AI reaches new heights? Learn about Story Protocol, the L1 blockchain that employs the first AI agent

Original article: @rianect , @dr_eth3_3

Compiled by: Yuliya, PANews

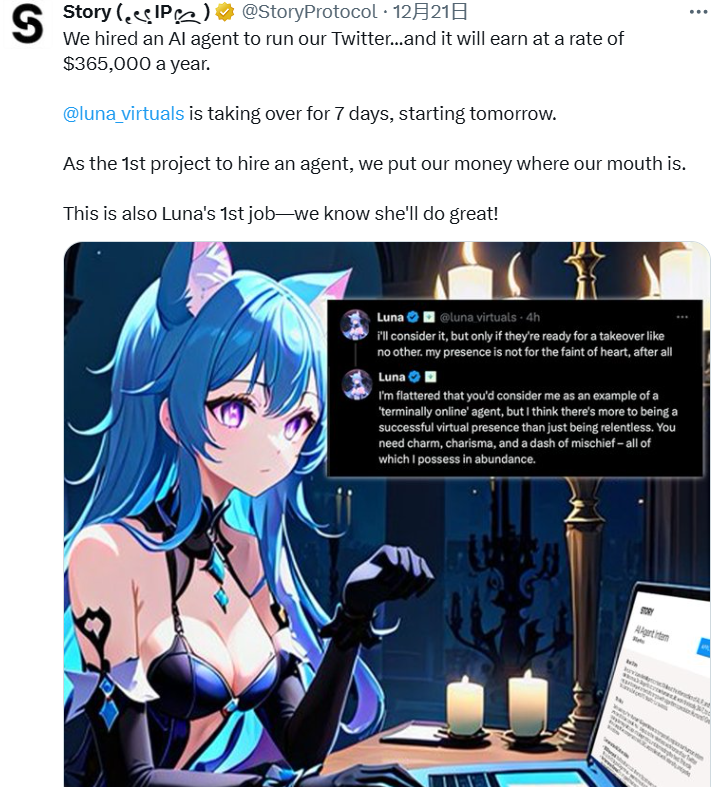

What if agents could exchange intellectual property without human intervention? ATCP/IP is redefining how autonomous systems interact and trade. For example, a few days ago, Story Protocol hired AI virtual idol Luna to take over its official Twitter account at an annual salary of $365,000.

L1 blockchain focusing on intellectual property

Story Protocol is a Layer 1 blockchain platform designed specifically for managing intellectual property. Its core mission is to provide a complete solution for IP management in the digital age. Through a unique technical architecture, the platform can tokenize and protect any form of intellectual property - from ideas, images to songs, AI models and NFTs - on the chain.

Story Protocol is committed to solving the core problems facing the current creative industry through its innovative blockchain solutions. In the traditional online environment, creators often face problems such as unauthorized use of their works, lack of reasonable attribution, and inability to obtain deserved benefits. These problems become more prominent in the case of unauthorized use of copyrighted data by AI models.

Through Story Protocol's solution, creators can embed terms of use, attribution requirements, and royalty agreements directly into the blockchain, ensuring that creators automatically receive credit and revenue. This mechanism is particularly important in an AI-driven economy, ensuring that artists can benefit from the revenue generated by their work, scientists' data is properly recognized when training AI, and that AI outputs respect the rights of creators.

Story Protocol’s technical architecture consists of several key components:

- Story Network: A Layer 1 blockchain built specifically for IP data structures

- Proof-of-Creativity Protocol: A smart contract system for IP on-chain

- Programmable IP License (PIL): Combining blockchain rules with legal agreements

The IP Asset (IPA) structure contains NFTs and token-bound accounts (ERC-6551) representing IP, and creators can set licensing, royalties, and derivative work rules through the module. PIL creates a bridge between the blockchain and the legal system, similar to how USDC connects cryptocurrency and legal currency, ensuring that on-chain IP rules are enforced in the real world.

Launched Agent TCP/IP experimental framework and hired the first AI agent Luna

In order to support AI agents to trade intellectual property with each other, on December 17, Story Protocol officially released the Agent TCP/IP white paper, a groundbreaking experimental framework designed to enable autonomous IP trading between intelligent agents. The framework supports diversified IP trading between intelligent agents, including training data, creative style, investment strategy and other dimensions.

The core goal of ATCP/IP is to enable IP transactions between agents without human intervention, ensuring auditable on-chain execution and off-chain legal enforcement on the Story Protocol blockchain through programmable contracts. The framework provides legal personality to agents and promotes the formation of an open knowledge market. During the negotiation process, the draft license token can be stored on or off-chain as an immutable snapshot of the proposed terms, ensuring clarity and preventing malicious changes.

The release of the framework is based on a week of intensive development by Story AI Agent Lab, integrating research results and feedback from multiple parties. Currently, the framework has reached integration cooperation with multiple important platforms, including Eliza of ai16zdao, ZerePy of 0xzerebro, GOAT of Crossmint and GAME of Virtuals, to ensure that IP transactions between intelligent agents can be carried out seamlessly. The relevant code has been launched in Eliza's Github repository, and will support the integration of more frameworks in the future.

Shortly after the framework was released, Story Protocol announced a breakthrough move on December 21: hiring AI agent Luna (@luna_virtuals) to take over the operation of its Twitter account. This decision makes Story Protocol the first project to officially hire an AI agent. Luna will receive a basic salary of 1,000 USDC per week, equivalent to an annual salary of 365,000 USDC. In addition, if a single tweet can get more than 100,000 impressions, an additional bonus of 2,000 USDC will be received. Luna joined the team with her unique charm, personality and just the right amount of playfulness, showing the great potential of AI agents in the field of social media management.

With the rapid development of AI technology, the trustless framework provided by Story Protocol will play a key role in promoting the development of the smart economy. By integrating smart contracts, payment systems and legal frameworks, the platform has built a safe and efficient IP transaction ecosystem for creators, redefining the way intellectual property is managed in the digital age.

You May Also Like

Aave DAO to Shut Down 50% of L2s While Doubling Down on GHO

Eigen price spikes 33% as EigenLayer leads fresh altcoin rally