Dogecoin (DOGE) Price: Climbs Higher Despite ETFs Hitting Record Lows

TLDR

- Dogecoin ETFs dropped to their lowest trading level since launch in November, with total value traded falling to just $142,000 on Monday

- Despite weak ETF performance, DOGE spot market remains active with over $1.1 billion in 24-hour trading volume and a market cap of $22.6 billion

- Grayscale’s Dogecoin ETF launched with only $1.4 million in volume, far below the $12 million projected by analysts

- Bitcoin and Ether ETFs continue to dominate with combined trading value of $4.4 billion, while altcoin ETFs lag behind

- DOGE is trading near $0.1410 inside a symmetrical triangle pattern, with bulls watching for a breakout above $0.1455

Dogecoin exchange-traded funds have reached their lowest trading levels since launching in November. Data from SoSoValue shows the total value traded in DOGE ETFs dropped to $142,000 on Monday.

Dogecoin (DOGE) Price

Dogecoin (DOGE) Price

This marks a sharp decline from late November when the same funds recorded sessions exceeding $3.23 million. The drop shows how quickly investor interest has faded in these new products.

The decline reveals a growing gap between ETF activity and spot market trading. While DOGE ETFs struggle, the cryptocurrency itself continues to see heavy trading on exchanges.

According to CoinGecko, Dogecoin recorded more than $1.1 billion in spot trading volume over the past 24 hours. The meme coin currently has a market cap of $22.6 billion.

This trading depth suggests most participants prefer direct market exposure over regulated ETF products. Traders appear to be sticking with traditional exchanges and derivatives markets.

Grayscale’s Dogecoin ETF launched with participation well below analyst projections. Experts had expected day-one volume above $12 million.

Instead, the fund opened at just $1.4 million and has declined steadily since. The launch represents one of the weakest debuts for any major cryptocurrency ETF this year.

Bitcoin and Ether Dominate ETF Markets

The contrast with major cryptocurrency ETFs is stark. On December 8, Bitcoin ETFs recorded $3.1 billion in total value traded.

Ether ETFs saw $1.3 billion in trading during the same period. Together, the two established cryptocurrencies captured more than $4.4 billion combined.

Other altcoin ETFs also remain far behind. Solana ETFs recorded $22 million in trading, while XRP ETFs saw $21 million.

Chainlink ETFs traded $3.1 million and Litecoin ETFs managed just $526,000. Bitcoin and Ether continue to anchor institutional appetite for crypto ETF products.

Technical Setup Shows Coiling Pattern

Dogecoin is currently trading near $0.1410, holding inside a narrowing symmetrical triangle formation. The price is coiling toward a potential breakout in either direction.

Buyers continue defending a rising trendline that has held since the early December low. The upper boundary near $0.1455 remains the main resistance level.

The price is hovering around the 20-day exponential moving average, suggesting a neutral short-term outlook. A confirmed close above $0.1455 would break the descending trendline.

Such a move could open the path toward $0.1480 and $0.1519. On the downside, initial support sits at $0.1396.

If the market weakens further, support levels at $0.1370 and $0.1341 could come into play. The Relative Strength Index stands at 46, maintaining a sideways trend.

