BlockDAG’s $420M Presale & BWT Alpine Formula 1® Team Deal Crushes Pi Network & Arbitrum’s L2 Growth

With Pi Network expanding its user base into the tens of millions, Arbitrum breaking daily transaction records, and BlockDAG turning heads through Formula one® sponsorship, the race among Layer-1s and Layer-2s is entering a new phase.

Pi Network’s delay in mainnet rollout, Arbitrum’s scaling dominance, and BlockDAG’s aggressive public positioning offer a rich comparative view into the future of adoption and value growth. While Pi and Arbitrum show technical and community momentum, BlockDAG may be redefining visibility through partnerships that reach far beyond the blockchain sector.

Pi Network: Scale Without Mainnet Still Raises Questions

Pi Network continues to command attention in app-based mining circles. As of September 2025, its user base has surpassed tens of millions of smartphone miners, making it one of the largest pseudo-crypto communities without a live, open-access mainnet. This has prompted a mix of optimism and skepticism when it comes to the Pi Network price prediction.

On one hand, its grassroots approach is unique in onboarding millions who may not have otherwise engaged with cryptocurrency. On the other hand, critics point out that real utility, liquidity, and valuation depend on a full mainnet launch, a milestone Pi Network has yet to deliver.

The lack of exchange listings and ongoing KYC rollout delays further complicate any clear Pi Network price prediction. Until Pi moves from a closed-loop system into tradable reality, much of its perceived value remains theoretical. Despite this, the platform’s scale is undeniable, and if transitioned correctly, could instantly become one of the most used crypto apps globally.

Arbitrum: Dominating Ethereum’s Scaling Layer

While Pi remains locked in speculation, Arbitrum is delivering measurable progress. Following its September 2025 technical upgrades, Arbitrum (ARB) has set new records in Layer-2 activity. Daily transactions have reached unprecedented highs, reaffirming Arbitrum’s dominance in Ethereum scaling solutions. With reduced fees, faster confirmations, and growing developer activity, Arbitrum offers a clear case of execution over hype.

The Arbitrum (ARB) price prediction has steadily trended upward as institutions and decentralised apps continue to migrate to Layer-2 platforms to escape high Ethereum gas fees. While Arbitrum faces competition from Optimism, Base, and zkSync, it remains the front-runner in terms of adoption, ecosystem funding, and protocol reliability.

Despite its growth, Arbitrum’s challenge lies in broader visibility. It operates primarily in developer and DeFi circles and hasn’t yet found a public-facing narrative strong enough to resonate with casual users or mainstream investors. The protocol’s utility is undeniable, but traction beyond technical audiences is still limited.

