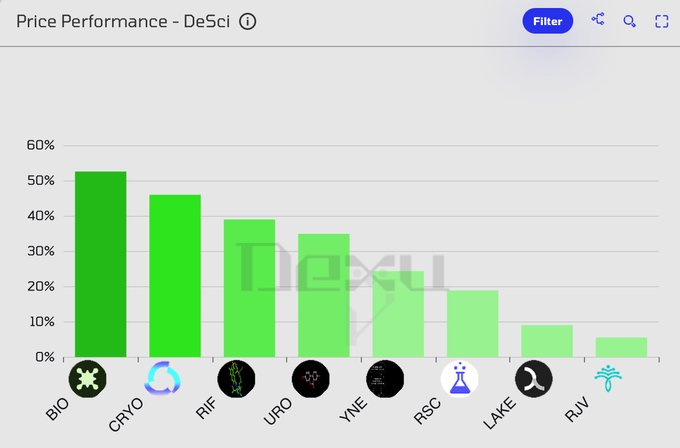

1. What are the most popular DeSci tokens currently?

- $BIO

- $CRYO

- $RIF

- $URO

- $YNE

- $RSC

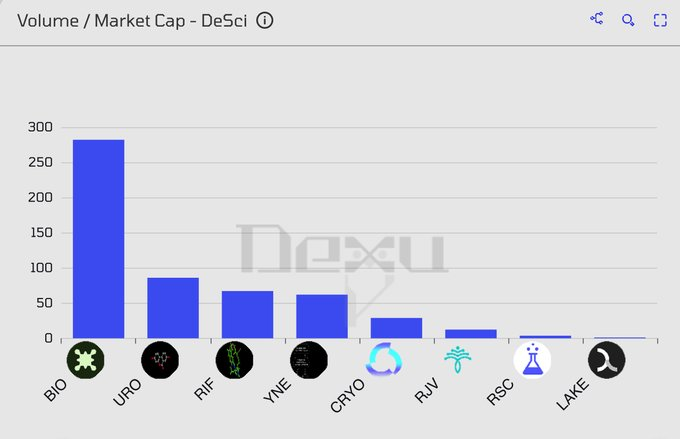

Over the past 24 hours, BIO has maintained its leading position in the sector with over $400 million in trading volume, while other competing products have only traded between $1 million and $4 million. If you notice a surge in BIO, you might want to look for similar tokens with potential to catch up, but this is very risky!

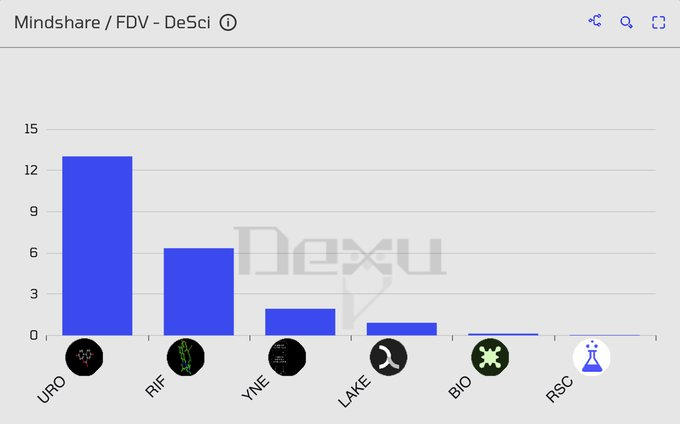

2. Value Discovery vs. Mind Share

Let’s take a look at mindshare/FDV to perhaps see how some coins have a different mindshare than FDV.

Compared to their FDVs, the following small-cap projects have great potential:

3. Funding Rate

Not all tokens on this list have funding rates, but it’s clear that despite BIO’s surge, some people are still shorting it. This may indicate that the token still has room to rise and its price may rise further.

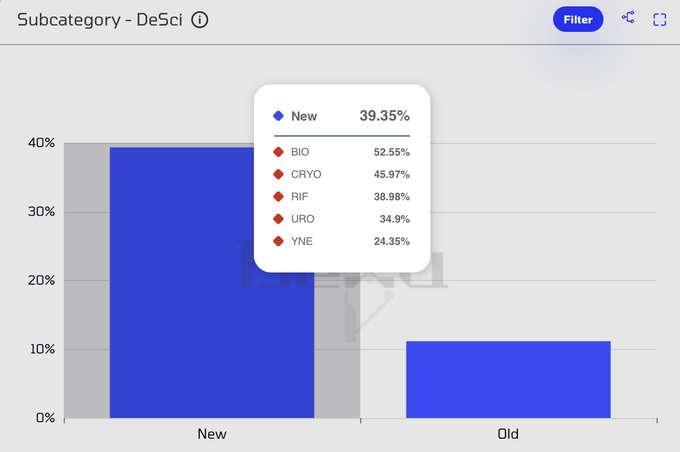

4. Comparison between new and old tokens

Whenever a new narrative emerges in the market, newly listed currencies usually see greater gains, which is exactly the case in the current market. Therefore, it is recommended to keep a close eye on these new currencies and other currencies that may be listed:

