PEPE’s Market Saturation Highlights Why This New Crypto May Be the Best Crypto to Buy for 2025

The post PEPE’s Market Saturation Highlights Why This New Crypto May Be the Best Crypto to Buy for 2025 appeared first on Coinpedia Fintech News

The crypto market is entering a period where investors are looking beyond hype and focusing on long-term potential. While meme tokens like Pepecoin (PEPE) continue to dominate headlines, there’s growing sentiment that their upside has peaked. In contrast, newer decentralized finance (DeFi) projects are gaining attention for their use cases and strong token models. One such contender is Mutuum Finance (MUTM), a DeFi crypto project already showing signs of becoming one of 2025’s most promising DeFi tokens.

Pepecoin (PEPE)

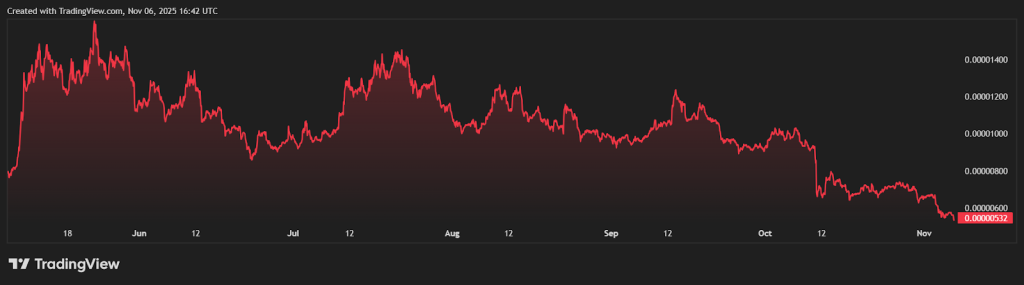

Pepecoin remains one of the most recognizable meme tokens in the crypto space. It trades around $0.0000050, with a market capitalization in the multi-billion-dollar range. That scale, while impressive, also creates a challenge, it’s far harder to deliver significant percentage gains when a project is already that large.

According to market analysts, PEPE is facing major resistance between $0.0000123 and $0.0000135, with additional ceilings near $0.000015. On the downside, the token has support near $0.0000040, and a deeper level at $0.0000030. The repeated inability to break above resistance levels has made it difficult for PEPE to sustain rallies.

Whale data and trading metrics also suggest reduced liquidity at higher price zones. This means that even if PEPE manages small surges, profit-taking pressure tends to kick in quickly. Many traders now believe the token is in a maturity phase, where the returns are likely to be modest compared to newer entrants with smaller market caps.

In a conservative scenario, analysts estimate PEPE could rise 30–40% from its current levels in 2025, but such growth would still fall short of its explosive early gains. Without new functionality or stronger ecosystem use cases, its price may remain range-bound for an extended period.

Mutuum Finance (MUTM)

While PEPE’s story may be flattening, Mutuum Finance (MUTM) is just getting started. The Ethereum-based project is developing a decentralized lending and borrowing protocol that connects lenders and borrowers through automated smart contracts. Unlike meme coins, MUTM’s foundation lies in utility, providing yield and enabling capital efficiency in the DeFi market.

Mutuum Finance’s structure revolves around its liquidity pools and the mtToken system. When users deposit assets, they receive mtTokens in return, which accrue interest as borrowers use the liquidity. This system allows lenders to generate passive income directly from lending markets, with all transactions executed transparently on-chain.

At the same time, borrowers can access liquidity by posting collateral under specific Loan-to-Value (LTV) ratios. If collateral values drop too far, liquidations occur automatically, protecting lenders and maintaining protocol stability. This model ensures both security and fairness without relying on intermediaries.

Strong Momentum and Rapid Adoption

Mutuum Finance’s presale has become one of the biggest events in decentralized finance this year. The token, MUTM, started at $0.01 in Phase 1 and is now priced at $0.035 in Phase 6 — marking a 250% gain for early buyers. So far, the project has raised over $18.4 million, attracted 17,850 holders, and sold 790 million tokens from the total supply of 4 billion.

With 45.5% of the total supply allocated to the presale (about 1.82 billion tokens), the team has made early participation a key focus. Each presale phase operates with a fixed price and token allocation, meaning that demand directly determines how fast the price advances to the next stage.

Currently, Phase 6 is more than 85% allocated, and with the official launch price set at $0.06, existing participants could see significant upside by the time MUTM begins trading.

Mutuum Finance has also completed a CertiK audit, scoring 90/100 on TokenScan, confirming the strength and reliability of its smart contracts. Alongside this, a 24-hour leaderboard rewards the top daily contributors with $500 worth of MUTM tokens, boosting transparency and community engagement during the presale.

Could MUTM Outperform PEPE?

1. Market Cap Advantage

Pepecoin’s massive market cap makes it difficult to replicate its early explosive surges. Even a small percentage gain now requires billions in new capital. Mutuum Finance, on the other hand, is still in its early stage, offering much more growth potential from a lower base. If its ecosystem performs as expected, it could deliver exponential returns that larger tokens like PEPE can no longer achieve.

2. Utility vs. Meme Appeal

Pepecoin is primarily a meme coin — its momentum depends on social sentiment and short-term trading trends. Mutuum Finance offers actual utility, driven by lending operations that generate protocol revenue. A portion of this revenue is used to buy MUTM tokens on the open market, and MUTM purchased on the open market is redistributed to users who stake mtTokens in the safety module. This mechanism creates organic buying pressure and ties token value directly to platform activity, something meme tokens lack entirely.

3. Perfect Timing for Transition

Many early PEPE investors are now rotating into projects with tangible DeFi value. The timing aligns perfectly for Mutuum Finance, which is advancing toward a major milestone, the V1 launch on the Sepolia Testnet in Q4 2025. This early adoption window gives investors a chance to participate before the token lists publicly and before its utility-driven demand begins to build.

Why Investors Are Paying Attention

Mutuum Finance’s roadmap shows consistent progress. Phase 2 (Building Mutuum) is underway, focusing on core smart contract development, DApp front-end creation, back-end infrastructure, and advanced feature integration. Internal and external audits continue regularly to maintain system integrity.

The next stage, Phase 3 (Finalizing Mutuum), will focus on bug reporting, beta testing, and preparing for exchange listings. The confirmed V1 testnet launch on Sepolia marks the project’s transition from development to live testing.

Meanwhile, Mutuum’s team has implemented strong transparency and engagement tools — from its daily leaderboard to recent updates allowing direct card payments with no purchase limits. This frictionless entry process has helped drive daily inflows and attract new holders globally.

While Pepecoin’s market cap may limit its potential to repeat past rallies, MUTM’s low entry price, active presale, and upcoming protocol launch give it a strong narrative heading into 2026. In a market shifting toward utility and transparency, Mutuum Finance appears well-positioned to capture both investor attention and future adoption.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://www.mutuum.com

Linktree: https://linktr.ee/mutuumfinance

You May Also Like

Mockery abounds as 'All-American Halftime Show' faces technical difficulties

ARK Invest Sells $22M in Coinbase Shares While Increasing Exposure to Bullish