XRP Price Prediction: Which Of These PayFi Crypto Assets Will Hit $5 First? Remittix Vs Ripple

XRP price prediction models suggest Ripple could make a run toward $5 in 2025, but newer contenders like Remittix are moving fast. Remittix has already raised over $21 million through the sale of 618 million tokens at $0.0987 each, making it one of the most talked-about crypto projects this year. The question is, which will be first to cross the $5 line XRP or Remittix?

XRP Price Prediction: The Case for Ripple

Source: Armando Pantoja

Source: Armando Pantoja

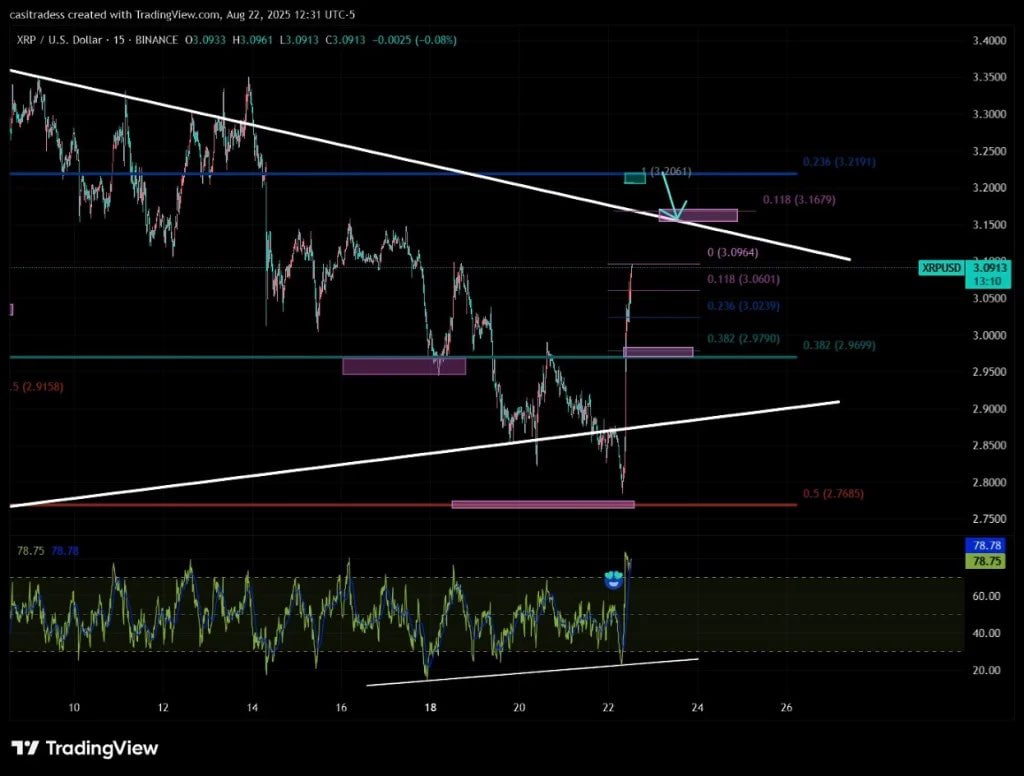

XRP has been consolidating near $3.50 but analysts see potential for a breakout. Ali Martinez recently highlighted key support around $3.00, calling it a zone that could spark a rally toward $5.85 if bulls stay in control. Another analyst, Stephiscrypto, suggests the structure mirrors past cycles, where XRP staged sharp parabolic surges before heavy retracements.

The XRP price prediction now depends on breaking the $3.80–$4.00 resistance. A successful breakout could set the stage for $5 and beyond, though risks remain if it slips under $2.85 support. Ripple’s regulatory clarity and its role in cross-border payments still make it one of the best long-term projects in the PayFi sector. However, its slower growth compared to emerging tokens may leave investors wanting more.

Remittix: Could It Hit $5 Faster?

While XRP eyes resistance levels, Remittix is already generating momentum that makes the $5 target more realistic in the near future. This PayFi-focused altcoin is designed for global transfers, with adoption potential that sets it apart from meme-driven hype cycles. With $21 million raised and whales quietly buying, analysts argue that Remittix could outpace XRP’s growth curve.

Why Remittix May Win the Race to $5

- Over $21M raised and 618M tokens sold, showing strong investor confidence

- Payment-first design with utility in 30+ countries at launch

- Next exchange listing expected after $22M milestone, creating upside pressure

- $250K giveaway campaign driving viral community engagement

- Institutional investors already backing it as the next big PayFi altcoin

Which Will Reach $5 First?

XRP price prediction models still see Ripple as a contender for $5 but its reliance on older cycles and heavy resistance may slow progress. Remittix, by contrast, is scaling faster and capturing fresh liquidity, making it a strong candidate to hit $5 first. For investors asking what is the best crypto to buy now, Remittix looks like the frontrunner in this race.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

This publication is sponsored. Coindoo does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or any other materials on this page. Readers are encouraged to conduct their own research before engaging in any cryptocurrency-related actions. Coindoo will not be liable, directly or indirectly, for any damages or losses resulting from the use of or reliance on any content, goods, or services mentioned. Always do your own research

The post XRP Price Prediction: Which Of These PayFi Crypto Assets Will Hit $5 First? Remittix Vs Ripple appeared first on Coindoo.

You May Also Like

Fed rate decision September 2025

GBP/USD rallies as Fed independence threats hammer US Dollar