5. DeSci Track's Mental Distribution

- $BIO-50%

- $CRYO -21.43%

- $LAKE -21.43%

- $URO -7.14%

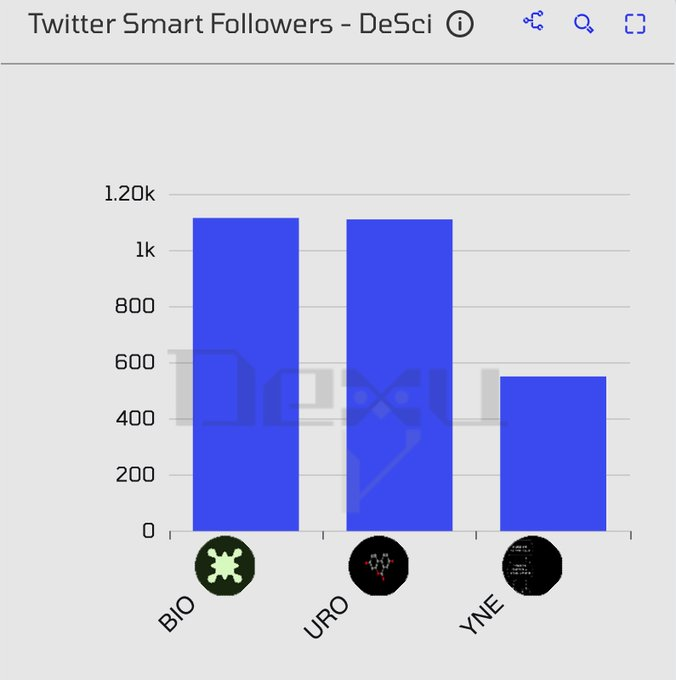

6. Smart Followers vs. Regular Followers

Let’s take a look at which coins have the smartest followers.

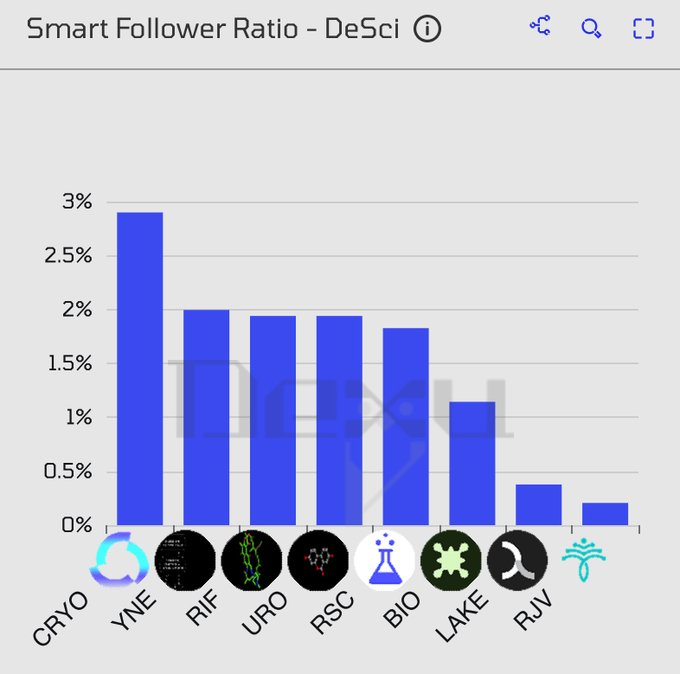

Now we can see the ratio of smart followers to regular followers and determine if they noticed a protocol earlier than others:

7. Key opinion leaders worth following in the DeSci track

Let’s take a look at who’s actively participating in reinvigorating the DeSci buzz + who’s an early adopter of this trend so you can follow them for the latest DeSci news and stay ahead of the narrative.

@zacxbt

@sjdedic

@paulkhls

@langeriuseth

@ViktorDefi

@0xSalazar

@this_investor

You May Also Like

Orbix-AI Unveils “The Brain of the Market”: A New Era of Predictive Analytics with Its Advanced AI Trading Indicator

OpenAI Cuts Spending Target to $600B and Projects $280B Revenue by 2030