5 Reasons Q1 2026 Could Spark the Biggest Crypto Bull Run Yet

Experts are increasingly signaling a potential crypto bull run in the first quarter (Q1) of 2026, driven by a convergence of macroeconomic factors.

Analysts suggest Bitcoin could surge between $300,000 and $600,000 if these catalysts materialize.

Five Macro Trends Fueling a Potential Rally in Q1 2026

A combination of five key trends is creating what analysts describe as a “perfect storm” for digital assets.

1. Fed Balance Sheet Pause Removes Headwind

The Federal Reserve’s quantitative tightening (QT), which drained liquidity throughout 2025, ended recently.

Simply halting the liquidity drain is historically bullish for risk assets. Data from previous cycles suggest Bitcoin can rally up to 40% when central banks stop contracting their balance sheets.

Analyst Benjamin Cowen indicated that early 2026 could be the time when markets begin to feel the impact of the Fed ending its QT.

2. Rate Cuts Could Return

The Federal Reserve recently cut interest rates, with its commentary and Goldman Sachs forecasts indicating interest rate cuts could resume in 2026, potentially bringing rates down to 3–3.25%.

Lower rates typically increase liquidity and boost appetite for speculative assets such as cryptocurrencies.

3. Improved Short-End Liquidity

Increased Treasury bill purchases or other support at the short end of the yield curve could ease funding pressures and reduce short-term rates. The Fed says it will start technical buying of Treasury bills to manage market liquidity.

The Fed periodically comes in during short-term funding markets amid instances of liquidity imbalances. These imbalances manifest in the overnight repo market, where banks borrow cash in exchange for Treasuries.

Recently, multiple indicators point to a rising short-term funding pressure, including:

- Money market funds sitting on elevated levels of cash,

- T-bill issuance tightening as the Treasury shifted its borrowing mix, and

- Increasing seasonal demand for liquidity.

The Fed initiated a controlled purchase plan of Treasury bills to prevent short-term interest rates from deviating from the target Federal Funds Rate. These are the shortest-maturity government securities, typically ranging from a few weeks to one year in duration.

While not a classic QE move, this measure could still serve as a significant liquidity tailwind for crypto markets.

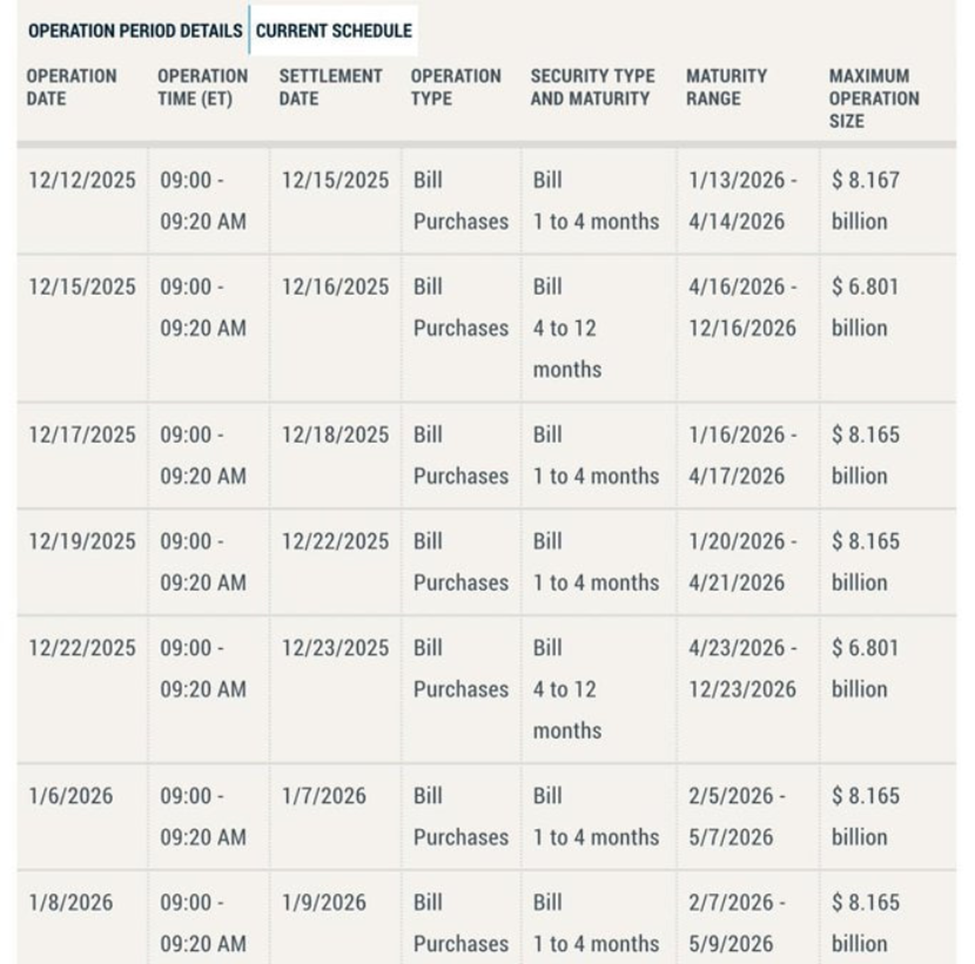

Schedule for regular Treasury bill (T-bill) purchase operations conducted by the New York Fed. Source: XWIN Research and Asset Management

Schedule for regular Treasury bill (T-bill) purchase operations conducted by the New York Fed. Source: XWIN Research and Asset Management

For Q1 2026, the broader implications for risk assets, such as crypto and equities, are generally positive but moderate, stemming from a shift in Fed policy toward maintaining or gradually expanding liquidity.

4. Political Incentives Favor Stability

With US midterm elections scheduled for November 2026, policymakers are likely to favor market stability over disruption.

This environment reduces the risk of sudden regulatory shocks and enhances investor confidence in risk assets.

5. The Employment “Paradox”

Weakening labor market data, such as soft employment or modest layoffs, often triggers dovish Fed responses.

Softer labor conditions increase pressure on the Fed to ease policy, indirectly creating more liquidity and favorable conditions for cryptocurrencies.

Expert Outlook Suggests Bullish Sentiment Growing

Industry observers are aligning with the macro view. Alice Liu, Head of Research at CoinMarketCap, forecasts a crypto market comeback in February and March 2026, citing a combination of positive macro indicators.

Some analysts are even more optimistic. Crypto commentator Vibes predicts Bitcoin could reach $300,000 to $600,000 in Q1 2026. This reflects extreme bullish sentiment amid improving liquidity and easing macro conditions.

Currently, market participation remains muted. Bitcoin open interest has declined, reflecting cautious trader sentiment.

However, if these macroeconomic tailwinds materialize, consolidation could quickly give way to a significant surge, setting the stage for a historic start to 2026 in the crypto markets.

You May Also Like

Fed Decides On Interest Rates Today—Here’s What To Watch For

👨🏿🚀TechCabal Daily – Sun King makes it rain