Dow Jones drops, Tesla stock gets crushed on earnings miss

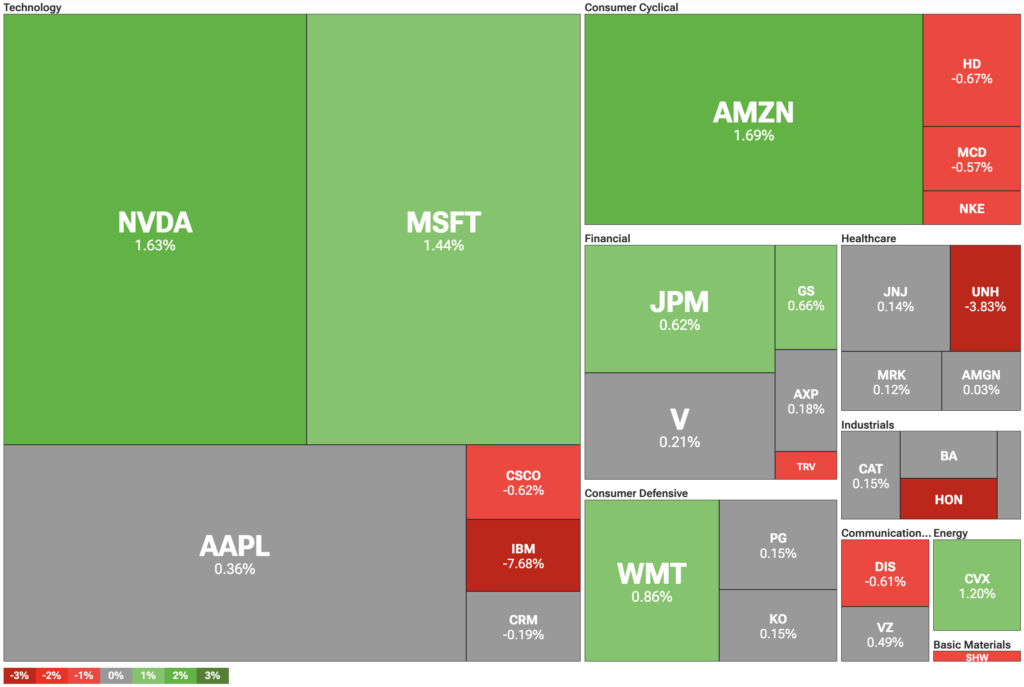

Tesla stole the spotlight Thursday—not for the right reasons—as its 9% stock plunge weighed on sentiment despite upbeat earnings from Alphabet and IBM, leaving U.S. markets mixed. The Dow Jones slipped, dragged by a surprise IBM selloff, while the Nasdaq and S&P 500 edged higher on strong results from Google’s parent company.

- Dow Jones diverged from other indices

- IBM lost 8% despite strong earnings

- Tesla stock lost 9% on earnings miss

US stock indices are mixed

On Thursday, July 24, Dow Jones was down 200 points or 0.43%, dragged down by low IBM earnings. At the same time, the S&P 500 was up 0.26%, while the tech-heavy Nasdaq rose 0.32%, boosted by strong Alphabet earnings.

Shares of Alphabet, Google’s parent company, were up 1.38% after the company reported strong quarterly results. The company reported earnings per share at $2.31, up from $1.89 in the same quarter of last year, and beating the $2.18 estimate. Strong Google Cloud revenue, at $13.6 billion, was the biggest surprise in Q2.

Google also announced that it would raise its capital expenditures by $10 million to meet customer demand for cloud computing. Strong earnings and new investments are good news for Meta and Microsoft, which are set to post earnings on Friday.

Tesla, IBM sink as earnings fail to impress

IBM’s stock sank 8% despite its earnings beating expectations. The firm reported $2.80 earnings per share for Q2, beating consensus expectations of $2.65. The firm’s revenue, at $17 billion, also beat expectations, as did its operating margin.

Still, investors expected more from the tech giant. Critically, the company also underperformed in one critical metric, which is software revenue. This slower-than-expected growth in a high-margin business spooked investors, leading to the stock’s decline.

Another big loser was Tesla, whose stock plunged 9% on a major earnings miss and Musk’s warnings. In the second quarter, EV maker’s revenues were down 12% year over year to $22.5 billion, missing consensus expectations of $22.64 billion. Earnings were also at 40 cents per share, compared to the estimated 42 cents.

At the same time, Musk warned that the company could have “a few rough quarters” ahead. One major factor, which Musk alluded to, is the loss of the electric vehicle incentives, which were taken away in Trump’s budget deal.

You May Also Like

Is it ‘over for Solana’? 97% network activity crash sparks fresh debate

Bitcoin 8% Gains Already Make September 2025 Its Second Best