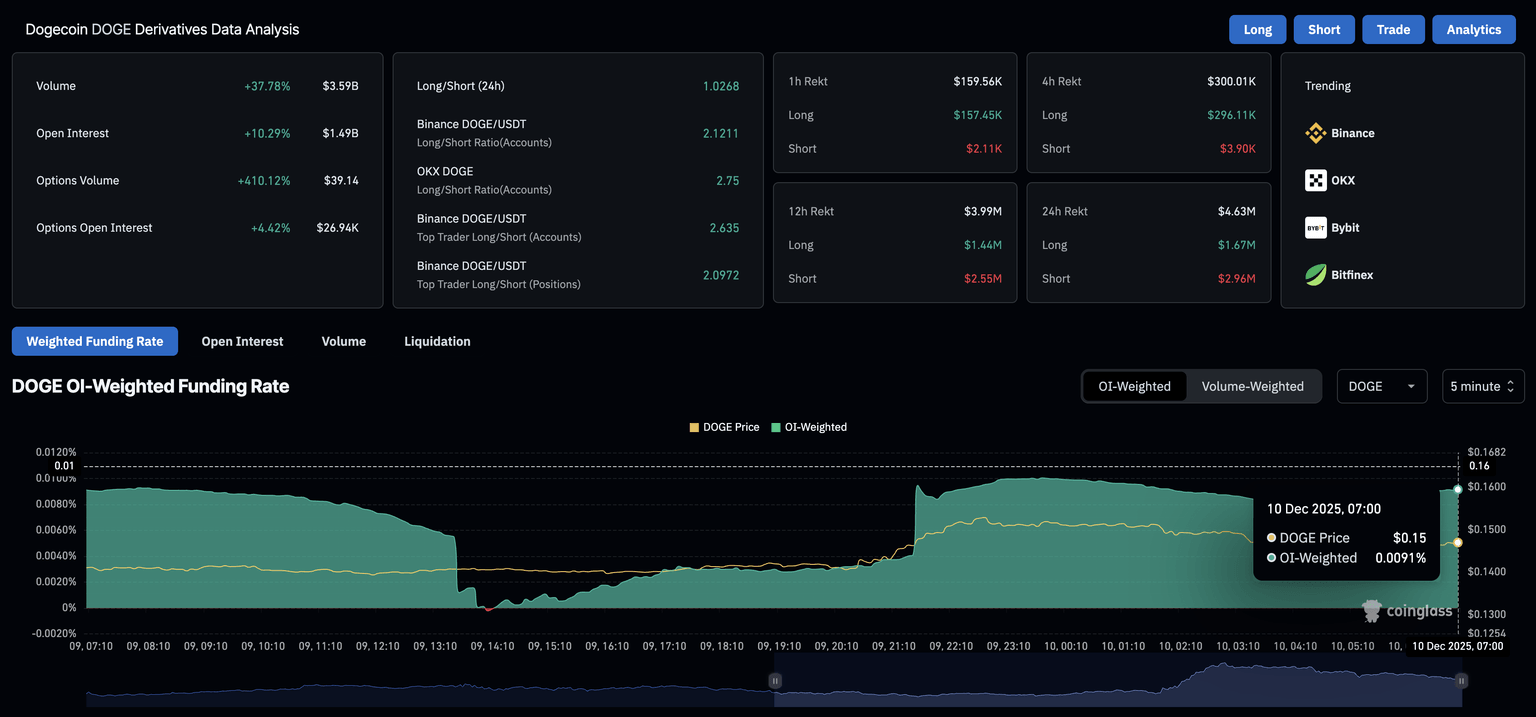

Source: Coinglass

Source: Coinglass

Derivatives data shows renewed interest from traders. DOGE futures open interest stands at $1.49 billion, up 10.29% over the last 24 hours.

The open interest-weighted funding rate is at 0.091%, reflecting a bullish bias among investors. Bulls currently hold 50.83% of all active positions, up from 48.44% on Sunday.

CryptoQuant data indicates that large wallet investors are driving increased demand for DOGE derivatives. A surge in average order size for DOGE futures suggests whales are anticipating further recovery.

If Dogecoin breaks above the resistance trendline at $0.1480, it could target the 50-day exponential moving average at $0.1644. A supply zone above $0.1800 could serve as additional overhead resistance.

The post Dogecoin (DOGE) Price: Climbs Higher Despite ETFs Hitting Record Lows appeared first on CoinCentral.

You May Also Like

Gold Hits $3,700 as Sprott’s Wong Says Dollar’s Store-of-Value Crown May Slip

The U.S. OCC has warned Wall Street about the "de-banking" of industries such as digital assets, calling such practices "illegal."