Pump.Fun (PUMP) Price: Livestream Comeback Fuels Token Rally to New Heights

TLDR

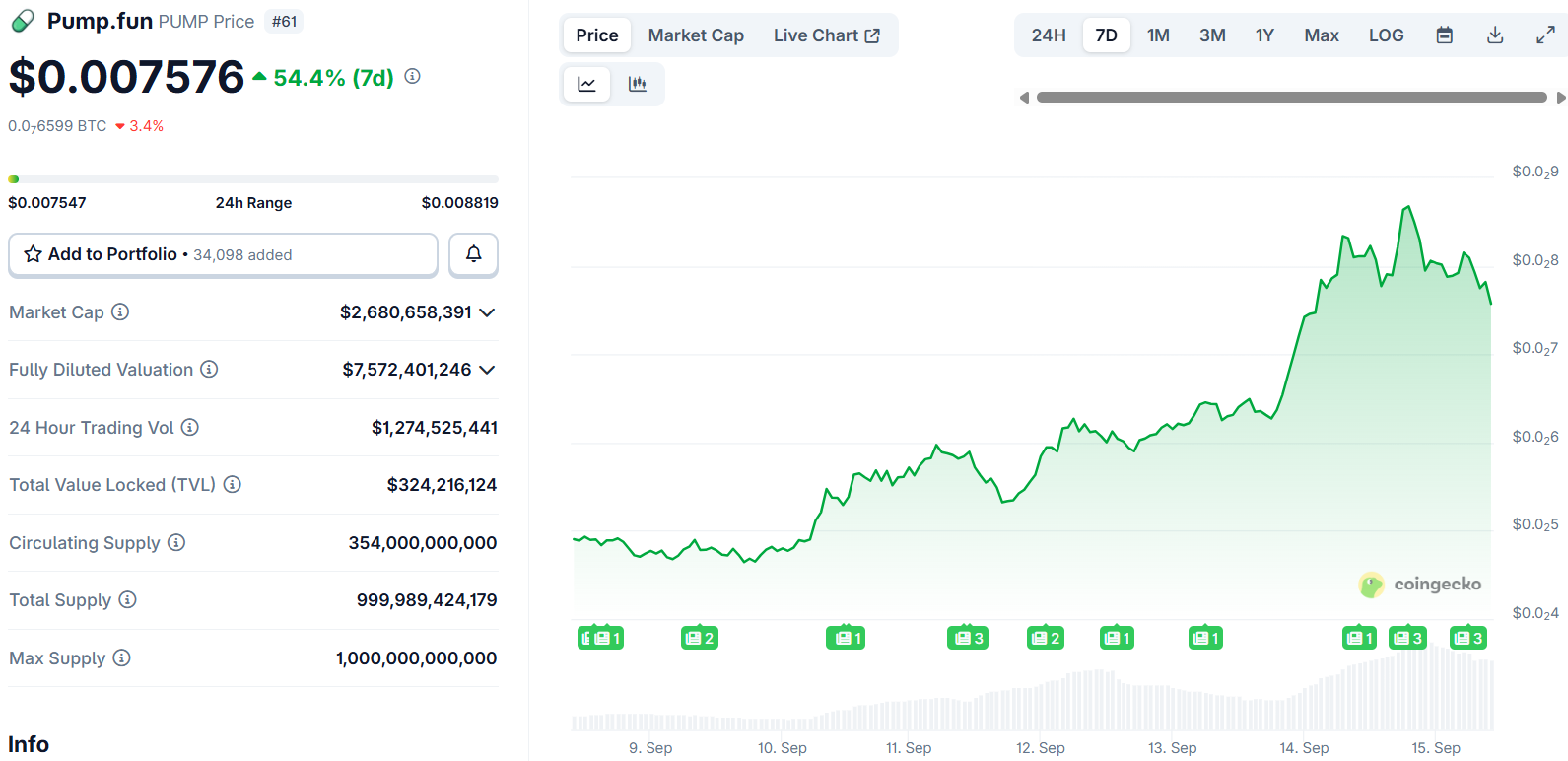

- PUMP token crossed $3 billion market cap milestone for the first time on Sunday

- Co-founder claims platform surpasses Rumble in concurrent livestreams and targets Kick

- Token hit new all-time high of $0.00849, gaining 71% over the past week

- Daily buyback program purchasing $2 million worth of PUMP tokens creates steady demand

- Platform’s controversial livestream feature relaunched in April after suspension due to inappropriate content

Pump.fun’s native PUMP token reached a $3 billion market cap on Sunday, marking a major milestone for the Solana-based memecoin launchpad. The achievement comes less than two months after the platform’s initial coin offering raised nearly $600 million in just 12 minutes.

Pump.Fun (PUMP) Price

Pump.Fun (PUMP) Price

The token hit a new all-time high of $0.00849 during the rally. Weekly gains topped 71%, making PUMP one of the fastest-moving tokens in the Solana ecosystem.

Co-founder Alon Cohen took to X to celebrate the milestone. He claimed the platform now surpasses livestreaming rival Rumble in concurrent livestreams and is targeting Kick next.

The livestream feature has become central to Pump.fun’s recovery story. The platform allows users to create and trade memecoins with simple clicks. Creators can use livestreams to pitch their tokens in real time.

However, viewer data tells a different story than stream count. Rumble averaged 79,000 concurrent viewers in the past week. Kick logged 719,000 concurrent viewers, while market leader Twitch recorded over 2 million.

Pump.fun doesn’t publish equivalent viewer data. The platform isn’t tracked on Streams Charts, making Cohen’s claims difficult to verify.

Buyback Program Drives Recovery

The token’s surge comes partly from a daily buyback program. The team purchases around $2 million worth of PUMP tokens each day, creating steady demand.

When PUMP launched, critics called it one of the worst ICOs. The token price dropped over 60% from initial levels. The buyback program has helped restore confidence among investors.

Platform fees are rising as activity increases. Total value locked is growing, and Pump.fun has become the second most active token in liquidity on Solana.

Trading data shows the rally is driven mainly by buybacks and retail investors. Large whales haven’t shown strong participation yet. Perpetual futures trading supports short-term price moves, with most leveraged positions betting on higher prices.

Livestream Feature Returns After Controversy

The livestream feature nearly destroyed the platform last year. Users performed dangerous stunts, threatened pets, and faked suicides during streams. Pump.fun suspended all livestreams in November 2024.

The platform quietly relaunched livestreaming in April with new guidelines and policies. A creator revenue-sharing program launched in May allocates 50% of PumpSwap revenue directly to coin creators.

Analysts predict PUMP could reach $0.01 in the short term if it holds above $0.0069 support. Some longer-term forecasts suggest higher prices during the current bull cycle.

Daily trading volumes show strong participation despite questions about organic demand. The token stands out as one of the most-watched in the market.

Pump.fun has quickly become a major player in the Solana ecosystem. The platform’s recovery from last year’s controversies demonstrates the resilience of the memecoin market.

The post Pump.Fun (PUMP) Price: Livestream Comeback Fuels Token Rally to New Heights appeared first on CoinCentral.

You May Also Like

Solana Treasury Stocks: Why Are These Companies Buying Up SOL?

Raoul Pal Predicts Bitcoin’s Correlation With ISM Index