Bitcoin (BTC) Price: Reclaims $70K as Analysts Debate Whether Bottom Is In

TLDR

- Bitcoin climbed 17% from Friday’s $60,150 low back above $70,000 but still sits 44% below its October all-time high of $126,000

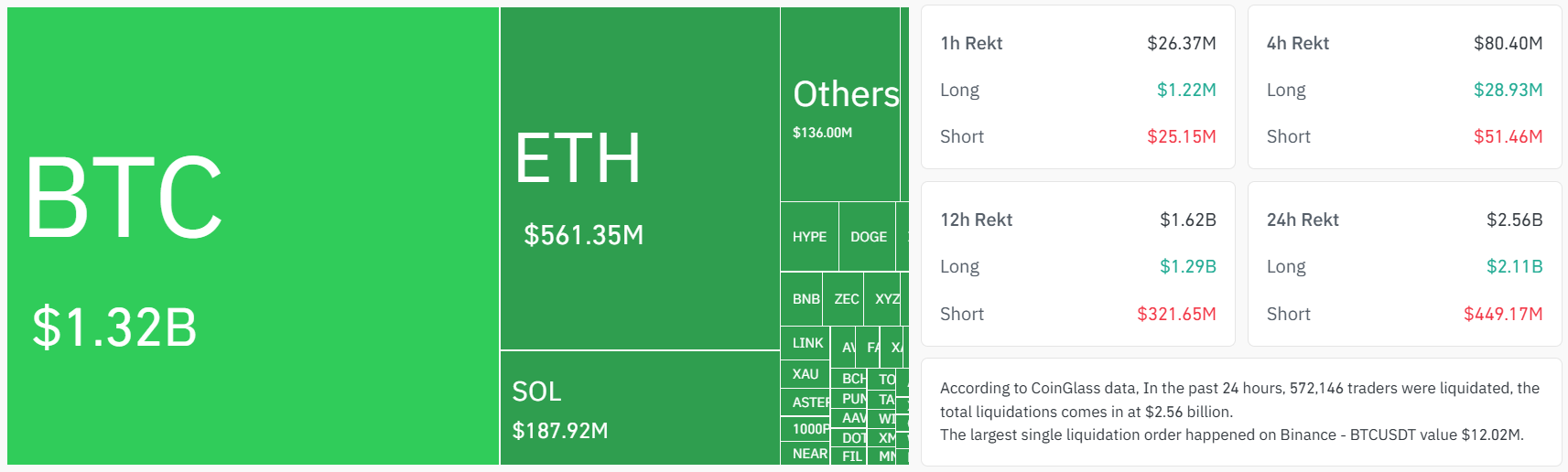

- Traders liquidated $1.8 billion in leveraged Bitcoin futures over five days, with the crash mirroring wild swings not seen since the FTX collapse in late 2022

- Derivatives data shows extreme fear among professional traders with options skew reaching 20%, the highest panic level in over a year

- Futures basis rates dropped to 2%, the lowest in more than a year, showing bulls remain cautious about adding leveraged positions

- Analysts point to support zones between $56,000-$58,000 as potential accumulation areas based on historical technical levels

Bitcoin bounced back above $70,000 on Friday after briefly dropping below $60,000 just one day earlier. The recovery marks a 17% gain from the $60,150 low recorded on Friday morning.

Bitcoin (BTC) Price

Bitcoin (BTC) Price

The crash on Thursday evening represented one of the worst single-day drops since the FTX exchange collapse in late 2022. Bitcoin fell roughly 52% from its October all-time high of $126,000 to the Thursday low near $60,000.

The selloff wiped out $1.8 billion in leveraged bullish futures contracts across five days. Traders worry that major hedge funds or market makers may have experienced catastrophic losses during the decline.

Source: Coinglass

Source: Coinglass

Bitcoin futures data shows traders added positions between $70,000 and $90,000 during the downward pressure. Aggregate futures open interest on major exchanges totaled 527,850 BTC on Friday, remaining virtually flat from the prior week.

The notional value of those contracts dropped from $44.3 billion to $35.8 billion. This 20% decline matches the 21% Bitcoin price drop over the seven-day period.

The crash did not happen in isolation. Tech stocks also tumbled on Thursday after Anthropic released an AI plugin that threatened some major companies’ business models. Shares of Nvidia and Microsoft recovered on Friday alongside Bitcoin’s rebound.

Professional Traders Remain Cautious

Bitcoin futures basis rates fell to 2% on Friday, the lowest level in more than a year. This metric measures the price difference between futures and spot contracts.

Source: laevitas.ch

Source: laevitas.ch

Under normal market conditions, the premium ranges from 5% to 10% annualized. The current 2% rate shows a clear lack of demand for bullish leverage.

Options markets tell a similar story. The options skew metric hit 20% on Friday, representing market panic levels. This metric measures the difference in demand between put options and call options.

Excessive demand for put options pushes the skew above 6% and indicates bearishness. The current 20% reading rarely persists and typically signals extreme fear among traders.

For comparison, the skew stood at 11% on November 21, 2025, after a 28% price correction to $80,620. The current fear level exceeds that earlier panic despite a smaller percentage decline.

Technical Support Levels in Focus

Galaxy Research analyst Alex Thorn identified key support zones near long-term technical levels. The realized price currently sits around $56,000 while the 200-week moving average hovers near $58,000.

Both levels served as accumulation areas during previous bear markets. Thorn noted a supply gap between $70,000 and $80,000 where relatively few coins changed hands.

Bitwise Asset Management sees the current sentiment as similar to 2018 and 2022 bear market bottoms. Those periods preceded massive rallies for long-term investors.

Bitwise CIO Matt Hougan pointed to improving fundamentals despite weak prices. These include rising stablecoin use, tokenization growth, and increased integration of AI and crypto technologies.

MicroStrategy, the largest corporate Bitcoin holder, announced a $12.4 billion net loss in its most recent quarter. Executive chairman Michael Saylor expressed confidence in a rebound based on favorable Trump administration policies.

Bitcoin traded at approximately $70,000 on Friday afternoon according to Binance data.

The post Bitcoin (BTC) Price: Reclaims $70K as Analysts Debate Whether Bottom Is In appeared first on CoinCentral.

You May Also Like

Crypto News: Donald Trump-Aligned Fed Governor To Speed Up Fed Rate Cuts?

Korean Regulators Probe Bithumb After 620,000 Bitcoins Mistakenly Sent to Users

Highlights: Bithumb mistakenly sent 620,000 Bitcoins to 695 users during a promotion event. The exchange recovered 618,212 Bitcoins, covering almos