Ethereum ETF Flows Grow as Solana Holds Key Support; Zexpire’s $ZX Adds New Angle to Options Market

Rising allocations into exchange-traded funds backed by Ethereum signal renewed institutional engagement, with the latest weekly data pointing to the strongest net inflow since early spring. At the same time, Solana’s price has steadied above a widely watched support band near the 200-day moving average, reinforcing confidence that last month’s pullback remains contained.

Against this backdrop, derivatives platform Zexpire has rolled out its governance and utility token, $ZX, positioning the asset as a fresh conduit for option-style exposure without the customary expiration constraints. The simultaneous growth in Ethereum fund demand, Solana’s technical resilience, and Zexpire’s product launch highlights a market environment where both established and emerging assets are drawing capital for distinct strategic reasons.

Ethereum (ETH) Sees Steady Climb as Network Expansion Continues

Ethereum is a Proof-of-Stake blockchain that lets developers run apps through automated contracts without a central gatekeeper. It hosts the widest mix of apps, from trading hubs to lending desks, and supports extra layers like Arbitrum and Polygon that make deals faster and cheaper. The chain’s token standard, ERC-20, lets new coins live on the same network while fees are always settled in ETH. Born in 2015 after a 2014 crowd sale, the chain moved away from energy-heavy mining in 2022 and now aims to split its database into 64 parts, a step called sharding, to boost speed and cut costs. All of this keeps ETH at the heart of trading, staking, and app rewards, setting the stage for the latest market moves.

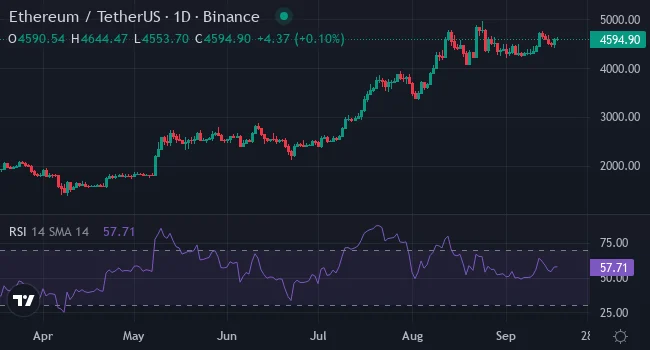

Source: TradingView

ETH trades between $4335 and $4825, up 5.73% in a week, 6.55% in a month, and 134.05% over six months. The coin sits above its 10-day and 100-day average prices, showing firm upward pressure, while momentum tools point to steady but not extreme buying. The nearest ceiling stands at $5040; clearing it could open a path to $5530, roughly a 12% gain from today’s midpoint. Support rests at $4061, with deeper cover at $3571, marking a 12% to 22% cushion if sellers take control. Current strength, rising averages, and a healthy yet not overheated demand gauge suggest bulls still hold the edge, making another push toward $5000 more likely than a slide below $4000 in the short term.

Zexpire Introduces One-Click Simplicity to Capture Crypto Options Boom

Crypto options has become one of DeFi’s fastest-growing segments, as its daily trading volumes average around $3 billion. Traditionally, this market has long been dominated by professionals, but now it’s starting to open up to a broader audience.

Zexpire, the first 0DTE DeFi protocol, removes the complexity of options trading and turns it into a one-click prediction experience. The process is reduced to a binary choice: users bet on whether the price will stay within a defined range or break out in the next 24 hours

Simply put, trading with Zexpire works like this: Guess right, and you win. Guess wrong, and your loss is capped at your stake. No margin calls. No cascading liquidations.

$ZX Serves the Fuel Behind Simplified Options Trading with Zexpire

To earn on volatility with Zexpire, you need its native token ZX. It serves as a governance token and provides its holders with discounts on game tickets and cashback on losses.

Before its exchange debut, $ZX is available in in seed access at just $0.003, nearly 800% cheaper than the planned listing price of $0.025.

Besides the reduced price, early participants get more advantages such as:

- Staking rewards up to 5% before a TGE

- Loyalty bonuses

- Airdrops and beta access

$ZX Rises with Each Stage — Buy Now for the Steepest Discounts

Zexpire has also built in a deflationary mechanism. 20% of platform fees will be burned, and a buyback program is designed to support demand. $ZX is available across multiple chains including Base, Solana, TON, and Tron and can be purchased directly with a card.

Why $ZX Could Be the Next Breakout Token

Options trading has become one of crypto’s biggest growth stories. BTC options volumes regularly hit billions, yet participation is dominated by pros. Zexpire is making a contrarian bet by stripping it all down to a fast, gamified format.

HYPE became one of this cycle’s strongest tokens by riding the derivatives boom on Hyperliquid. Zexpire is aiming to do the same in the options niche, but with an even broader retail angle: fixed-risk mechanics and gameplay simplicity that make it accessible to anyone.

If Zexpire can capture even a fraction of the momentum that HYPE did, $ZX could be DeFi’s next breakout token.

Buy $ZX, the Next Breakout Token

Market Watch Solana (SOL) Surge on Speed Promise and Strong Demand

Founded by former Qualcomm and Dropbox engineer Anatoly Yakovenko in 2017, Solana aims to fix slow and costly transactions on older chains. The network can process over 50000 deals each second, keeps fees tiny and locks them in less than one second. It uses a fast time stamping method, stake checks, parallel work and compressed data to reach this speed. Since the 2020 mainnet beta many apps have launched and bridges now link it with other chains. The native coin SOL pays fees and helps run on chain votes. Market value sits above 103 billion USD and many traders see it as a chief rival to Ethereum. This strong base sets the scene for a look at the latest market action.

Source: TradingView

SOL now trades between 213.85 and 257.95 USD after a lively climb. The coin gained 10.12% in the past week, jumped 34.83% in one month and stands 92.13% higher than six months ago. Price sits near the 10 day average of 245.85 and holds above the 100 day line at 238.90, showing steady upward drive. Firm support appears near 187.67 with deeper backing at 143.57, while buyers target the first ceiling at 275.87 and then 319.97. Momentum gauges remain upbeat; RSI is 67.90 and stochastic is 87.95, both signs of strong demand. A push through 275.87 could lift value another 8% toward the next barrier, while a slip under 187.67 would trim about 13%. Given current trend strength and volume, price is more likely to press higher and test fresh peaks soon.

Conclusion

ETH fund inflows keep rising, pointing to steady demand. SOL defends its key price floor, showing buyers still active. Both assets look good as wider sentiment turns calmer.

Yet Zexpire stands out. The new platform flips crypto volatility into a chance to earn. Users click once to guess if Bitcoin stays in range or breaks out each day. Losses are fixed, with no forced sales. Every round uses $ZX, driving constant need for the token. Early buyers get fee cuts and a stream of buybacks. $ZX represents a promising opportunity too.

Get more information about Zexpire ($ZX) here:

- Site: https://zexpire.com/

- Telegram: https://t.me/zexpire_0dte

- X: https://x.com/Zexpire_0dte

This article is not intended as financial advice. Educational purposes only.

You May Also Like

Solana Treasury Stocks: Why Are These Companies Buying Up SOL?

Raoul Pal Predicts Bitcoin’s Correlation With ISM Index