Daily Market Update: Stock Futures Drop as Bitcoin Rebounds From $60K, Amazon Misses Earnings

TLDR

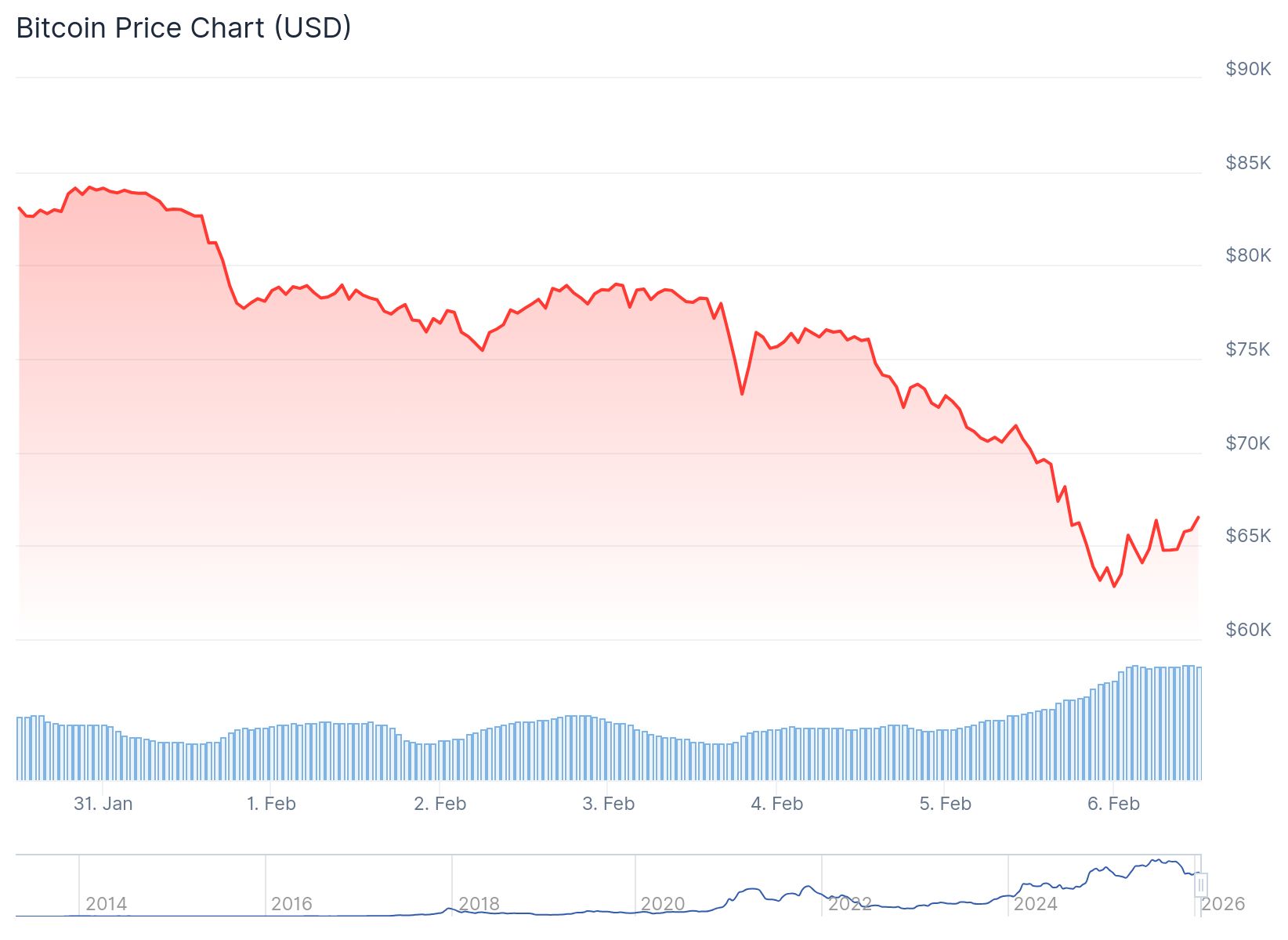

- Bitcoin dropped to $60,033 before recovering to $65,926 in Friday’s Asian session after Thursday’s 13% crash, its worst decline since November 2022

- Leveraged traders lost $700 million in four hours as $530 million in long positions and $170 million in shorts were liquidated during the volatility

- S&P 500 futures fell 0.1% and Nasdaq 100 futures declined 0.3% as Amazon shares dropped over 10% after-hours on disappointing earnings

- Michael Saylor’s Strategy posted a $12.4 billion quarterly loss tied to bitcoin price declines in its holdings

- Both S&P 500 and Nasdaq Composite have turned negative for 2026 as tech stocks continue selling off

Stock futures traded lower early Friday as investors dealt with continued volatility across cryptocurrency and technology markets. S&P 500 futures fell 0.1% while Nasdaq 100 futures dropped 0.3%. Dow Jones Industrial Average futures declined 0.1%.

E-Mini S&P 500 Mar 26 (ES=F)

E-Mini S&P 500 Mar 26 (ES=F)

The losses came after Thursday’s sharp sell-off on Wall Street. Both the S&P 500 and Nasdaq Composite have now turned negative for the year 2026. Technology stocks continued to lead the market lower.

