Baidu, Inc. (BIDU) Stock: Jumps Almost 8% on AI Partnership and $56M Bond Plans

TLDRs;

- Baidu stock jumped nearly 8% in U.S. trading after announcing an AI partnership and $56.2M bond plans.

- The company struck a deal with state-owned China Merchants Group to develop AI agents and industrial digital employees.

- A 4.4 billion yuan offshore bond will fund Baidu’s AI infrastructure, cloud computing, and chip development.

- Analysts upgraded Baidu, citing AI growth prospects and reduced reliance on U.S. chipmakers like Nvidia.

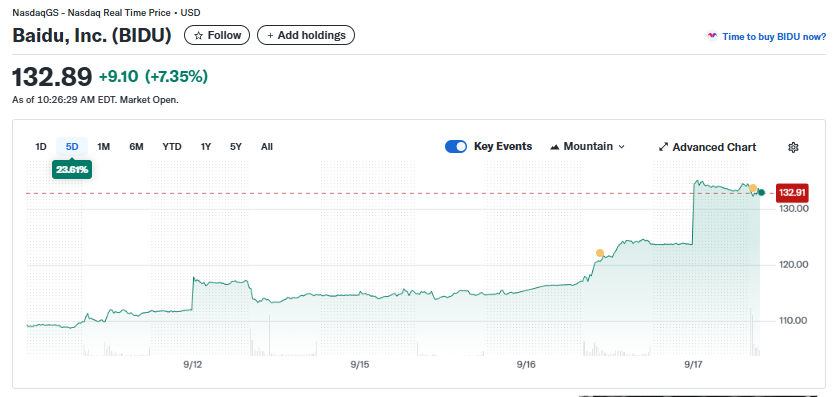

Chinese technology giant Baidu, Inc. (BIDU) saw its shares climb 7.35% in U.S. trading on Wednesday after the company unveiled a strategic AI partnership and announced plans for a $56.2 million offshore bond issue.

The surge underscores investor confidence in Baidu’s aggressive pivot toward artificial intelligence, even as its traditional advertising business faces mounting challenges.

The stock momentum followed a similar rally in Hong Kong, where Baidu shares gained nearly 16% to touch two-year highs, driven by optimism over its AI-focused growth path and improving analyst sentiment.

Baidu, Inc. (BIDU)

Baidu, Inc. (BIDU)

AI Partnership With State-Owned Giant

Earlier this week, Baidu confirmed a new collaboration with China Merchants Group, one of the country’s largest state-owned conglomerates.

The deal will focus on large language models, AI agents, and digital employee applications tailored for industrial sectors such as logistics, finance, and real estate.

Both companies highlighted that the partnership is not just experimental but aimed at scalable, real-world business scenarios. Analysts see this as a significant vote of confidence in Baidu’s AI offerings, particularly its Ernie Bot and newer enterprise-facing AI solutions.

Offshore Bond Boost for AI Push

In addition to its industrial AI partnership, Baidu revealed a 4.4 billion yuan (US$56.2 million) offshore bond sale due in 2029.

Proceeds will fund the company’s AI infrastructure buildout, including cloud computing capacity, data training, and AI chip development.

The move follows a larger $2 billion bond issuance earlier this year, signaling that Baidu is doubling down on its AI investment strategy. Debt-funded capital injections are becoming increasingly common among Chinese tech giants, with Tencent and others also tapping global investors to secure billions for their AI bets.

Market Analysts Shift Outlook

The latest announcements have prompted analyst upgrades. Research firm Arete Research Services recently raised its rating on Baidu’s U.S.-listed shares from sell to buy, citing growth potential in AI cloud services and chip ventures.

Baidu has been developing internally designed AI chips, a move that could reduce its reliance on U.S. chipmaker Nvidia, which faces tightening export restrictions. This strategy not only strengthens Baidu’s domestic AI independence but also positions it as a competitive force against emerging startups like DeepSeek.

Despite a recent dip in advertising revenue, analysts believe Baidu’s AI-driven businesses could more than offset legacy weaknesses. One bond analyst even described Baidu’s recent financial moves as an “all-in AI pivot.”

Ernie Bot and AI Race in China

Baidu’s Ernie Bot chatbot, approved by Chinese regulators earlier this year, has become the company’s flagship AI product. At its developer conference last week, Baidu unveiled Ernie X 1.1, a reasoning model it claims outperforms rivals on several benchmarks.

The push comes amid intensifying AI competition in China, with companies racing to secure funding and market dominance. Tencent, Alibaba, and smaller startups have all announced fresh rounds of fundraising and AI product rollouts in recent months.

With its bond-funded expansion, state-backed partnership, and AI-first strategy, Baidu appears intent on solidifying its role as a leading player in China’s next tech boom.

The post Baidu, Inc. (BIDU) Stock: Jumps Almost 8% on AI Partnership and $56M Bond Plans appeared first on CoinCentral.

You May Also Like

Crypto News: Donald Trump-Aligned Fed Governor To Speed Up Fed Rate Cuts?

What Is Ripple Doing at Davos — and Who’s With Them?