BlockDAG: From Blockchain Forum to Formula 1® Grandstand

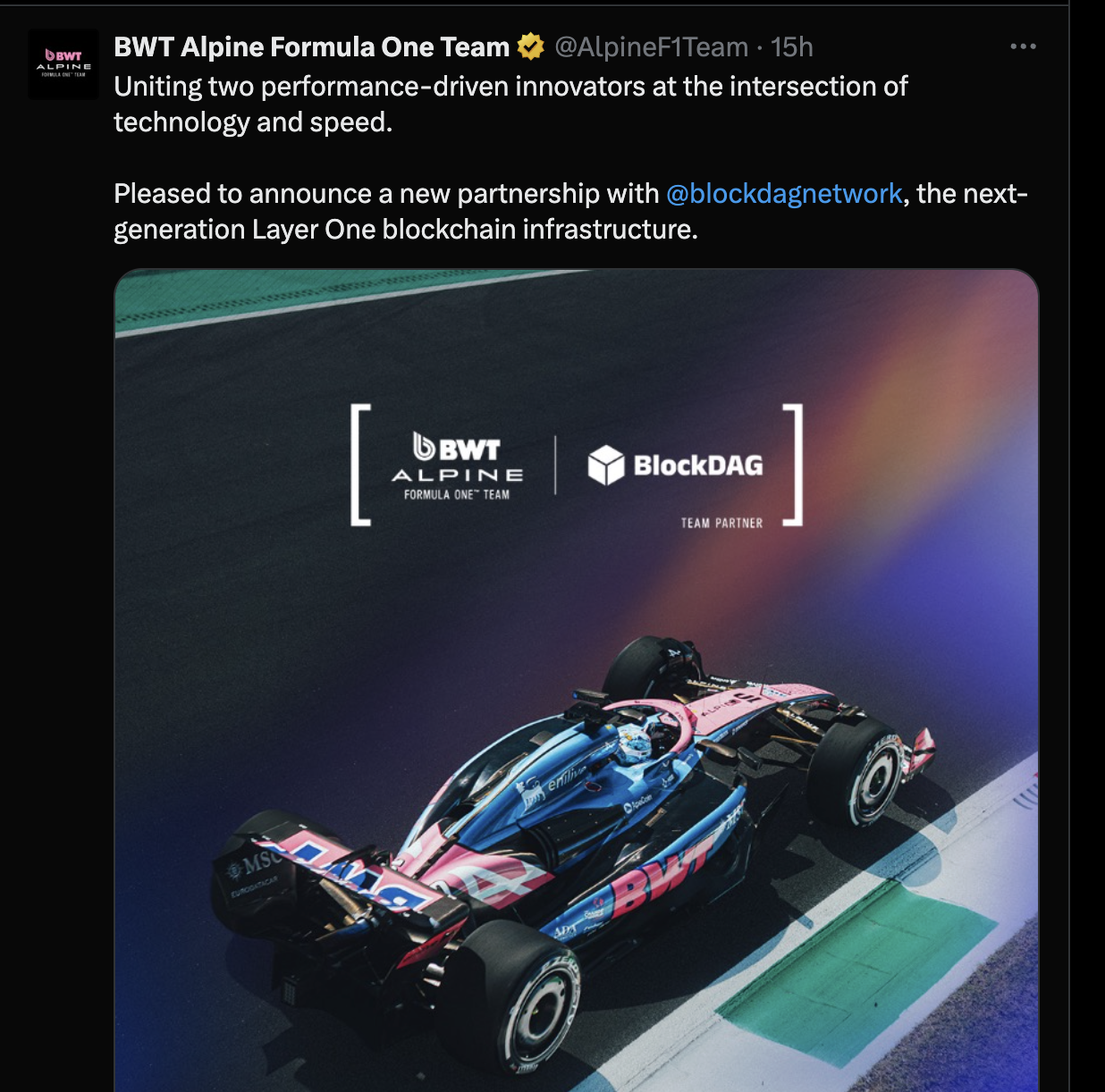

Where Pi scales in users and Arbitrum scales Ethereum, BlockDAG scales visibility. The project’s partnership with the BWT Alpine Formula 1® Team isn’t just symbolic; it brings blockchain branding into the global spotlight of motorsports. From car liveries to fan experience zones and media tie-ins, BlockDAG is embedding itself into cultural spaces that few crypto projects have accessed.

This public exposure is not without substance. BlockDAG is building a full-fledged Layer-1 infrastructure that supports high throughput, energy efficiency, and horizontal scalability. Yet, unlike many tech-first projects, it is also prioritising mainstream awareness from the outset. That combination, technical credibility and cultural relevance, positions it as a compelling case in the Layer-1 race.

As of now, BlockDAG has raised over $420 million in its presale, selling more than 26.5 billion coins. The current batch 30 is priced $0.0015. With a recorded ROI since batch 1, investors tracking top trending crypto projects are increasingly taking notice.

BlockDAG’s traction is not tied to just roadmap releases but is physically visible at race tracks, fan simulators, and promotional events. This kind of positioning helps attract both users and strategic partnerships, giving it a differentiating edge over projects that only exist in technical communities or speculative exchanges.

Why BlockDAG’s Visibility May Matter More Than Headlines

In comparing all three, what stands out most is how each project approaches traction. Pi Network builds it through sheer user onboarding, though it is still delayed in delivering token liquidity. Arbitrum does so through technical leadership in Layer-2 scaling, though largely invisible to non-DeFi audiences. BlockDAG is achieving traction by bridging Web3 with real-world, high-exposure platforms, shifting from protocol awareness to brand awareness.

The ability to gain recognition outside of the crypto-native world is increasingly important in a crowded field of protocols. BlockDAG’s mainstream strategy, especially through BWT Alpine Formula 1® Team, positions it as more than a speculative Layer-1; it becomes a recognisable brand that can scale not only usage but also public trust.

Presale: https://purchase.blockdag.network

Website: https://blockdag.network

Telegram: https://t.me/blockDAGnetworkOfficial

Discord: https://discord.gg/Q7BxghMVyu

The post BlockDAG’s $420M Presale & BWT Alpine Formula 1® Team Deal Crushes Pi Network & Arbitrum’s L2 Growth appeared first on Blockonomi.

You May Also Like

Which Altcoins Stand to Gain from the SEC’s New ETF Listing Standards?

SEC approves generic listing standards, paving way for rapid crypto ETF launches