The crypto market is on the lookout for early signs of a bottom.

To start with, December opened with some serious volatility. Mid-week, a 5% drop in the TOTAL crypto market cap wiped out almost all the early-week momentum, pulling back from the brief rally to $3.17 trillion.

Against this backdrop, Bitcoin’s [BTC] sideways chop looks like the usual cooling-off phase. Historically, when BTC enters consolidation, liquidity starts rotating into altcoins. Will the same playbook apply this time as well?

A $300 million bet just raised the stakes for altcoins

Traders have started capitalizing on the current market indecision.

Supporting this, Coinalyze’s Open Interest (OI) shows a 1.85% jump in OI across all crypto assets excluding Bitcoin and Ethereum [ETH], pushing the total to $17 billion. This brings their combined OI share to 27.61%.

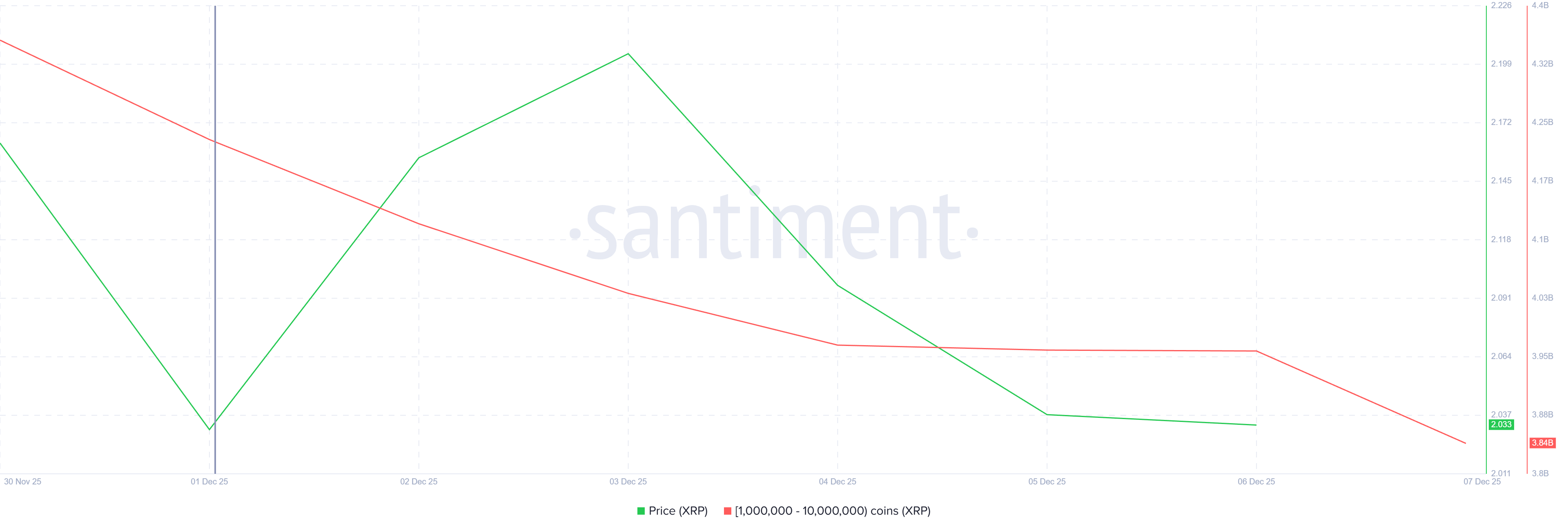

Put simply, leverage is flowing back into altcoins. Adding to that, Arkham Intelligence recently flagged a wallet that opened a $300 million long position split across ETH, Ripple [XRP], and Hyperliquid [HYPE].

Source: X

However, the wallet is already sitting on a $20.64 million unrealized loss.

Why does this matter? Notably, all three assets the trader bet on are utility-driven projects with solid fundamentals.

Yet, their recent lag highlights a clear disconnect between fundamentals and short-term market rotation.

In this context, is trading altcoins becoming riskier?

Simply put, during Bitcoin’s chop phase, are investors increasingly favoring speculative, “high-risk/high-reward” plays over fundamentally strong tokens, signaling a deeper divergence in overall market behavior?

Market signals point to a favorable altcoin setup

Early signals suggest the altcoin market might be finding a bottom.

On-chain, the Altcoin Season Index has been chopping in the 35-40 range over the past week, marking a phase seen as a setup for market rotation. At the same time, technical indicators are showing similar support.

The TOTAL2 market cap (ex-BTC) has gained about 3.6% over the last two weeks, hovering near $1.20 trillion. Together, these on-chain and technical cues hint that altcoins could be gearing up for renewed movement.

Source: CryptoQuant

In short, the market seems to be back in a buying zone.

CryptoQuant’s Darkfrost shows that altcoins’ 30-day trading volumes are still below the yearly average, suggesting selling pressure is light. For traders, this makes it a favorable setup to gradually accumulate altcoins.

Layer in the sideways-chopping Altcoin Season Index, the steadily rising TOTAL2, bullish on-chain metrics, and weekly charts highlighting the top three gainers as solid Layer-1 chains, and the setup looks constructive.

In this context, the $300 million position appears more like a strategic bet.

Final Thoughts

- Bitcoin’s sideways consolidation and a surge in altcoin Open Interest suggest liquidity is rotating back into altcoins.

- On-chain metrics, including the Altcoin Season Index and TOTAL2, alongside a $300 million strategic trade, point to favorable conditions for gradual accumulation.

Source: https://ambcrypto.com/altcoin-market-eyes-a-bottom-as-bitcoin-consolidates-is-it-time-to-rotate/