Amazon shares crashed over 10% in after-hours trading after reporting earnings. The e-commerce giant missed Wall Street’s earnings per share estimates. The company also announced plans for $200 billion in capital expenditures for the year, sparking worries about AI spending.

Bitcoin experienced extreme price swings during Asian trading hours on Friday. The cryptocurrency fell as much as 4.8% to around $60,033 during late U.S. trading. It then surged back to as high as $65,926 in the Asian session.

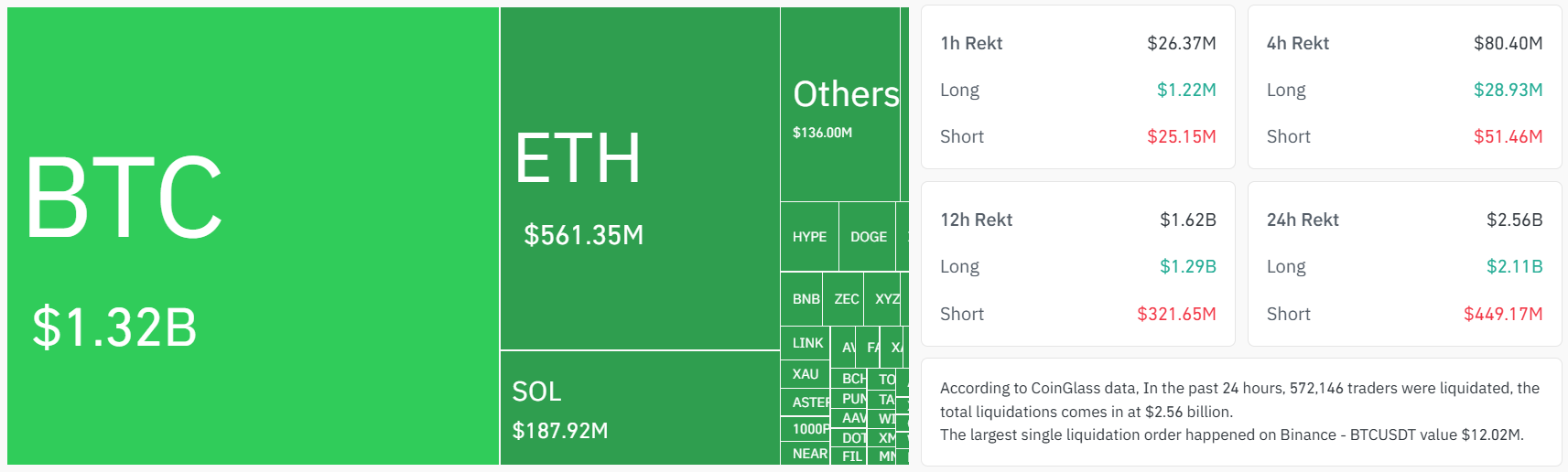

Crypto Liquidations Hit $700 Million

The bitcoin rebound came after Thursday’s brutal 13% decline. That drop marked bitcoin’s worst one-day performance since November 2022. The November 2022 crash happened when Sam Bankman-Fried’s FTX exchange collapsed.

Bitcoin (BTC) Price

Bitcoin (BTC) Price

Liquidations swept through crypto markets as prices whipsawed. About $700 million in leveraged crypto positions were wiped out over four hours, according to CoinGlass. The liquidations included roughly $530 million in long positions and $170 million in short positions.

Source: Coinglass

Source: Coinglass

Traders were first forced out on the decline. They then got caught on the wrong side during the rebound. The $60,000 price level served as a key psychological support that market participants had been monitoring.

Damien Loh, chief investment officer at Ericsenz Capital, noted the rebound shows strong support around $60,000. He cautioned that sentiment remains weak given broader market conditions. Bitcoin has now dropped more than 50% from its October peak.

Strategy Reports Major Loss on Bitcoin Holdings

Altcoins followed bitcoin’s volatile moves. Solana dropped as much as 14% before recovering all those losses within hours. The rapid price reversals highlight how quickly conditions are changing as liquidity dries up.

Michael Saylor’s Strategy reported a $12.4 billion net loss for the fourth quarter on Thursday. The loss stemmed from mark-to-market declines on the company’s bitcoin holdings. Strategy shares fell following the announcement.

The crypto market has remained unstable since October liquidations shook investor confidence. Recent price declines have been made worse by turmoil in global markets. Investors have been selling speculative assets across different sectors.

Traders say the market is still being driven by leverage rather than fundamental buying. The price action appears driven by forced selling instead of long-term investment decisions. The negative sentiment spread beyond stocks and crypto to other assets.

Reddit shares jumped in after-hours trading after beating earnings estimates. The social media company issued positive guidance and announced a stock buyback program. Roblox shares also rallied in extended trading.

Investors await earnings from Toyota and Philip Morris before Friday’s opening bell. The nonfarm payrolls report was postponed to next Wednesday after the federal government shutdown ended.

The post Daily Market Update: Stock Futures Drop as Bitcoin Rebounds From $60K, Amazon Misses Earnings appeared first on Blockonomi.

You May Also Like

RFK Jr. may have perjured himself with key vaccines claim: newly revealed emails

US SEC approves options tied to Grayscale Digital Large Cap Fund and Cboe Bitcoin US ETF Index