Dogecoin (DOGE) Price: Whale Wallets Reach 4-Year Highs Before Rex Osprey ETF Launch

TLDR

- Dogecoin surged 34% this week, trading around $0.27-$0.30 as whale activity increases

- Rex Osprey Dogecoin ETF expected to launch within days, with 93% approval chance

- Key resistance at $0.40 could confirm breakout from 2021 downtrend

- Whales accumulated 200 million DOGE, with large wallets at 4-year highs

- Analysts target $0.60 and $1 if breakout confirms above $0.40 resistance

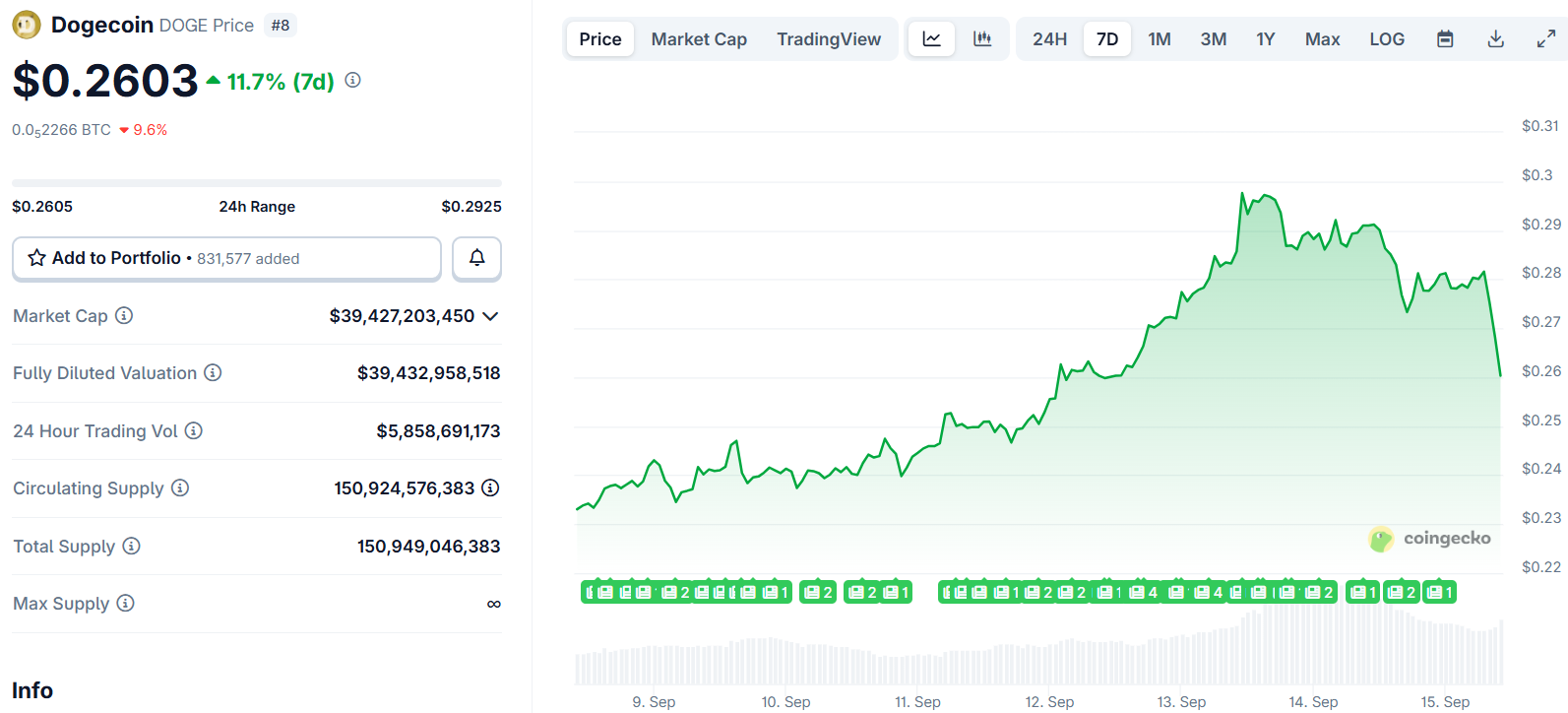

Dogecoin price jumped 34% this week, reaching $0.27 as excitement builds around the upcoming Rex Osprey Dogecoin ETF launch. The meme coin approached key resistance levels that could determine its next major move.

Dogecoin (DOGE) Price

Dogecoin (DOGE) Price

The token climbed back to a descending resistance line that has capped growth since 2021. This weekly rally marks one of Dogecoin’s strongest performances in years.

Whale activity intensified as large holders moved 200 million DOGE tokens. These major players are accumulating rather than selling, with wallets holding 1-10 million DOGE reaching their highest levels in four years.

The Rex Osprey DOGE ETF is set to become the first meme coin ETF in the United States. Bloomberg analyst Eric Balchunas forecasts the launch within days, with experts estimating a 93% approval chance.

This ETF will allow traditional investors to gain exposure to Dogecoin without directly owning the cryptocurrency. The product uses a regulatory pathway under the Investment Company Act of 1940.

Technical Levels Point to Breakout Potential

Chart analysts identify the $0.35-$0.40 zone as the next critical test for DOGE price. A weekly close above $0.40 would confirm a structural shift and end the multi-year downtrend.

Such a breakout would turn the resistance zone into support. This development often signals broader trend reversals in cryptocurrency markets.

The foundation for this rally came from accumulation in the $0.06-$0.08 range during earlier months. That base allowed the recent surge to maintain momentum.

Trading volume has increased alongside the price gains. Higher participation typically accompanies major price movements in digital assets.

If DOGE breaks above $0.40, analysts see $0.60 as the first target. The psychological $1 level remains in focus for longer-term projections.

Market Conditions Support Continued Gains

Bitcoin’s consolidation near major resistance has encouraged capital rotation into altcoins. This rotation historically benefits tokens like Dogecoin during market cycles.

Community support remains strong across social media platforms. Activity on X continues to fuel visibility for the meme coin.

Payment integrations and tipping applications help maintain Dogecoin’s utility beyond speculative trading. These use cases support broader adoption efforts.

Current whale wallet distribution shows 7.23% of total supply concentrated in addresses holding 1-10 million DOGE. This concentration represents the highest level seen in four years.

Large holders appear positioned for the ETF launch rather than preparing to sell. This accumulation pattern differs from previous periods when whales reduced positions during uncertainty.

The ETF launch could trigger institutional interest if retail demand follows. Analysts warn about potential “sell the news” events that sometimes follow major announcements.

Key resistance levels at $0.25, $0.26, and $0.30 will determine the path forward. These zones have acted as barriers during previous attempts to break higher.

The Rex Osprey ETF launch represents a potential inflection point for Dogecoin price action with institutional participation expected to increase.

The post Dogecoin (DOGE) Price: Whale Wallets Reach 4-Year Highs Before Rex Osprey ETF Launch appeared first on CoinCentral.

You May Also Like

Solana Treasury Stocks: Why Are These Companies Buying Up SOL?

Raoul Pal Predicts Bitcoin’s Correlation With ISM Index