Ripple CTO Joins Meme Coin Effect, Fuels 40% Price Rally for PHNIX

PHNIX, a token built on the XRP Ledger and the associated NFT, surged by almost 40% after Ripple (Twitter) profile picture to a PHNIX NFT.

The move mirrors token reactions after the purported DOGE father flips his profit picture to a particular meme coin.

Ripple CTO Sparks PHNIX Frenzy With Profile Picture Shift, Token Soars 40%

The move sent traders into a frenzy, reviving comparisons with Elon Musk’s history of sparking meme coin rallies through subtle social media tweaks.

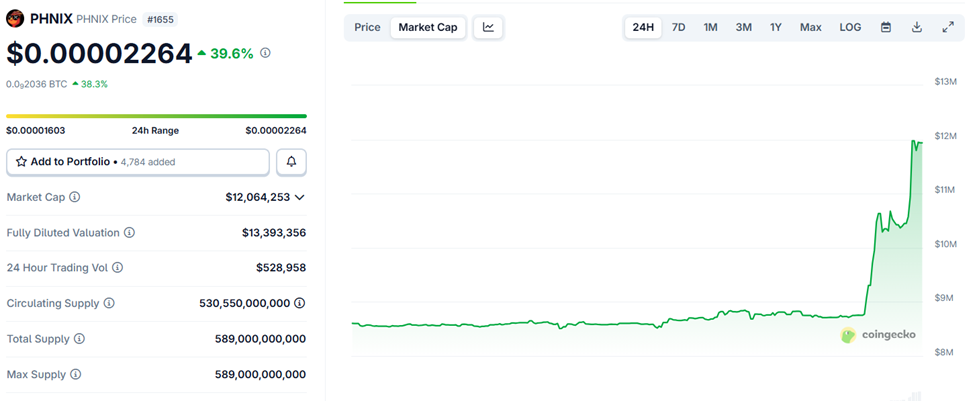

In the immediate aftermath, PHNIX token rose nearly 40% to trade for $0.00002264 as of this writing.

Phoenix (PHNIX) Price Performance. Source: CoinGecko

Phoenix (PHNIX) Price Performance. Source: CoinGecko

The rally mirrors past episodes tied to Elon Musk. In 2021, Dogecoin jumped 20% after Musk briefly changed his X profile picture to reference the DOGE meme coin.

Earlier this year, his decision to rename his profile to “Harry Bōlz” triggered a 3,000% rally in the associated token.

Similarly, the KEKIUS soared 120% in May after Musk adopted it as part of his X branding. Therefore, Schwartz’s move brings that same speculative energy into the XRP ecosystem.

However, unlike Musk, the Ripple CTO is not known for meme coin antics, making the endorsement all the more surprising.

The PHNIX surge highlights the influence of high-profile crypto figures on market psychology.

While Schwartz did not comment on whether his profile change was intended as an endorsement, the effect was immediate. Data on CoinGecko highlights liquidity and trading volumes in PHNIX spiked as retail traders rushed to buy in.

This phenomenon suggests a broader theme in crypto markets, where meme coins become a shilling point for speculative liquidity.

Personality-driven actions, memes, and cultural signals can often overshadow fundamentals in the short term.

Nonetheless, Musk-related rallies have historically fizzled after initial euphoria, often leaving latecomers exposed. This suggests the PHNIX price could suffer a similar pattern unless a subsequent fundamental event or announcement presents.

You May Also Like

XRP Price News: Elon Musk Confirms X Money Crypto Plans as Pepeto’s Three Products Approach Launch and the 537x Window Stays Open

What should investors expect from the Federal Reserve after latest jobs data?