XRP in Danger: Ripple Token Could Fall Further After Losing Key Resistance (Analyst)

TL;DR

- XRP trades near $3 after rejection at $3.32, with support at $2.90 in focus.

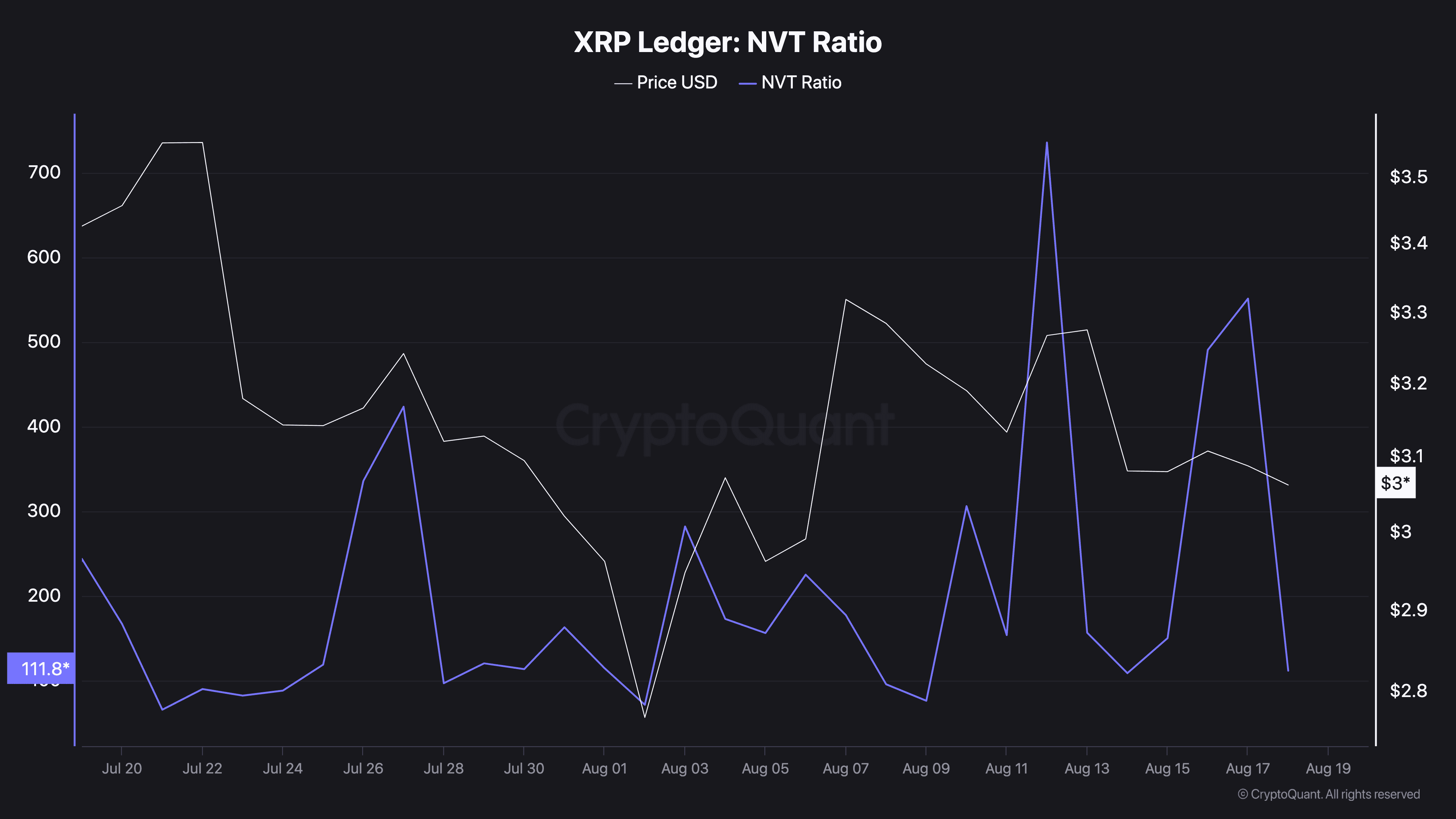

- XRP Ledger’s NVT ratio falls 80%, showing higher transaction activity despite ongoing market weakness.

- SEC postpones decision on several ETF applications, including Nasdaq’s CoinShares proposal, until October, extending regulatory uncertainty.

Price Holds Near $3.00

Ripple’s XRP closed Monday near $3.00 after giving back gains from earlier in the day. A late selloff in the final trading hour pushed the token lower on heavier volumes. Traders pointed to stop-loss liquidations and possible institutional selling behind the move.

At the press, the XRP’s price was changing hands at $3.00, and the Daily volume stood at $6.57 billion. The token rose just over 1% in 24 hours but is still down nearly 5% on the week. In the past day, the price moved between $2.95 and $3.10. For the week, the range has been $2.96 to $3.34. The token remains 18% below the record $3.65 set on July 18.

Analyst BitGuru said XRP has been sliding since it failed to hold above $3.32. The four-hour chart shows a clear downtrend, with lower highs and lower lows. The asset is now resting on another crucial support zone at $3.00.

If buyers can defend that level, a rebound toward $3.20 looks possible, which is an area that stopped rallies earlier this month. If $3.00 breaks, the next level sits at $2.90. A deeper move could open the way toward $2.70 to $2.80, where demand was seen in July.

On-Chain Data Shows Activity

While the price is under pressure, network activity is holding firm. The XRP Ledger’s NVT ratio has dropped to 111.8, down almost 80% from earlier levels. The fall means more transaction volume relative to market value.

Source: CryptoQuant

Source: CryptoQuant

That increase in activity suggests the token is being used more on-chain even while the price consolidates. Market watchers often treat lower NVT readings as signs of healthier usage compared with valuation.

SEC Pushes Back ETF Decision

In addition, regulators added to the uncertainty. The US Securities and Exchange Commission delayed its ruling on Nasdaq’s proposal to list the CoinShares XRP ETF. The decision, originally due August 24, has been moved to October 23.

The agency said it needed more time to review the filing and comments. The delay extends the wait for investors watching progress on new XRP-linked products.

Additionally, the US regulator postponed making a decision on a few more XRP ETF applications, including those from Bitwise, Canary, and Grayscale.

The post XRP in Danger: Ripple Token Could Fall Further After Losing Key Resistance (Analyst) appeared first on CryptoPotato.

You May Also Like

WLFI Bank Charter Faces Urgent Halt as Warren Exposes Trump’s Alarming Conflict of Interest

UNI Price Prediction: Targets $5.85-$6.29 by Late January 2026