From zero-sum game to value creation: Hivemapper leads the new paradigm of DePIN and DeFi integration

In the current cryptocurrency market, a large number of investors are still chasing zero-sum games, while DePIN (decentralized physical infrastructure network) is opening up a new path for value creation. With the rapid development of Web3 technology, the deep integration of DePIN and DeFi (decentralized finance) is reshaping the development landscape of the blockchain industry. This integration can not only enhance the liquidity of physical assets, but also bring substantial innovation to the entire blockchain ecosystem.

Recently, the Hivemapper Foundation announced a strategic partnership with Kamino and Jito Labs to jointly launch the HONEY-JitoSOL Liquidity Treasury Incentive Program . This innovative liquidity solution is built on the Orca trading platform and aims to bring unprecedented user experience and additional benefits to HONEY token liquidity providers.

In this regard, Tushar Jain, managing partner of Multicoin Capital, commented: "This is a powerful example of the composability between DePIN and DeFi. Solana's dominance in the DePIN field is a huge boon to Solana DeFi."

Project Background and Development Status

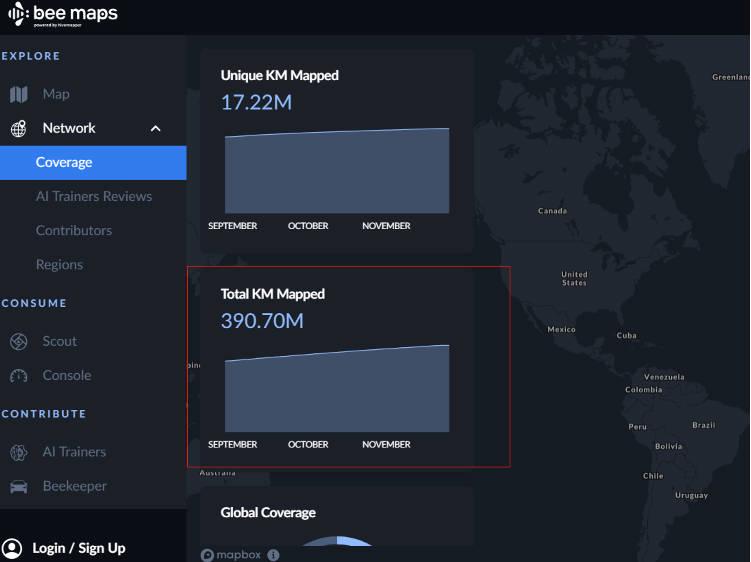

Before we delve deeper into this collaboration, it’s necessary to understand the development history of Hivemapper. As a decentralized mapping network built on the Solana blockchain, Hivemapper has grown rapidly since its launch in November 2022, having mapped 29% of the world’s roads in two years. Through innovative “Bee” dashcam devices and AI technology, the platform can capture more than 28 million kilometers of street-level images per month, growing five times faster than Google Street View. According to official data from Bee Maps , the project has completed more than 390 million kilometers of decentralized mapping.

In addition, Hivemapper uses the HONEY token incentive mechanism to attract users to participate in data collection, while serving the tens of billions of dollars in the enterprise map market. It has currently received investments from well-known institutions such as A16Z and Binance, and has established partnerships with many global map production giants. It is providing solutions to the development and maintenance problems of high-precision maps through the innovative model of AI+DePIN.

Innovative liquidity solutions

In collaboration with Kamino and Jito Labs, Hivemapper launched an innovative liquidity solution built on the Orca trading platform. The solution will provide up to $17,000 in JTO and HONEY rewards per month, bringing multiple benefits to HONEY token liquidity providers:

-

Automated transaction fee income

-

HONEY Token Incentives

-

JTO Token Incentives

-

ORCA Token Incentives (2,500 ORCA bonus per week for the first two weeks)

Automated design to lower barriers to participation

Considering that many DePIN users may be exposed to DeFi projects for the first time, Kamino has specially designed a fully automated vault infrastructure:

-

All fees are automatically reinvested: transaction fees are automatically reinvested into user positions

-

Smart rebalancing: The system automatically adjusts asset allocation to optimize returns

-

Professional analysis tools: real-time tracking of investment performance, helping users cope with the risk of impermanent loss caused by HONEY and JitoSOL price fluctuations

Market response

The market has responded positively to this innovative cooperation. According to official data, the HONEY-JITOSOL liquidity pool has performed well:

-

The current Boosted APY is as high as 36.02%

-

TVL exceeded 500,000 USD in the first 4 hours after launch

-

TVL is about to hit the maximum capacity limit of $1 million

These data not only verify the market's recognition of the DePIN and DeFi integration model, but also demonstrate the huge development potential of this innovative model.

Industry revelation and future prospects

The significance of this innovative cooperation lies in the creation of a new model of deep integration of DePIN and DeFi. In sharp contrast to the large number of zero-sum games in the current market, Hivemapper is bringing new development directions to the industry through substantial innovation. As the famous venture capital company a16z crypto pointed out: "DePIN represents the most promising innovation direction in the crypto field."

With the introduction of more innovative mechanisms, Hivemapper is opening up new ways for the deep integration of DePIN projects and the DeFi ecosystem. This innovation can not only enhance the user experience, but also bring continuous growth momentum to the entire ecosystem.

For users who want to participate in blockchain innovation, HONEY Liquidity Vault provides a low-threshold, high-efficiency entry point, allowing users to easily enjoy the benefits brought by DeFi innovation. This is a model of blockchain technology empowering the real economy and shows the infinite possibilities of decentralized finance.

You May Also Like

US crypto bill and xrp price implications as Garlinghouse sees 90% chance of Clarity Act by April

Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?