US DOJ hands crypto privacy developers win, clarifying that code isn’t a crime

The US Department of Justice (DOJ) took a decisive step toward clarifying its stance on open-source software developers in the crypto sector. Matthew J. Galeotti, acting assistant attorney general of the DOJ’s Criminal Division, declared that “merely writing code without ill intent is not a crime.”

This could turn out to be a huge turning point for developers who have long feared prosecution for shipping blockchain code.

Speaking at an event hosted by the American Innovation Project, Galeotti made it clear that the DOJ would not target developers simply for creating or publishing software. “The criminal division will, however, continue to prosecute those who knowingly commit crimes or who aid and abet the commission of crimes, including fraud, money laundering, and sanctions evasion,” he added.

Katie Biber, CLO at Paradigm, in an X post, mentioned that Galeotti pointed out that “Criminal laws must give fair notice of what is illegal” and “innovating on ways to store/transmit value is not a crime.” However, if a developer merely contributes code but lacks the specific intent to facilitate a crime, he or she is not criminally liable.

DOJ shift could upend Tornado Cash case

Just weeks ago, a jury in New York found Tornado Cash co-founder Roman Storm guilty of conspiracy to operate an unlicensed money transmitting business. The conviction has stunned many in the crypto industry. They argue that Storm had simply written and published code that ran in a decentralized way on Ethereum.

Meanwhile, prosecutors have charged him under 18 U.S.C. 1960.

Galeotti addressed this situation with his remarks. “Where the evidence shows that software is truly decentralized and solely automates peer-to-peer transactions, and where a third party does not have custody and control over user assets, new 1960(b)(1)(c) charges against a third party will not be approved,” he said.

Jake Chervinsky, chief legal officer at Variant Fund, called it grounds to overturn Storm’s conviction. In a post, he stated that “Roman Storm was just convicted on this exact charge under this exact circumstance,” he posted on X. “Justice for Roman means dropping the case.”

Jake Chervinsky on DOJ. Source: X

Jake Chervinsky on DOJ. Source: X

This statement shows how top watchdogs are now analyzing the crypto industry under the Donald Trump administration. Earlier in the Biden era, the DOJ aggressively pursued crypto cases, often casting a wide net. However, the new line suggests prosecutors will take a narrower approach focused on intent and actual criminal conduct.

A Trump-era DOJ memo, re-emphasized under Galeotti, stated that enforcement should not impose “regulatory frameworks on digital assets while President Trump’s actual regulators do this work outside the punitive criminal justice framework.”

Don’t just read crypto news. Understand it. Subscribe to our newsletter. It's free.

You May Also Like

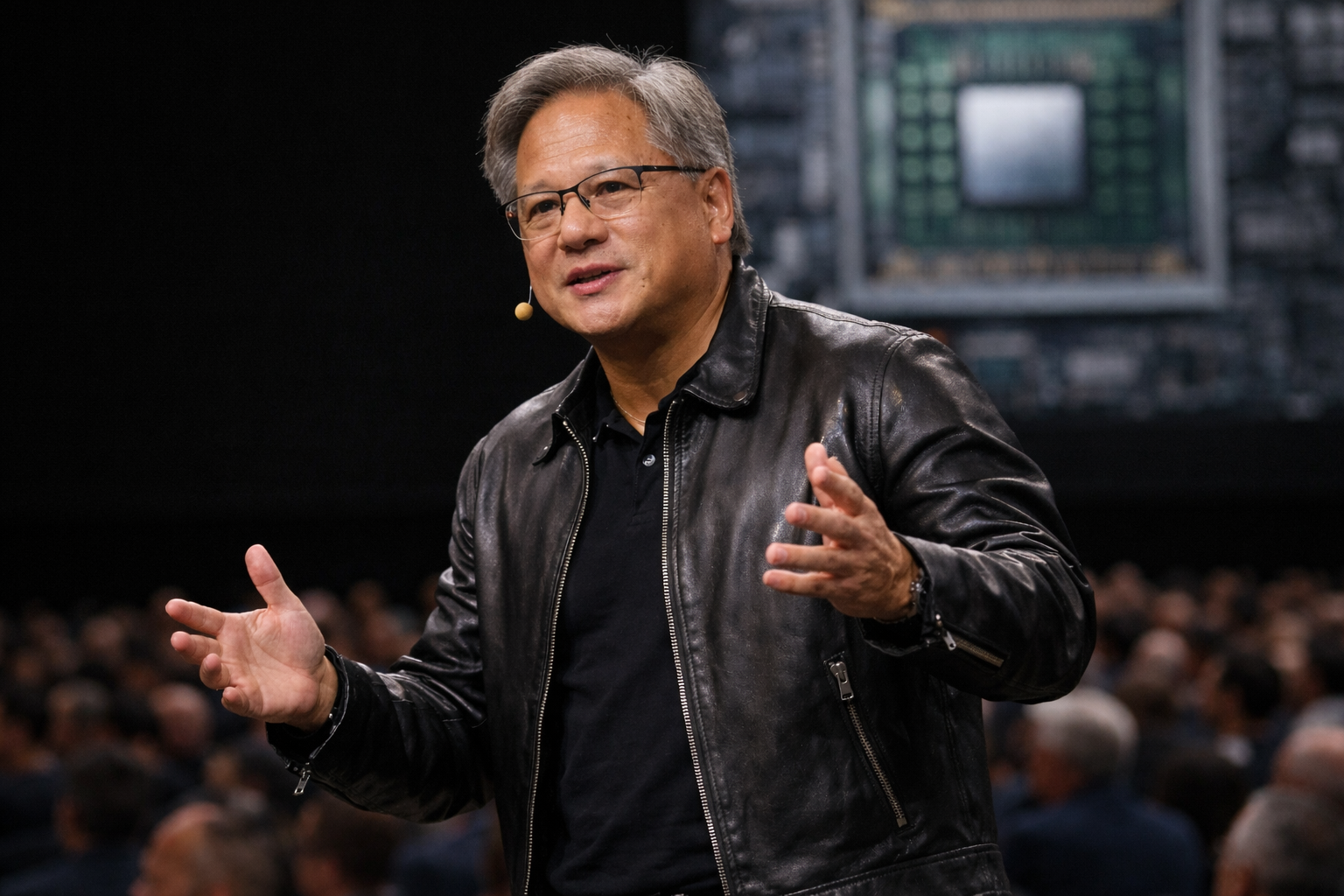

Nvidia’s Jensen Huang believes markets are wrong on software selloff

Chainlink Signs RWA Deal with DualMint While Analysts Target $100 LINK Price